Please use a PC Browser to access Register-Tadawul

IonQ’s Quantum Networking Breakthrough and New Board Addition Might Change the Case for Investing in IONQ

IonQ IONQ | 50.35 | -4.19% |

- In recent days, IonQ announced the appointment of General John W. “Jay” Raymond, former Chief of Space Operations for the U.S. Space Force, to its Board of Directors, and revealed a breakthrough in quantum networking technology supported by the Air Force Research Lab, alongside new investments in autonomous freight company Einride and continued acquisitions to build its ecosystem.

- These moves highlight IonQ’s intent to position itself as a leader in quantum computing by accelerating government partnerships, technical innovation, and global expansion through both internal developments and targeted acquisitions.

- We'll explore how IonQ's progress in quantum networking technology signals expanding ambitions in both the government and commercial quantum sectors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is IonQ's Investment Narrative?

To be an IonQ shareholder, you have to believe in a vision where quantum computing moves rapidly from laboratory experiments to practical, global deployment, and IonQ establishes itself as the leader in this transformation. The company's latest announcements, including the appointment of General John W. “Jay” Raymond to the board and the progress in quantum networking, seem tailored to reinforce IonQ’s government relationships and technical capability. While these moves may not immediately shift the short-term financial catalysts, such as earnings momentum or revenue acceleration, they help address a core risk around leadership depth and government credibility, which previously was flagged given the relative inexperience of the board and management team. The expanded technical reach into quantum networking, combined with high-profile defense partnerships, may also offset concerns about whether IonQ can convert long-term opportunities into commercial traction. However, the business remains unprofitable, cash burn is significant, and integration risks from recent acquisitions persist, so the company still faces fundamental execution risks in the near term. Unlike many companies, IonQ’s path depends heavily on unproven quantum breakthroughs and managing mounting losses.

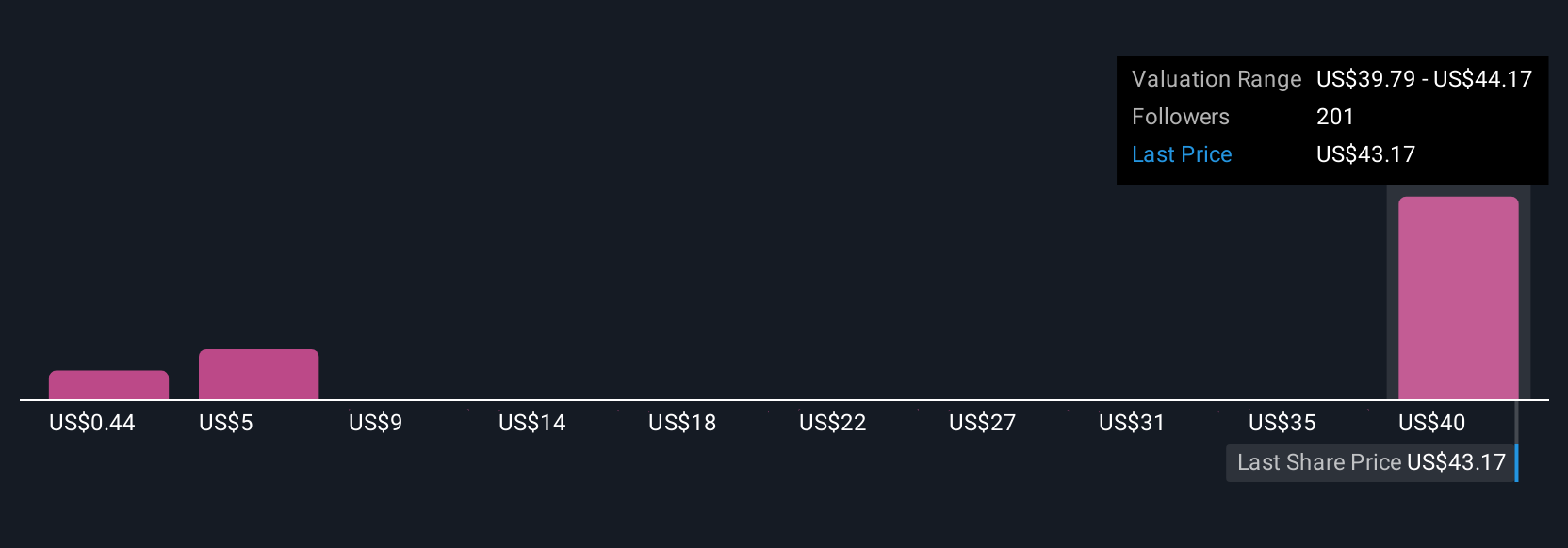

Our valuation report unveils the possibility IonQ's shares may be trading at a premium.Exploring Other Perspectives

Explore 62 other fair value estimates on IonQ - why the stock might be worth as much as $64.62!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.