Please use a PC Browser to access Register-Tadawul

Investors Holding Back On Cheche Group Inc. (NASDAQ:CCG)

Cheche Group Inc. Class A CCG | 0.80 | 0.00% |

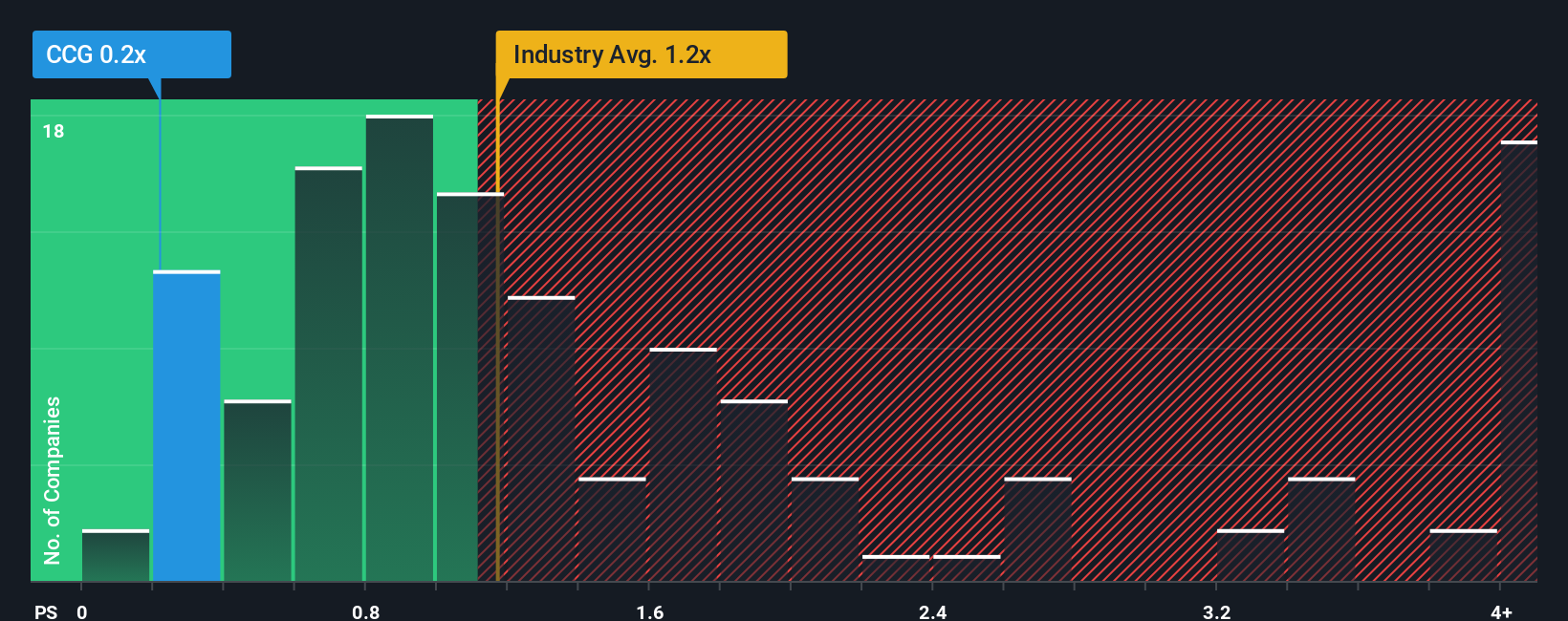

Cheche Group Inc.'s (NASDAQ:CCG) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Insurance industry in the United States have P/S ratios greater than 1.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Cheche Group Performed Recently?

Cheche Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cheche Group.Is There Any Revenue Growth Forecasted For Cheche Group?

In order to justify its P/S ratio, Cheche Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 46% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.0%, which is noticeably less attractive.

In light of this, it's peculiar that Cheche Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Cheche Group's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Cheche Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks.

If you're unsure about the strength of Cheche Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.