Please use a PC Browser to access Register-Tadawul

IPO Monitor | The Year's Biggest Tech IPO Arrives! Design Software Giant Figma Debuts on the Market Today—Can AI Software Stocks Soar Along?

Netflix, Inc. NFLX | 94.57 | +0.85% |

Duolingo, Inc. DUOL | 186.77 | +0.43% |

Snowflake SNOW | 220.60 | +2.47% |

monday.com Ltd. MNDY | 150.14 | -0.61% |

Direxion Shares ETF Trust Direxion Daily MSFT Bear 1X Shares MSFD | 11.74 | -0.40% |

2025's Biggest Tech IPO: Investors Rush for Figma's Upcoming Listing

The tech IPO market in 2025 is showing signs of recovery, with investors keenly interested in high-growth, high-potential SaaS stocks. Silicon Valley design software giant Figma, ticker symbol $FIG, is set to officially list on the NYSE on July 31 (Thursday). The IPO is co-managed by top-tier investment banks, including Morgan Stanley, Goldman Sachs, Allen & Company, and JPMorgan Chase, making it one of the most anticipated tech IPOs of the year.

On Wednesday, Figma, the American design software developer, priced its IPO at $33 per share, exceeding the expected range of $30-$32. The company aims to raise $1.2 billion, achieving a valuation of $19.3 billion. Investor enthusiasm is extremely high, with the offering oversubscribed more than 30 times, highlighting strong confidence in Figma's growth potential.

The funds raised through this IPO will be primarily allocated to three key areas:

1. Increasing investment in AI research and development, including proprietary model training and computational infrastructure.

2. Exploring strategic acquisition opportunities, targeting low-code development platforms or innovative AI startups to accelerate product integration and technology upgrades.

3. Partially repaying existing debt to optimize capital structure and solidify its leading position in the design collaboration ecosystem.

Figma has adopted an unusual pricing strategy for this IPO, requiring investors to submit limit orders instead of traditional market orders to achieve more precise pricing in the market. This "auction-style IPO" method was previously employed by popular companies such as DoorDash and Airbnb during the pandemic. As the tech IPO market revives, Figma's choice to employ this mechanism reflects the growing demand for high-quality tech stocks.

Despite the attention surrounding Figma's listing, its current valuation of $19.3 billion is slightly lower than Adobe's $20 billion acquisition offer in 2022. Adobe's high bid indicates that Figma poses a significant strategic threat to Adobe's core business. Adobe's own UI/UX design tool, XD, has underperformed in areas such as real-time collaboration, component systems, development delivery efficiency, and ecosystem activity compared to Figma.

What Makes Figma a Hot Design Software Unicorn in Silicon Valley?

Founded in 2012, Figma is a cloud-based collaborative design platform that has revolutionized the traditional design tool paradigm. It pioneered a "web-first" architecture, enabling users to access and use the platform directly through a browser without the need to install local software. Additionally, Figma supports real-time collaborative editing by default, enabling efficient interaction among design teams. The platform also fosters an active user community, encouraging the sharing of resources and creative exchanges. These three features constitute Figma's distinct competitive advantage over traditional desktop software giants like Adobe.

