Please use a PC Browser to access Register-Tadawul

IonQ (IONQ) Reports US$21 Million Sales Despite Increased Net Loss

IonQ IONQ | 49.67 | +7.81% |

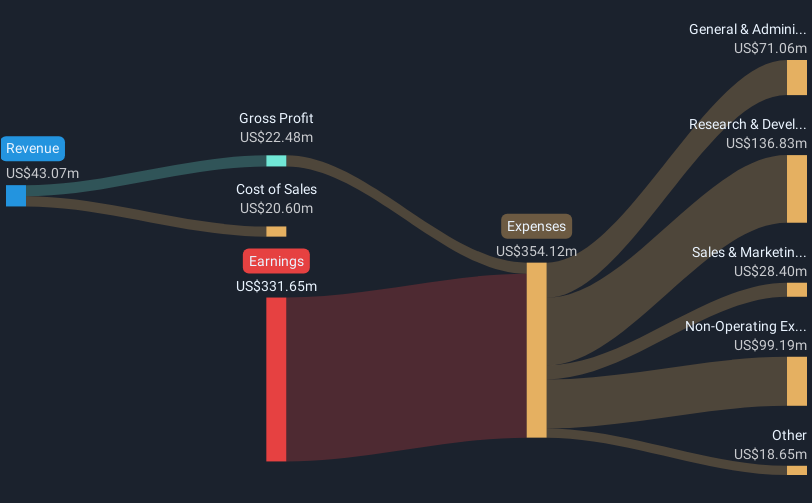

IonQ (IONQ) recently reported its second quarter earnings, showcasing notable revenue growth but also substantial net losses, raising investor concerns despite a 29% stock price increase over the last quarter. This price movement occurred alongside broader market dynamics, where the tech-heavy Nasdaq Composite rose 1% due to positive investor sentiment. Although IonQ's partnerships and advancements in quantum computing technology may have contributed to more interest in the stock, the company's growing losses could have tempered enthusiasm. Additionally, market factors such as US tariff news and overall tech sector performance are likely to have influenced IonQ's stock trajectory.

Over the past three years, IonQ has seen a very large total shareholder return, driven largely by the performance of its stock, with no dividends to factor in. This significant appreciation contrasts sharply with IonQ's one-year performance, which exceeded both the US Tech industry and broader US Market, as well, in this timeframe. However, the company's substantial net losses and intense market competition could pose a challenge to sustaining this trajectory.

The introduction highlights IonQ's recent developments, which have potential implications for its financial forecasts. Revenue growth, fueled by strategic partnerships and innovations, could continue to bolster expectations. However, increasing net losses may temper enthusiasm and influence earnings forecasts negatively. Furthermore, with IonQ's current share price at US$41.23, the stock appears to be trading at a discount to the consensus analyst price target of US$49.29, suggesting potential upside. However, the high Price-To-Book Ratio compared to peers indicates that IonQ may be expensive, warranting cautious optimism among investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.