Please use a PC Browser to access Register-Tadawul

Investors Give SolarEdge Technologies, Inc. (NASDAQ:SEDG) Shares A 28% Hiding

SolarEdge Technologies, Inc. SEDG | 29.53 | -7.78% |

SolarEdge Technologies, Inc. (NASDAQ:SEDG) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

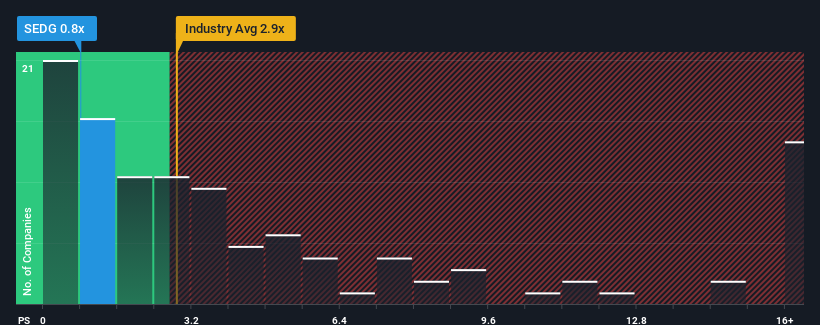

Following the heavy fall in price, SolarEdge Technologies may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Our free stock report includes 2 warning signs investors should be aware of before investing in SolarEdge Technologies. Read for free now.

How SolarEdge Technologies Has Been Performing

SolarEdge Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on SolarEdge Technologies will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SolarEdge Technologies?

In order to justify its P/S ratio, SolarEdge Technologies would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 70%. The last three years don't look nice either as the company has shrunk revenue by 54% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 25% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 24% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that SolarEdge Technologies' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

SolarEdge Technologies' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that SolarEdge Technologies currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.