Please use a PC Browser to access Register-Tadawul

Institutional Interest And Air Force Contracts Refocus Intuitive Machines Outlook

Intuitive Machines, Inc. Class A LUNR | 18.02 | +1.58% |

- Trustees of the University of Pennsylvania recently increased their position in Intuitive Machines by over 2,500,000 shares, according to an SEC filing.

- Intuitive Machines secured contracts with the U.S. Air Force Research Laboratory, expanding its government work alongside its lunar and space services.

- These developments affect both the shareholder base and future contract pipeline for NasdaqGM:LUNR.

For you as an investor, the mix of fresh institutional interest and new government contracts puts Intuitive Machines in sharper focus. At a share price of $18.62, NasdaqGM:LUNR has seen a 12.1% gain over the past week and a 46.2% return over three years, while remaining roughly flat over the past year with a 0.7% decline. Taken together, this points to a stock that has already moved over a multi year period but is still working through shorter term volatility.

The larger stake from the University of Pennsylvania’s trustees and the new U.S. Air Force Research Laboratory work highlight shifts in both who holds the stock and where future revenue opportunities could come from. As you weigh NasdaqGM:LUNR, it is worth tracking how these contracts progress and whether more institutional holders step in or adjust their positions over time.

Stay updated on the most important news stories for Intuitive Machines by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Intuitive Machines.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$18.62, the share price is roughly 1.6% above the US$18.33 average analyst target, sitting close to consensus.

- ❌ Simply Wall St Valuation: Valuation status is unknown, so you cannot rely on a DCF or P/E based fair value signal here.

- ❌ Recent Momentum: The 30 day return of about 3% decline shows recent weakness despite the contract and ownership headlines.

There is only one way to know the right time to buy, sell or hold Intuitive Machines. Head to the Simply Wall St company report for the latest analysis of Intuitive Machines's Fair Value..

Key Considerations

- 📊 Increased ownership by the University of Pennsylvania’s trustees and new U.S. Air Force Research Laboratory contracts both point to growing institutional attention and government demand for Intuitive Machines’ services.

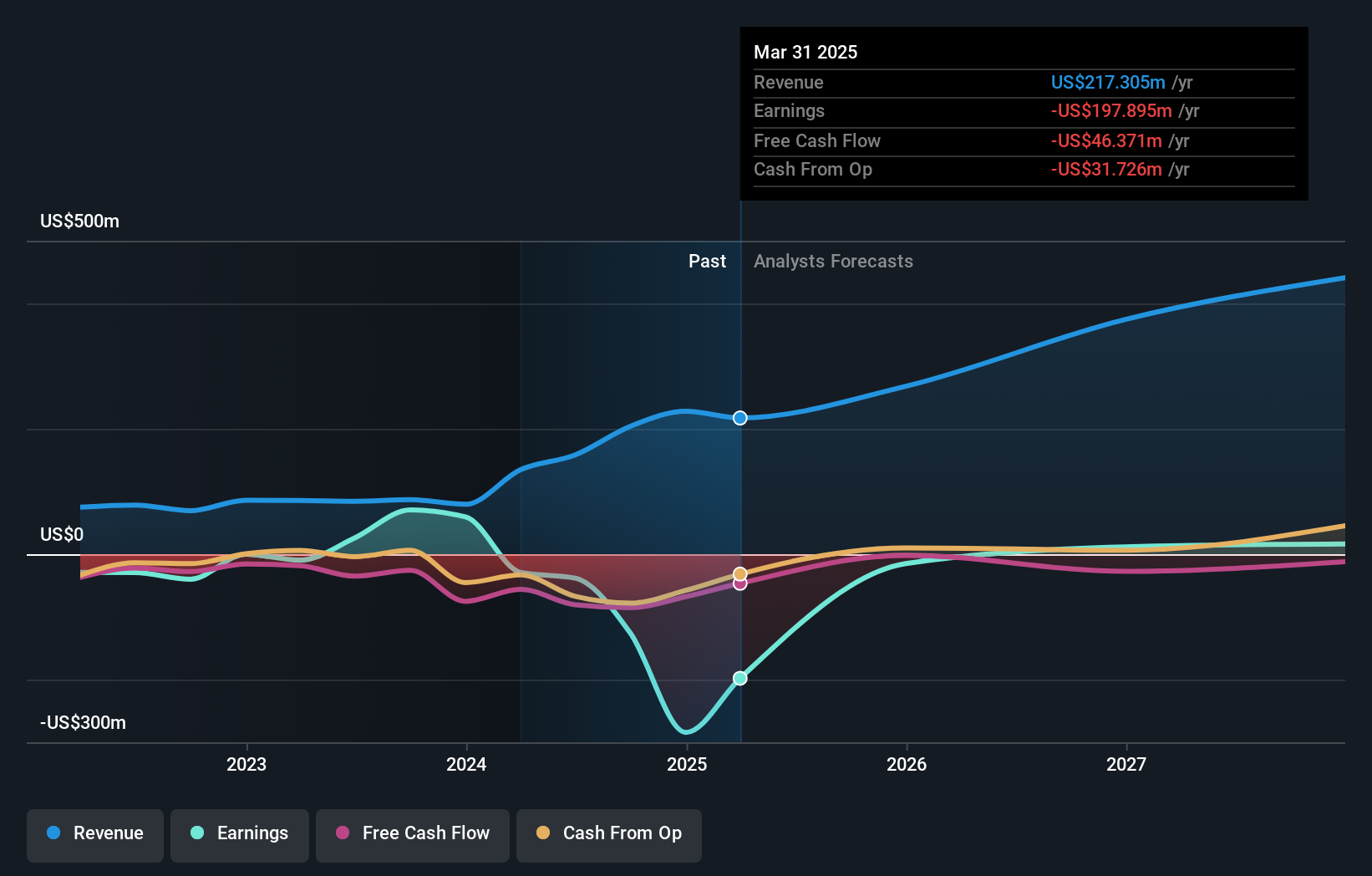

- 📊 Watch how the share price trades around the US$18.33 analyst target, the highly negative net income margin of about 88%, and any updates on contract size or follow on awards.

- ⚠️ The stock has been highly volatile over the past three months, so position sizing and risk tolerance matter if news flow turns against expectations.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Intuitive Machines analysis. Alternatively, you can check out the community page for Intuitive Machines to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.