Please use a PC Browser to access Register-Tadawul

Investors Give Toast, Inc. (NYSE:TOST) Shares A 25% Hiding

Toast, Inc. Class A TOST | 27.07 | -2.06% |

Toast, Inc. (NYSE:TOST) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

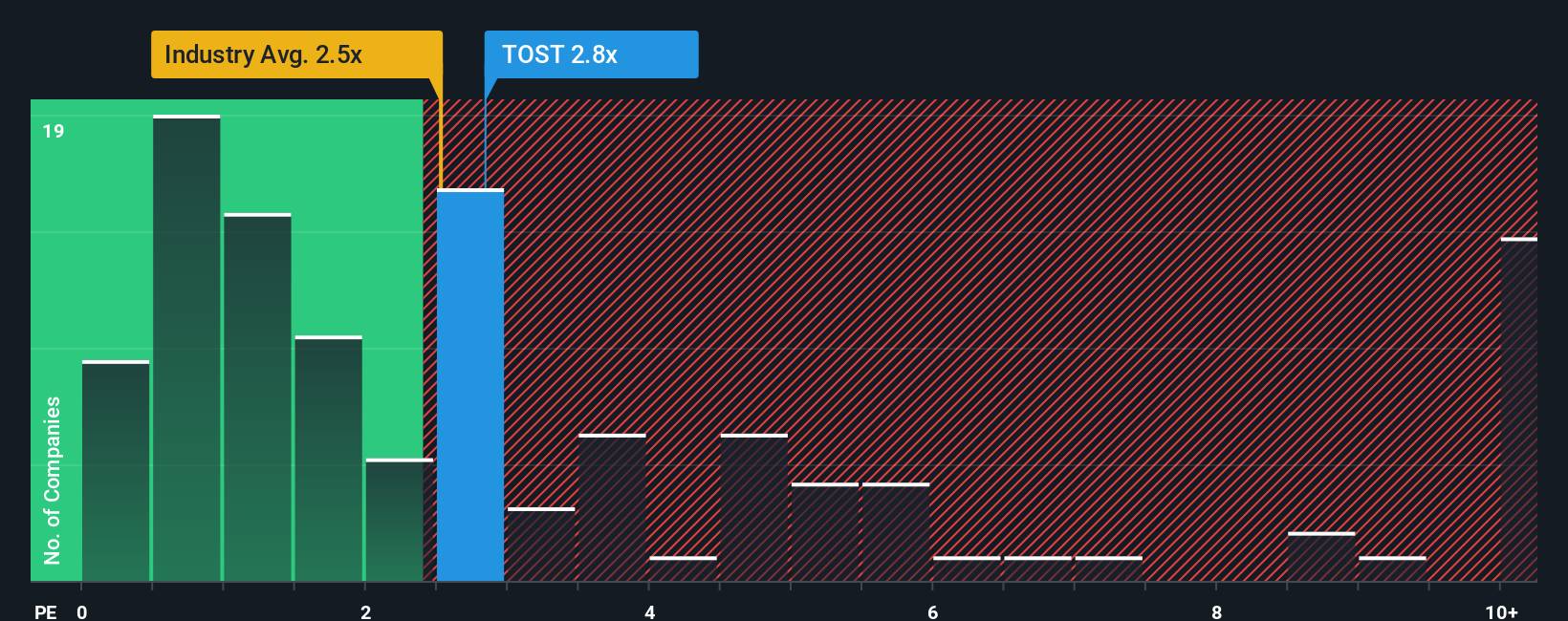

In spite of the heavy fall in price, there still wouldn't be many who think Toast's price-to-sales (or "P/S") ratio of 2.7x is worth a mention when the median P/S in the United States' Diversified Financial industry is similar at about 2.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Toast Performed Recently?

With revenue growth that's superior to most other companies of late, Toast has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Toast.What Are Revenue Growth Metrics Telling Us About The P/S?

Toast's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. Pleasingly, revenue has also lifted 137% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 18% per year over the next three years. That's shaping up to be materially higher than the 9.0% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Toast's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price dropping off a cliff, the P/S for Toast looks to be in line with the rest of the Diversified Financial industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Toast currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.