Please use a PC Browser to access Register-Tadawul

Interactive Brokers (IBKR) Is Up 6.5% After Strong Q2 Earnings and New Product Launches – Has The Bull Case Changed?

Interactive Brokers Group, Inc. Class A IBKR | 64.57 | +2.39% |

- Interactive Brokers Group recently reported second quarter results showing net income of US$224 million and earnings per share of US$0.51, both higher than the previous year, and also affirmed a quarterly dividend of US$0.08 per share payable in September 2025.

- The company introduced innovative tools like Investment Themes and the IBKR InvestMentor app, enhancing both investor research capabilities and financial education for a global audience.

- We'll examine how the strong earnings growth and product launches contribute to Interactive Brokers Group's broader investment potential.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder of Interactive Brokers Group, you need conviction in the global growth of self-directed investing, scalable technology, and the company’s ability to maintain a competitive edge as client accounts and international activity expand. The most important short-term catalyst right now remains further account growth from recent product launches, while the biggest risk stems from unpredictable trading volumes tied to shifting market sentiment; this quarter’s strong results offer some reassurance, but do not materially change the revenue sensitivity to market volatility.

Of the recent announcements, the launch of Investment Themes stands out, directly supporting the company’s drive to enhance engagement and attract new users. By simplifying the research process and offering actionable insights for investors worldwide, this tool aligns with Interactive Brokers’ push to convert market trends into client growth, reinforcing the near-term importance of continued organic account expansion.

Yet, on the other hand, investors should not overlook how quickly a dip in market activity could affect the company’s...

Interactive Brokers Group's outlook anticipates $5.9 billion in revenue and $740.3 million in earnings by 2028. This reflects 5.9% annual revenue growth and a $42.3 million increase in earnings from the current $698.0 million.

Exploring Other Perspectives

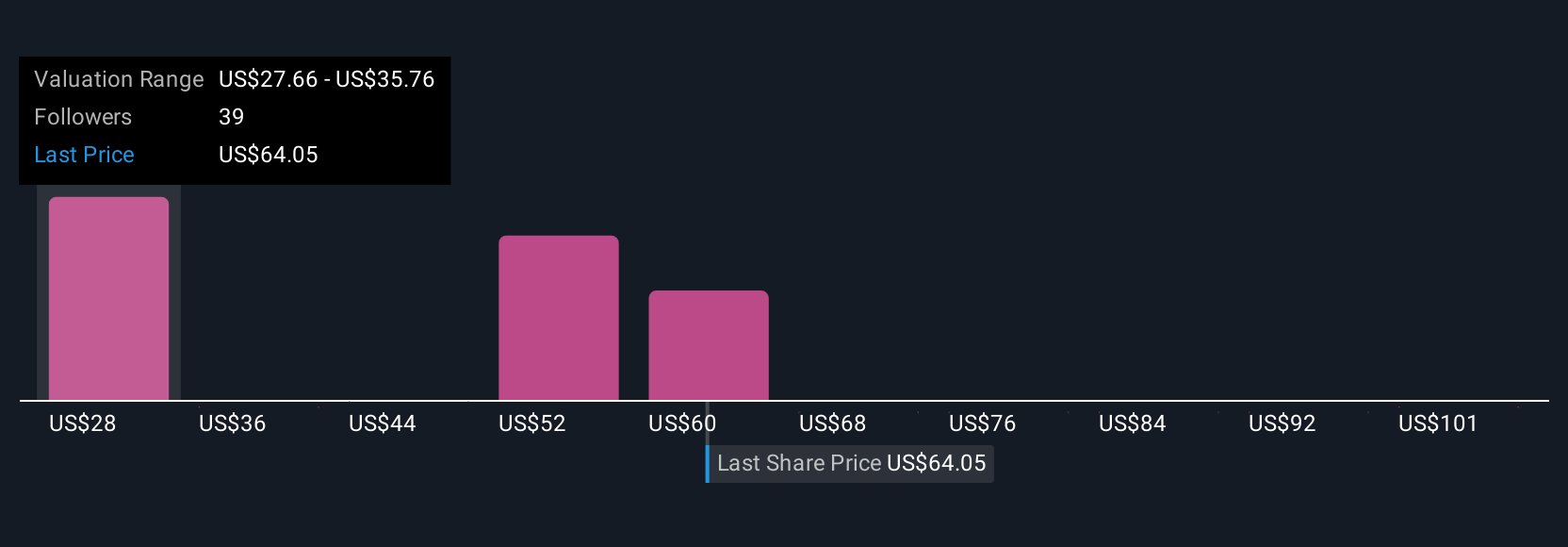

Fair value estimates for Interactive Brokers from seven Simply Wall St Community members range widely, from US$27.70 to US$108.63 per share. As you consider these diverse outlooks, remember that competitive pressure in key international markets could have broad implications for account growth and future returns.

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.