Please use a PC Browser to access Register-Tadawul

Investors Still Aren't Entirely Convinced By Lazard, Inc.'s (NYSE:LAZ) Revenues Despite 26% Price Jump

Lazard Ltd Class A LAZ | 50.70 | +0.06% |

Despite an already strong run, Lazard, Inc. (NYSE:LAZ) shares have been powering on, with a gain of 26% in the last thirty days. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

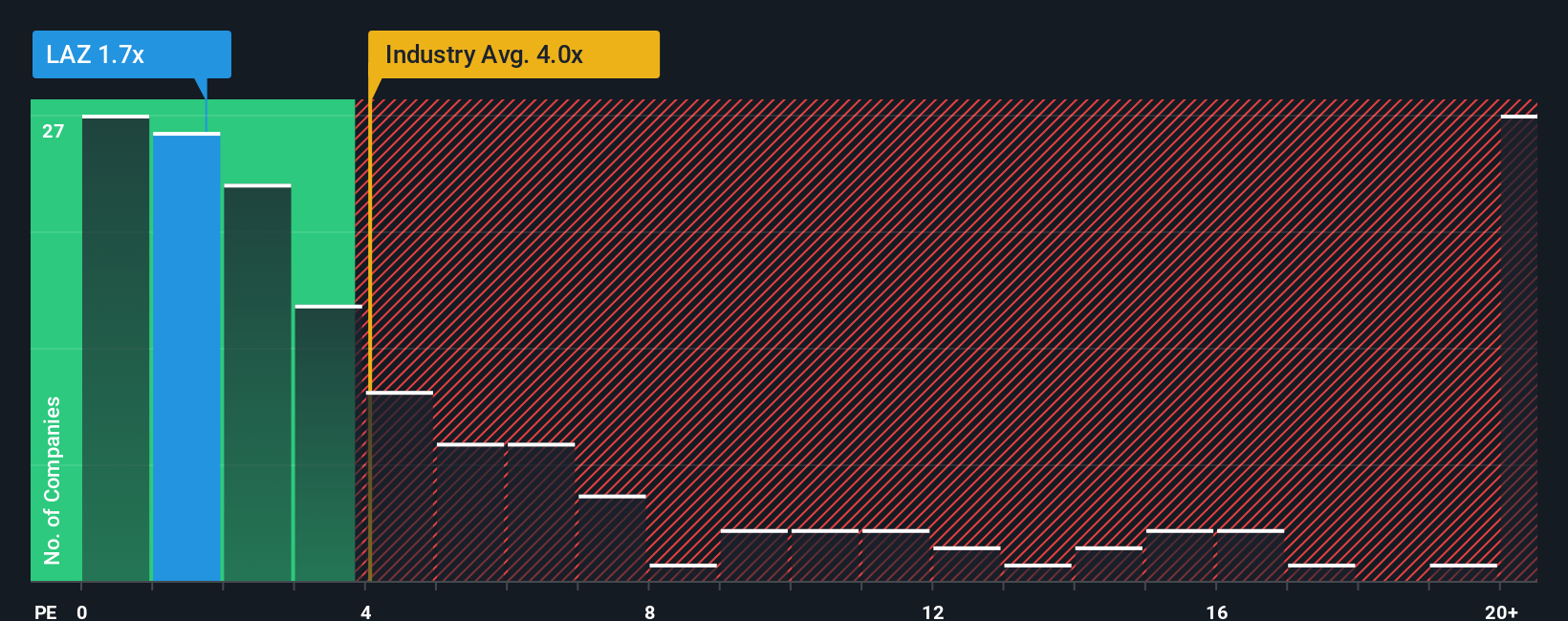

Although its price has surged higher, Lazard's price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Capital Markets industry in the United States, where around half of the companies have P/S ratios above 4x and even P/S above 12x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Lazard's P/S Mean For Shareholders?

Recent times haven't been great for Lazard as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Lazard's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Lazard?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Lazard's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. Still, lamentably revenue has fallen 9.1% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 5.8% as estimated by the seven analysts watching the company. With the industry only predicted to deliver 3.2%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Lazard's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Lazard's P/S

Shares in Lazard have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Lazard currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.