Please use a PC Browser to access Register-Tadawul

InterDigital (IDCC) Is Up 5.2% After New Major Licensing Deal and Raised Q3 Guidance – What's Changed

InterDigital, Inc. IDCC | 354.28 | -1.02% |

- In the past week, InterDigital announced an expanded third-quarter earnings guidance and a major new license agreement with a prominent Chinese smartphone maker, lifting its projected revenue range to US$155 million–US$159 million and increasing annualized recurring revenue to a record US$579 million.

- With this agreement, InterDigital now licenses approximately 85% of the global smartphone market, further consolidating its position as a leading provider in wireless technology licensing.

- We’ll explore how the new license agreement, which expanded InterDigital’s recurring revenue base, could reshape its investment outlook and potential.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

InterDigital Investment Narrative Recap

To invest in InterDigital, you need to believe in the long-term value of its wireless technology IP and its ability to expand and monetize licensing agreements globally. The recent lift in earnings guidance and the addition of a major Chinese smartphone maker as a licensee strengthens the company’s short-term revenue outlook and reinforces recurring revenue as the key near-term catalyst. However, this also means that any slowdown or disappointment in expansion beyond smartphones, especially into new verticals, remains the biggest risk for now.

Among recent announcements, the sizable increase in the quarterly dividend from US$0.60 to US$0.70 per share stands out. This move is a clear signal of confidence in cash flows following record recurring revenues, yet it arises at a time when revenue growth expectations outside the smartphone market are facing increased scrutiny. Despite this show of financial strength, investors should still weigh whether future contract renewals and diversification will match current optimism.

By contrast, it’s important to stay alert to potential risks around expansion into non-smartphone verticals, which could prove more challenging than many expect...

InterDigital's narrative projects $633.9 million revenue and $173.4 million earnings by 2028. This scenario assumes a -10.8% yearly revenue decline and a $290.1 million decrease in earnings from $463.5 million.

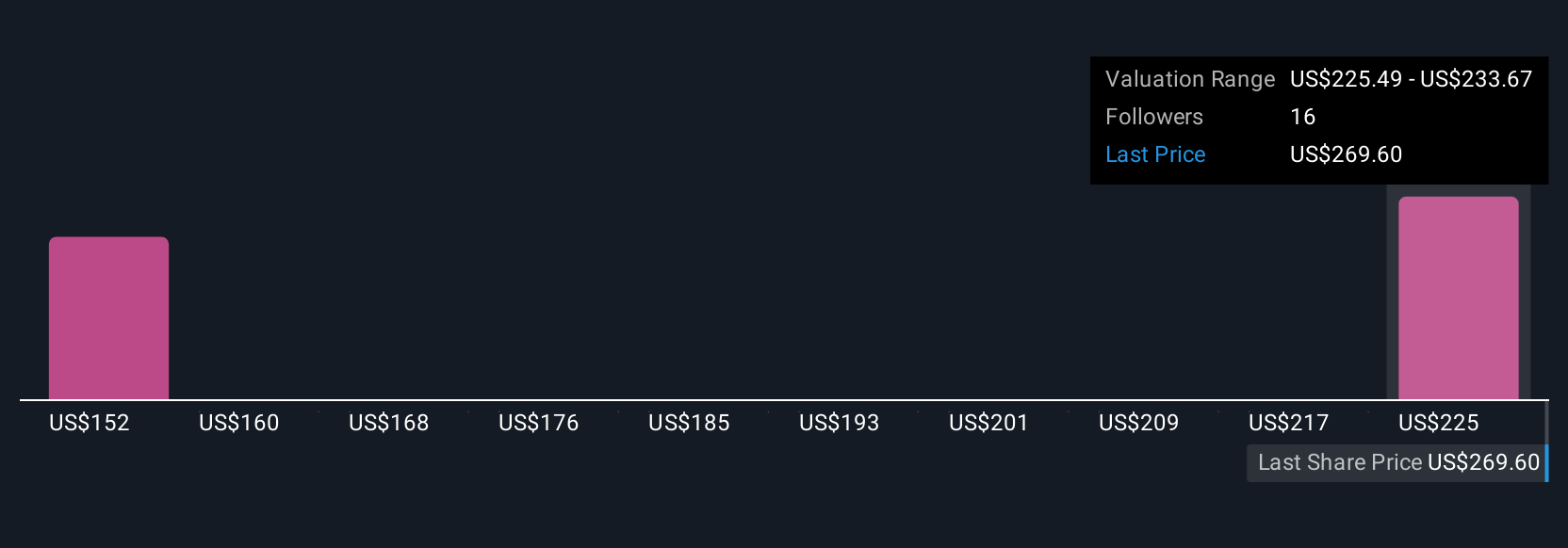

Uncover how InterDigital's forecasts yield a $283.67 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for InterDigital, ranging from US$157.78 to US$300 per share. Still, with the company’s recurring revenue base hitting a record high, you’ll want to consider how expectations for growth beyond smartphones could affect future outcomes, explore these different viewpoints here.

Explore 3 other fair value estimates on InterDigital - why the stock might be worth as much as $300.00!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.