Please use a PC Browser to access Register-Tadawul

Investor Optimism Abounds Montrose Environmental Group, Inc. (NYSE:MEG) But Growth Is Lacking

Montrose Environmental Group Inc MEG | 23.09 | +2.03% |

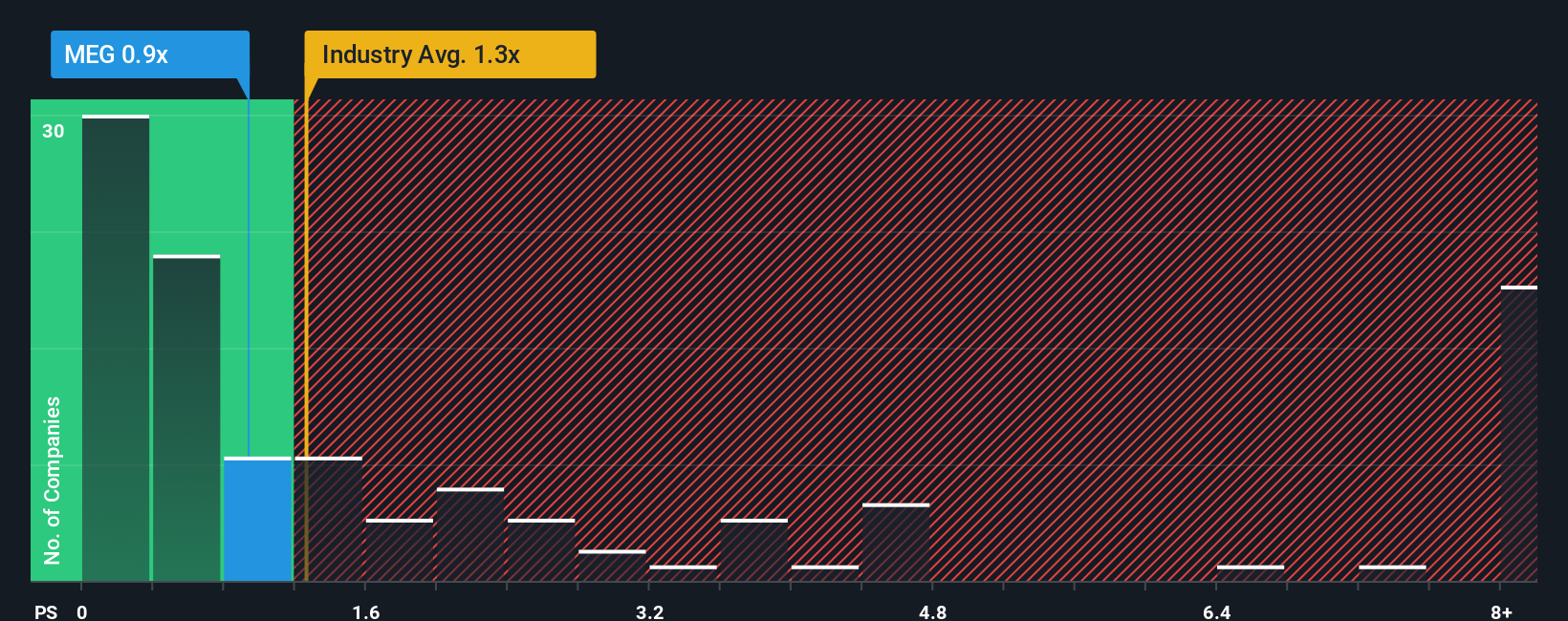

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Commercial Services industry in the United States, you could be forgiven for feeling indifferent about Montrose Environmental Group, Inc.'s (NYSE:MEG) P/S ratio of 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Montrose Environmental Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Montrose Environmental Group has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Montrose Environmental Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Montrose Environmental Group?

In order to justify its P/S ratio, Montrose Environmental Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 1.8% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 5.6% growth forecast for the broader industry.

In light of this, it's curious that Montrose Environmental Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Montrose Environmental Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Montrose Environmental Group's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Plus, you should also learn about this 1 warning sign we've spotted with Montrose Environmental Group.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.