Please use a PC Browser to access Register-Tadawul

Intuit (INTU) Valuation in Focus as AI Partnership with Aprio Targets Mid-Market Growth

Intuit Inc. INTU | 670.92 670.92 | -0.75% 0.00% Pre |

Intuit (INTU) has just announced a strategic partnership with Aprio, bringing together AI-powered business management tools and expert advisory services. This move aims to make scaling easier for mid-market companies that are overwhelmed by complex and outdated systems.

Intuit’s new partnership with Aprio comes at a pivotal time, as the company’s 1-year total shareholder return of 8.44% reflects steady long-term momentum, even after recent volatility. While the share price dipped over the past 90 days, broader performance remains robust and suggests that investors still see growth potential as Intuit pivots toward AI-driven business solutions.

If you’re keen to spot what else is gaining traction beyond the headlines, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Intuit trading about 10 percent below its analyst target, should investors see today’s level as undervaluation? Or is the market already pricing in the company’s anticipated growth from this AI-powered expansion?

Most Popular Narrative: 19.3% Undervalued

Intuit’s fair value, according to the most widely followed narrative, stands well above its recent closing price, hinting at considerable upside if growth projections are realized.

The accelerating adoption of Intuit's AI-driven all-in-one platform, which includes virtual teams of AI agents and human experts, positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers. This supports higher average revenue per customer (ARPC) and net margin expansion over time.

Want to know what’s fueling this optimistic outlook? The main calculation is anchored in aggressive revenue expansion, fatter profit margins, and a future earnings multiple that few software rivals command. Wondering just how ambitious these forecasts are? The full narrative unveils the bold projections and the numbers powering that premium fair value.

Result: Fair Value of $819.73 (UNDERVALUED)

However, Mailchimp's sluggish growth and potential saturation in international markets remain clear risks. These factors could limit Intuit's projected revenue acceleration.

Another View: Looking at Valuation Multiples

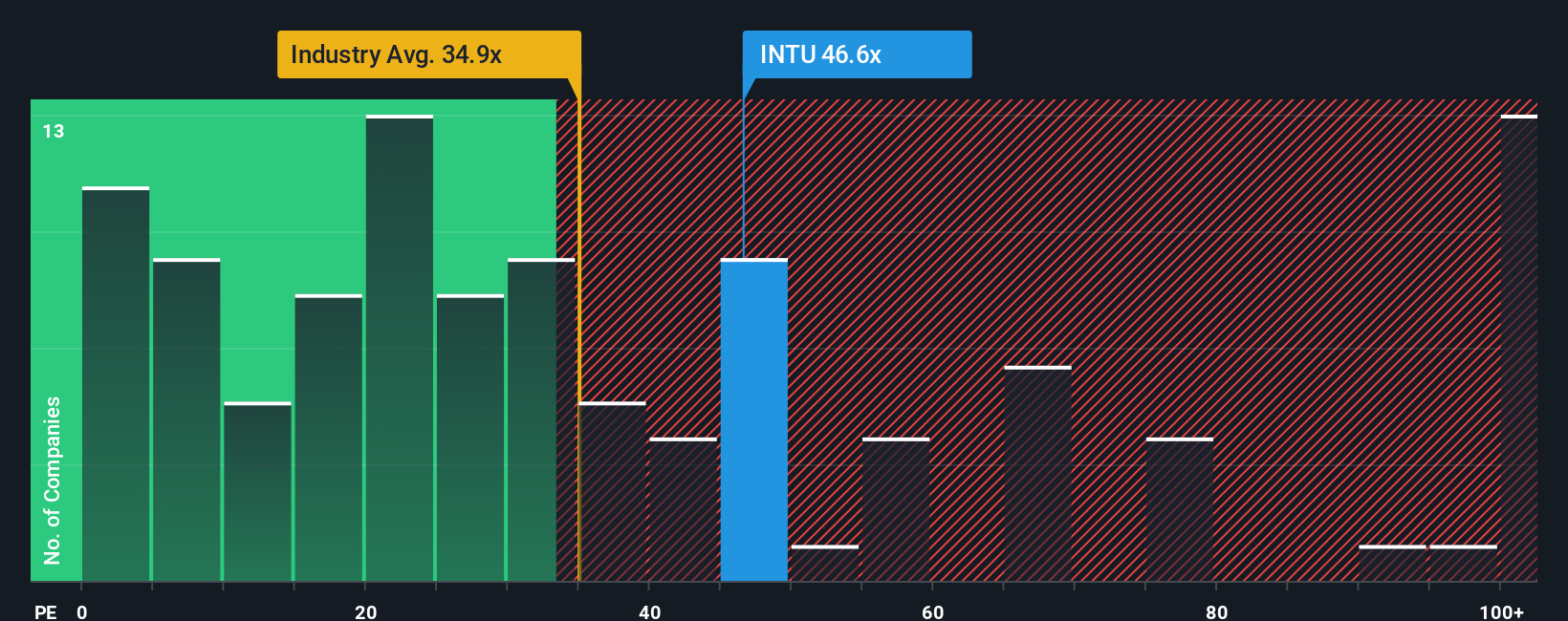

Switching gears from projected earnings, let’s consider how Intuit stacks up based on its price-to-earnings ratio. At 47.7 times earnings, Intuit trades higher than both the US Software industry average of 34.9x and even above what’s considered a fair ratio at 43.6x. While this suggests investors are already pricing in strong growth and premium positioning, it raises a real question as to whether these lofty expectations can be met or even sustained, especially if sector sentiment shifts.

Build Your Own Intuit Narrative

If you want to put these claims to the test or follow your own instincts, building your independent take on Intuit only takes a few minutes. Why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Intuit.

Looking for more investment ideas?

Don’t let your investment strategy stall. Use the Simply Wall Street Screener now and catch other big opportunities before they’re on everyone’s radar.

- Uncover hidden potential by starting with these 3596 penny stocks with strong financials which offer strong financials and room for explosive growth.

- Get ahead of market trends by assessing these 24 AI penny stocks which harness artificial intelligence for real-world solutions and breakthrough innovation.

- Secure potential bargains by targeting these 877 undervalued stocks based on cash flows which are currently trading below their intrinsic value, giving you a possible edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.