Please use a PC Browser to access Register-Tadawul

Investors Continue Waiting On Sidelines For Ingram Micro Holding Corporation (NYSE:INGM)

Ingram Micro Holding Corporation INGM | 21.66 | +1.17% |

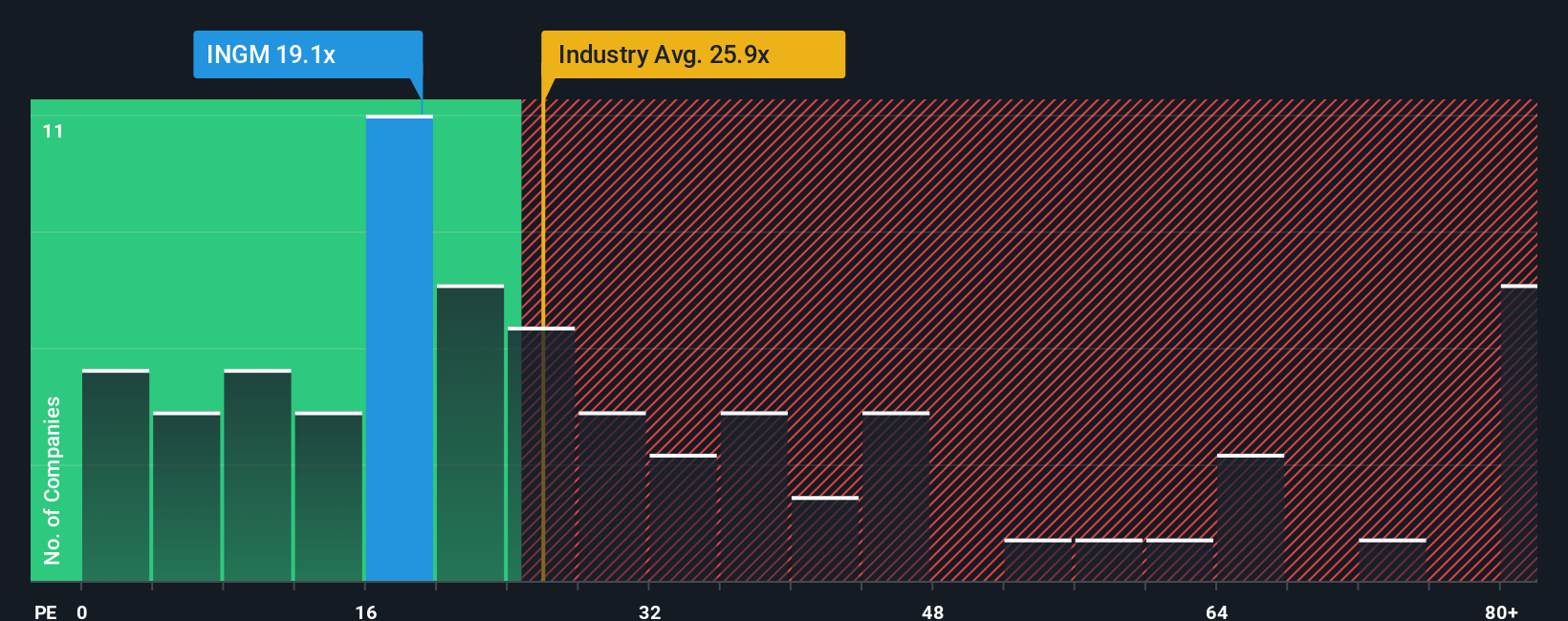

With a median price-to-earnings (or "P/E") ratio of close to 19x in the United States, you could be forgiven for feeling indifferent about Ingram Micro Holding Corporation's (NYSE:INGM) P/E ratio of 19.1x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Ingram Micro Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

How Is Ingram Micro Holding's Growth Trending?

The only time you'd be comfortable seeing a P/E like Ingram Micro Holding's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. As a result, earnings from three years ago have also fallen 90% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 35% per annum as estimated by the analysts watching the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Ingram Micro Holding is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ingram Micro Holding's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks.

Of course, you might also be able to find a better stock than Ingram Micro Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.