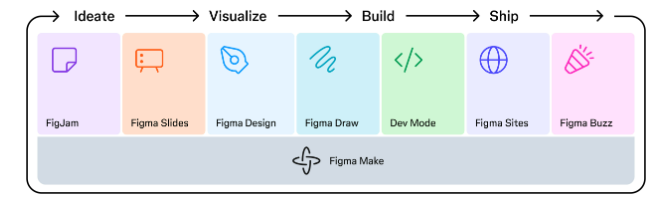

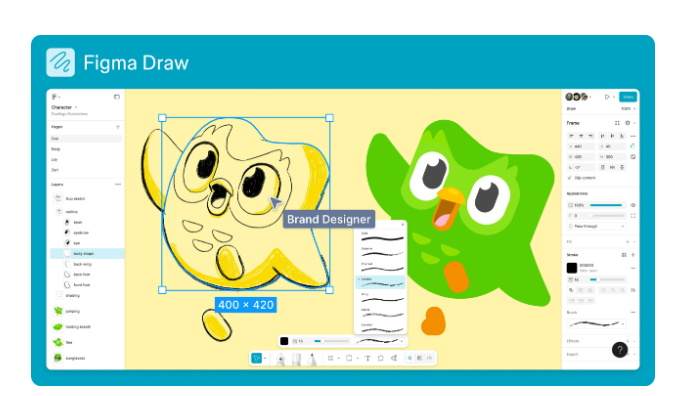

As an end-to-end product design and development collaboration platform, Figma offers a comprehensive toolchain covering every stage from ideation to product launch. Teams can use FigJam (an online collaboration whiteboard) and Figma Slides (a presentation tool) for brainstorming and decision-making. Designers utilize Figma Design (core design tool) and Figma Draw (vector drawing tool) to transform ideas into visual interfaces. Developers can directly view design specifications and generate code through the Dev Mode feature, enhancing delivery efficiency. Project outcomes can be quickly turned into responsive websites using Figma Sites, and marketing content can be created with Figma Buzz. The platform deeply integrates AI technology, such as Figma Make, which automatically generates interactive prototypes, further accelerating the design process. This suite of functions positions Figma as an integrated collaboration hub connecting product, design, and development teams, enabling seamless coordination from concept creation to design development and launch promotion.

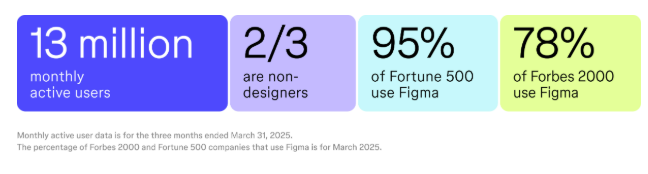

Figma's rapid growth is fueled by its broad and high-quality customer base. As of March 2025, the platform boasts over 13 million monthly active users, with professional designers comprising only about one-third, while 67% are non-designers (such as product managers and developers). This ratio highlights Figma's deep penetration and cross-departmental collaboration value among product, engineering, and marketing teams. Notably, about 85% of users are from international markets outside the U.S., yet overseas revenue contribution stands at 53%, indicating significant growth potential in paid conversion and commercial monetization among international users.

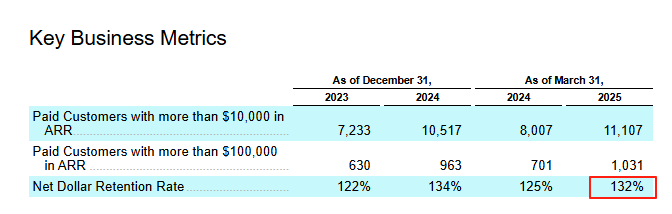

On the enterprise client front, Figma has attracted approximately 450,000 registered businesses using its services, with large clients contributing over $100,000 annually, reaching 1,031, a 47% increase from the previous year. The net dollar retention rate (NDR) is 132%, demonstrating strong demand and customer loyalty in the high-end enterprise market. Its flagship clients span various industries, including tech leaders like Netflix, Inc.(NFLX.US) and Stripe, education platforms like Duolingo, Inc.(DUOL.US), and Latin American e-commerce giant Mercado Libre.

