Please use a PC Browser to access Register-Tadawul

Investors Still Waiting For A Pull Back In Loop Industries, Inc. (NASDAQ:LOOP)

Loop Industries, Inc. LOOP | 1.05 | +0.96% |

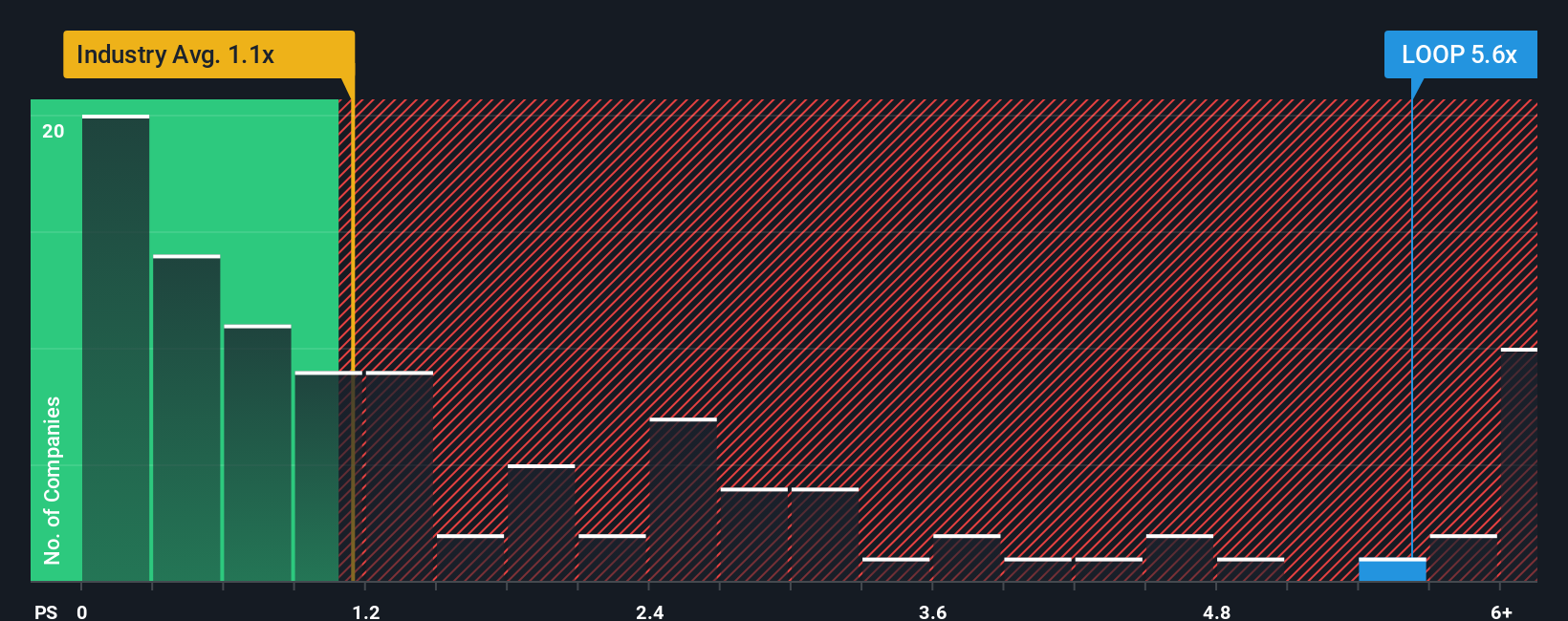

When close to half the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, you may consider Loop Industries, Inc. (NASDAQ:LOOP) as a stock to avoid entirely with its 5.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Loop Industries' P/S Mean For Shareholders?

Recent times have been advantageous for Loop Industries as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Loop Industries will help you uncover what's on the horizon.How Is Loop Industries' Revenue Growth Trending?

In order to justify its P/S ratio, Loop Industries would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 117% each year during the coming three years according to the two analysts following the company. That's shaping up to be materially higher than the 12% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Loop Industries' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Loop Industries shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Loop Industries (at least 2 which are significant), and understanding these should be part of your investment process.

If you're unsure about the strength of Loop Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.