Please use a PC Browser to access Register-Tadawul

Investors Appear Satisfied With Grindr Inc.'s (NYSE:GRND) Prospects As Shares Rocket 35%

Grindr Inc. Common Stock GRND | 13.28 | -3.77% |

The Grindr Inc. (NYSE:GRND) share price has done very well over the last month, posting an excellent gain of 35%. The last month tops off a massive increase of 125% in the last year.

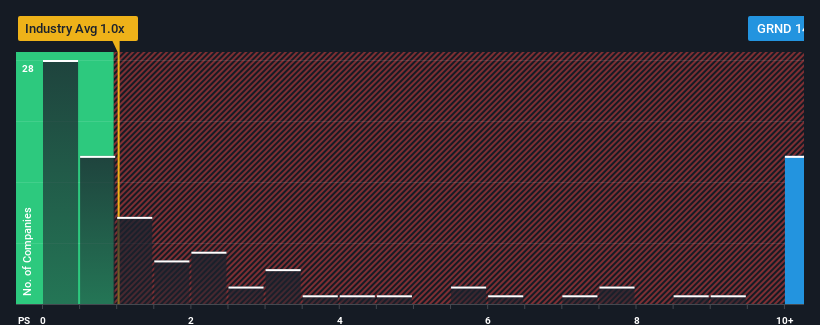

After such a large jump in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1x, you may consider Grindr as a stock not worth researching with its 14x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Grindr Has Been Performing

Grindr certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Grindr's future stacks up against the industry? In that case, our free report is a great place to start.How Is Grindr's Revenue Growth Trending?

Grindr's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. The strong recent performance means it was also able to grow revenue by 136% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 22% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's understandable that Grindr's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Grindr have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Grindr shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.