Please use a PC Browser to access Register-Tadawul

Investors Appear Satisfied With Upstart Holdings, Inc.'s (NASDAQ:UPST) Prospects As Shares Rocket 41%

Upstart UPST | 45.05 | -3.97% |

Upstart Holdings, Inc. (NASDAQ:UPST) shares have continued their recent momentum with a 41% gain in the last month alone. The annual gain comes to 229% following the latest surge, making investors sit up and take notice.

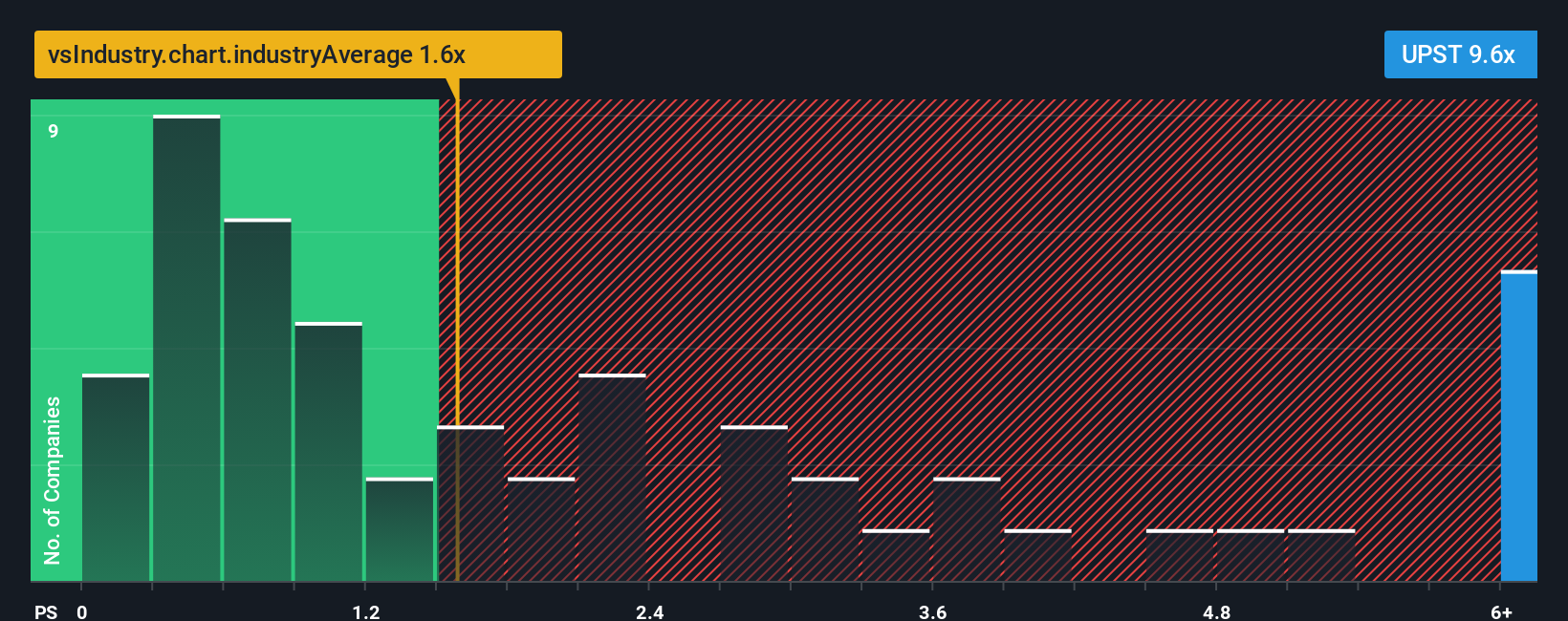

After such a large jump in price, when almost half of the companies in the United States' Consumer Finance industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Upstart Holdings as a stock not worth researching with its 9.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Upstart Holdings' P/S Mean For Shareholders?

Upstart Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Upstart Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Upstart Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Upstart Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 27% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 28% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 18% per year, which is noticeably less attractive.

In light of this, it's understandable that Upstart Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Upstart Holdings' P/S Mean For Investors?

Shares in Upstart Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Upstart Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.