Please use a PC Browser to access Register-Tadawul

Investors Interested In Corteva, Inc.'s (NYSE:CTVA) Earnings

CORTEVA INC CTVA | 65.48 65.48 | -0.61% 0.00% Pre |

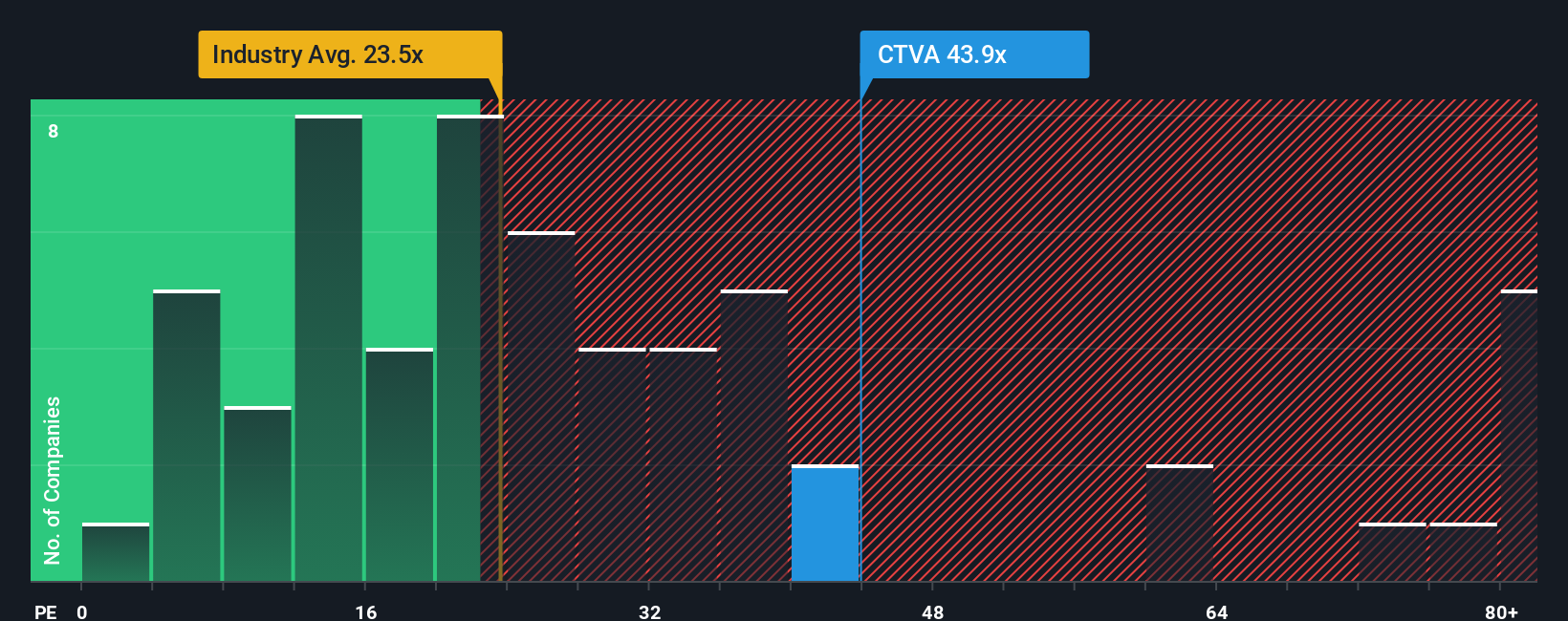

With a price-to-earnings (or "P/E") ratio of 43.9x Corteva, Inc. (NYSE:CTVA) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Corteva has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Corteva's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 67% gain to the company's bottom line. Still, incredibly EPS has fallen 31% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 29% per annum over the next three years. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

In light of this, it's understandable that Corteva's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Corteva maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You might be able to find a better investment than Corteva.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.