Figma's Core Investment Value Analysis and IPO Outlook

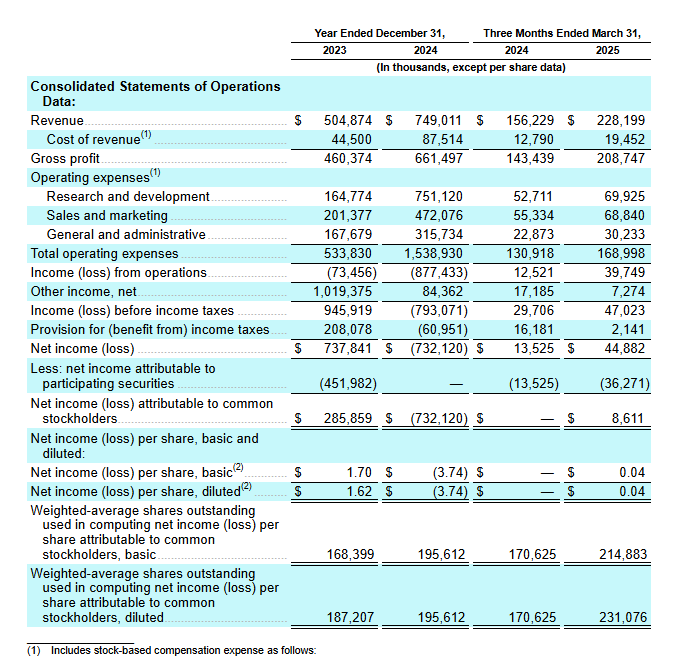

Figma demonstrates exceptional financial fundamentals, especially in a SaaS industry environment where overall growth is slowing. In the 2024 fiscal year, the company reported revenue of $749 million, a 48% increase year-over-year. In the first quarter of 2025, revenue reached $228 million, growing by 46%, significantly above the industry average.

Notably, this high growth is not driven by capital subsidies or aggressive investments but is based on a proven sustainable business model. Figma's non-GAAP operating profit margin stands at 18%, and its operating cash flow margin is 28%, both far exceeding the SaaS industry average of around 18%, showcasing strong profitability and operational efficiency.

In terms of profitability, Figma's Q1 gross margin is an impressive 91%, with revenue growing 46% to $228.2 million and an operating profit margin of 17%. This far surpasses the SaaS "Rule of 40" benchmark, which suggests that the sum of revenue growth rate and profit margin should be at least 40%, indicating that the company maintains excellent profitability while achieving rapid growth.

Although Figma incurred losses in 2024 due to $751 million in AI research and development investments, it achieved a net profit of $44.9 million in Q1 2025, tripling from $13.5 million in Q1 2024. Strategically, its net dollar retention rate of 132% underscores high customer product stickiness and expanding usage depth.

Furthermore, Figma is focused on deeply integrating AI technology into its product line, aiming to become the design operating system of the AI era and establish a second growth curve. The word "AI" is mentioned 150 times in its prospectus, highlighting the company's commitment to this strategic direction.

Specifically, Figma Make generates interactive prototypes from text prompts, Figma Draw uses AI to optimize vector graphics, and Figma Buzz can create marketing materials in bulk, significantly lowering the barriers to design work.

Thanks to the introduction of AI features, enterprise clients show a marked increase in upgrade intentions, with renewal rates for AI tool users 15% higher than non-users, and the upgrade to enterprise versions rising by 20%. If Figma can achieve a 10%-15% increase in average customer spend through its AI features, it could unlock a new market opportunity valued at approximately $20 billion.

In terms of valuation, with an offering price at 33$ per share, Figma's corresponding market value is $19.3 billion, with a price-to-sales (P/S) ratio of 22.9 times. Referencing Adobe's $20 billion acquisition offer, calculated at 487 million shares, this equates to approximately $41.03 per share. Should Figma's AI commercialization exceed expectations, the market may reassess its growth potential and grant a higher valuation premium.

Figma occupies a position of high margin, high growth, and strong synergy in the design tool sector, directly aligning its valuation logic with Adobe's billion-dollar UI/UX business. Despite Canva's strong performance in the consumer market, Figma's penetration in the B2B segment (450,000 enterprise clients) and AI technology barriers result in a significantly higher valuation compared to similar competitors.

Figma stands in the middle ground of growth and profitability within the SaaS industry. Its gross margin (91%) is notably higher than Snowflake(SNOW.US)'s (78%) and monday.com Ltd.(MNDY.US)'s (80%), though its growth rate (46%) is slightly lower than Snowflake's (58%). This combination places its valuation between the two, adhering to the premium logic of "high-margin SaaS."

