Please use a PC Browser to access Register-Tadawul

Investors Continue Waiting On Sidelines For CI&T Inc. (NYSE:CINT)

CI&T, Inc. Class A CINT | 5.00 | +2.67% |

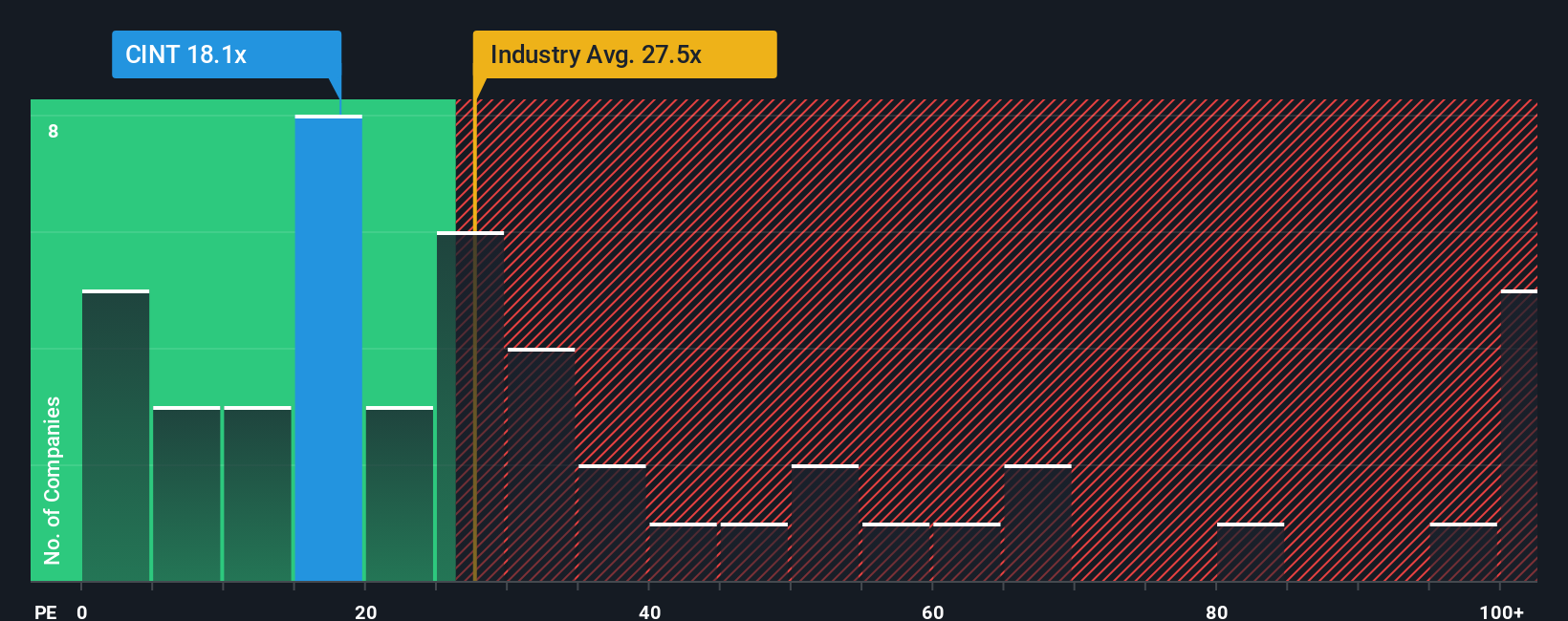

There wouldn't be many who think CI&T Inc.'s (NYSE:CINT) price-to-earnings (or "P/E") ratio of 18.4x is worth a mention when the median P/E in the United States is similar at about 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, CI&T has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is CI&T's Growth Trending?

In order to justify its P/E ratio, CI&T would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 48%. The strong recent performance means it was also able to grow EPS by 43% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 16% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we find it interesting that CI&T is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From CI&T's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of CI&T's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for CI&T with six simple checks.

If these risks are making you reconsider your opinion on CI&T, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.