The Figma Effect: Which AI Software Stocks Will Soar?

Figma's IPO is generating significant buzz, akin to the market excitement surrounding unicorn company Circle earlier this year. With a vast market size and backing from prominent investment firms, Figma has captured widespread attention. Since its founding in 2012, Figma has completed eight rounds of financing, with participation from renowned Silicon Valley venture capital firms such as Coatue, Sequoia, A16Z, and Kleiner Perkins.

Investors have high hopes for Figma's post-IPO performance, anticipating it to potentially double like Circle. Here are some AI software stocks worth watching for investors:

- AI + Multi-field

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Direxion Shares ETF Trust Direxion Daily MSFT Bear 1X Shares(MSFD.US) | Covers multiple AI tracks including cloud computing, enterprise services, office automation, and security. |

| Amazon.com, Inc.(AMZN.US) | Provides full-stack solutions from infrastructure to application layer in cloud computing and enterprise services. |

| Alphabet Inc. Class A(GOOGL.US) | Excels in areas such as search engines, cloud computing, advertising, autonomous driving, and medical AI. |

| Meta Platforms(META.US) | Demonstrates strong AI capabilities in social media, advertising, and the metaverse. |

| TENCENT HOLDINGS LIMITED(TCEHY.US) | Encompasses technology development, application scenarios, open platforms, and global layout, especially in gaming, social, and content creation. |

| Alibaba Group Holding Ltd. Sponsored ADR(BABA.US) | AI technology is widely applied in e-commerce, office, and logistics, driving business growth. |

AI + Data

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Palantir(PLTR.US) | Provides enterprise-level AI-driven data analysis platforms like AIP, supporting complex data analysis and decision-making in government, finance, healthcare, and more. |

| Oracle Corporation(ORCL.US) | Offers database and data analysis solutions, integrating AI technology to optimize enterprise data management and decision support. |

| International Business Machines Corporation(IBM.US) | Provides enterprise AI solutions like the Watson platform, supporting data analysis, automated decision-making, and intelligent customer service. |

| MONGODB(MDB.US) | Offers AI-driven data management platforms, supporting real-time data processing and AI application development. |

| Confluent, Inc.(CFLT.US) | Provides stream data processing platforms, supporting event-driven architecture and AI applications, widely used in real-time data processing. |

| Snowflake(SNOW.US) | Offers cloud data platforms, supporting data analysis and AI model training, widely used in enterprise data warehousing. |

| Kingsoft Cloud Holdings(KC.US) | Provides enterprise-level cloud computing services, covering cloud hosting, cloud storage, and cloud security. |

- AI + Security

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Cloudflare(NET.US) | Provides AI-driven CDN and security solutions, supporting DDoS protection and web application firewalls, widely used in internet applications. |

| Datadog(DDOG.US) | Offers AI-driven monitoring and analytics platforms, supporting real-time monitoring and anomaly detection, widely used in cloud-native applications. |

| CrowdStrike(CRWD.US) | Provides AI-driven endpoint security solutions, supporting malware detection and response, widely used in enterprises and government institutions. |

| Fortinet, Inc.(FTNT.US) | Offers AI-driven network security solutions, supporting firewalls and intrusion detection systems, widely used in small to medium-sized businesses. |

| Palo Alto Networks, Inc.(PANW.US) | Provides AI-driven network security solutions, supporting threat detection and defense, widely used in enterprise networks and cloud environments. |

- AI + Enterprise Services

| Related Stocks | Business Areas and Characteristics |

|---|---|

| C3.ai Inc(AI.US) | Provides comprehensive AI applications and platforms to help enterprises accelerate digital transformation. |

| Salesforce.com, inc.(CRM.US) | Offers AI-driven CRM solutions, supporting intelligent sales and customer service. |

| UiPath, Inc.(PATH.US) | Provides AI-driven automation platforms, supporting document processing and task automation to enhance operational efficiency. |

| Zoom Video Communications(ZM.US) | Transitioning from video conferencing to AI office platforms, offering AI assistants and customizable plugins to improve work efficiency and customer experience. |

| SAP SE Sponsored ADR(SAP.US) | Provides AI-driven enterprise resource planning (ERP) solutions, supporting supply chain, human resources, and customer relationship management across multiple fields. |

| ServiceNow, Inc.(NOW.US) | Offers AI-driven IT service management (ITSM) and enterprise workflow automation solutions to enhance IT operational efficiency. |

| Workday, Inc. Class A(WDAY.US) | Provides AI-driven human resources and financial management solutions, enhancing work efficiency and decision quality through Workday Illuminate. |

- AI + Education

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Duolingo, Inc.(DUOL.US) | Provides AI-driven language learning platforms, supporting personalized learning paths and intelligent teaching. |

| Coursera Inc(COUR.US) | Offers online courses and AI-driven learning experiences, supporting career development and skill enhancement. |

| Chegg, Inc.(CHGG.US) | Provides AI-driven tutoring services and learning resources, supporting student skill assessment and personalized learning. |

| GSX Techedu, Inc. Sponsored ADR Class A(GOTU.US) | Offers AI-driven educational services across multiple fields, supporting personalized learning and intelligent tutoring. |

| TAL Education Group Sponsored ADR Class A(TAL.US) | Provides AI-driven educational solutions, supporting personalized learning and intelligent teaching. |

- AI + Advertising

| Related Stocks | Business Areas and Characteristics |

|---|---|

| AppLovin Corporation(APP.US) | Provides AI-driven advertising and marketing platforms, supporting intelligent ad placement and user analysis. |

| The Trade Desk(TTD.US) | Offers real-time bidding systems, AI and machine learning optimization tools, and data management platform services. |

| Braze, Inc.(BRZE.US) | Provides AI-driven customer engagement platforms, supporting real-time data analysis, personalized messaging, and multi-channel marketing. |

| Digital Turbine(APPS.US) | Utilizes AI to provide services for mobile operators, device manufacturers, and advertisers. |

- AI + Finance

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Upstart(UPST.US) | Provides AI-driven lending platforms, supporting intelligent credit decisions. |

| Lemonade(LMND.US) | Offers insurance services through AI technology, including smart claims processing and risk assessment. |

| Intuit Inc.(INTU.US) | Provides AI-driven financial management software, including smart tax and financial planning services. |

| FICO $FICO | Utilizes AI technology to offer credit scoring and risk assessment services, helping financial institutions optimize decisions. |

| Guidewire $GWRE | Provides AI-driven insurance software solutions, optimizing claims processing and risk management. |

- AI + Healthcare

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Tempus AI(TEM.US) | Provides AI-driven precision diagnostics and personalized treatment in the medical field. |

| Schrodinger(SDGR.US) | Offers AI-driven drug development platforms, supporting drug design and molecular simulations. |

| RECURSION PHARMACEUTICALS, INC.(RXRX.US) | Provides AI-driven drug discovery platforms, supporting automated experiments and data analysis. |

| Doximity, Inc.(DOCS.US) | Offers AI-driven medical networking platforms, supporting physician collaboration and patient management. |

- AI + Voice

| Related Stocks | Business Areas and Characteristics |

|---|---|

| SoundHound AI(SOUN.US) | Provides voice recognition and conversational AI technology, supporting smart voice assistants and in-car voice interactions. |

| CERENCE INC(CRNC.US) | Offers in-car voice interaction and AI solutions, enhancing the smart driving experience. |

| Twilio, Inc. Class A(TWLO.US) | Enhances its communication platform with AI technology, offering intelligent voice interactions, automatic speech recognition, and natural language processing. |

- AI + Creativity

| Related Stocks | Business Areas and Characteristics |

|---|---|

| Adobe Systems Incorporated(ADBE.US) | Provides AI-driven creative tools, such as generative AI for image and video editing, supporting content creation. |

| Zhihu Technology Ltd(ZH.US) | Provides an AI-driven content creation and Q&A platform, supporting intelligent content recommendations and user interaction. |