Please use a PC Browser to access Register-Tadawul

IQVIA Duke Alliance Highlights Obesity Trials And Potential Valuation Upside

IQVIA Holdings Inc IQV | 165.62 | -2.21% |

- IQVIA Holdings (NYSE:IQV) and Duke Clinical Research Institute entered a collaboration focused on obesity and cardiometabolic clinical trials.

- The partnership combines IQVIA's global trial operations with DCRI's academic research capabilities to support new therapies in these disease areas.

- The collaboration aims to broaden access to diverse patient groups and set benchmarks for clinical and scientific quality in future studies.

For investors looking at NYSE:IQV, this move sits at the intersection of two notable forces: the growing focus on obesity treatments and the push to run more complex, data-heavy trials efficiently. IQVIA is involved in global clinical research and real-world data projects, and partnering with an academic organization in cardiometabolic medicine aligns with areas that currently attract significant healthcare spending and drug development attention.

Key considerations include how effectively this collaboration translates into trial wins, stronger relationships with biopharma sponsors, and scalable processes that can be applied across obesity and metabolic programs. As additional therapies enter clinical testing in these areas, investors may monitor whether IQVIA's role in study design, patient access, and operational benchmarks becomes a differentiating factor compared with other contract research and data-focused peers.

Stay updated on the most important news stories for IQVIA Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IQVIA Holdings.

Quick Assessment

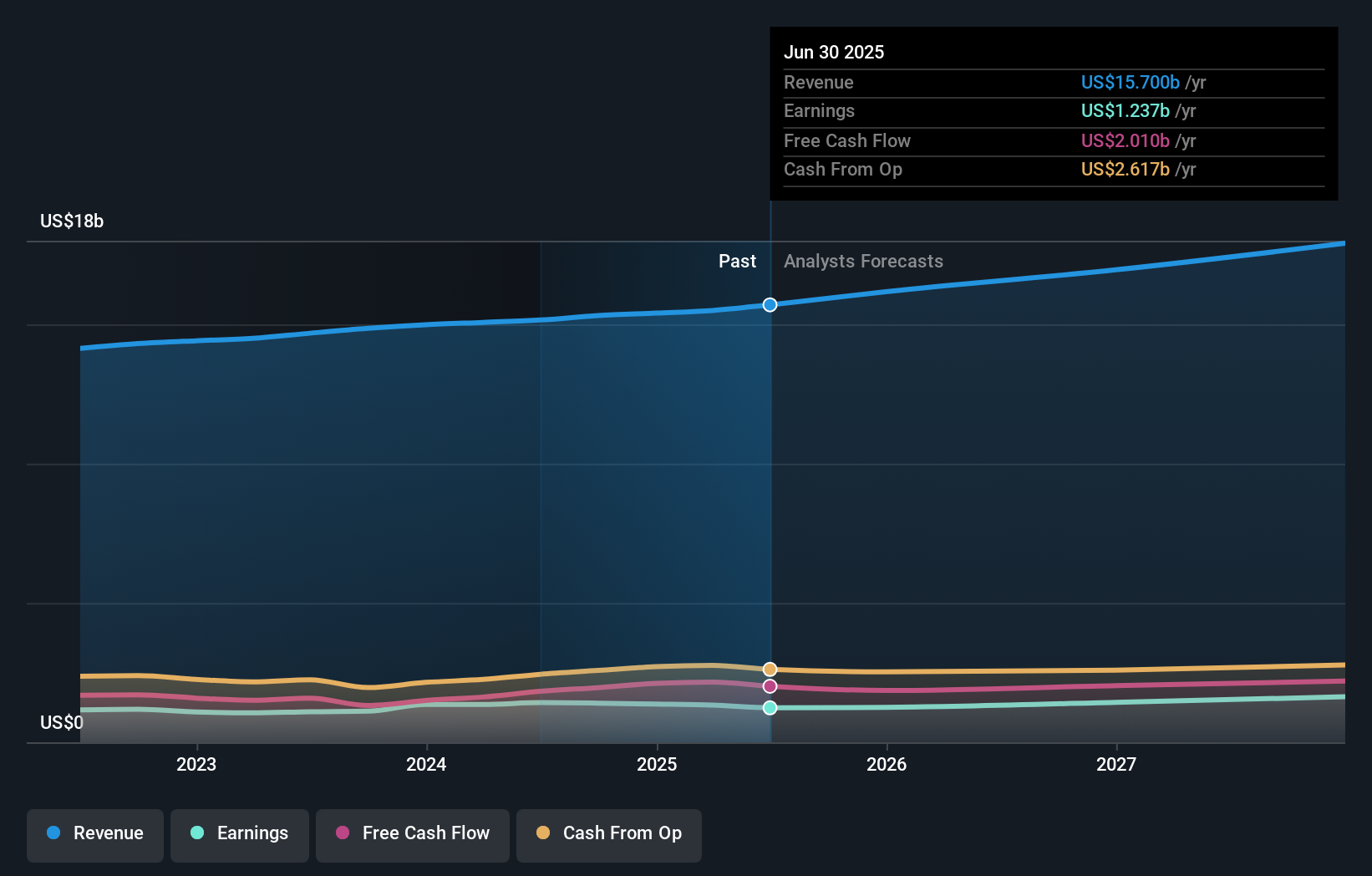

- ✅ Price vs Analyst Target: At US$177.18 against a consensus target of US$246.10, the price is about 28% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St currently estimates the shares are trading about 43% below fair value.

- ❌ Recent Momentum: The 30 day return of roughly 26% decline points to weak short term sentiment.

There is only one way to know the right time to buy, sell or hold IQVIA Holdings. Head to Simply Wall St's company report for the latest analysis of IQVIA Holdings's fair value.

Key Considerations

- 📊 The DCRI collaboration ties IQVIA more closely to obesity and cardiometabolic research, which already attracts significant clinical and funding attention.

- 📊 Keep an eye on new trial wins, cardiometabolic related revenue contributions, and whether the current P/E of 22.1 stays below the Life Sciences industry average of 32.9.

- ⚠️ Debt coverage by operating cash flow is flagged as a key risk, so heavier trial activity would be worth viewing alongside leverage and cash generation trends.

Dig Deeper

For the full picture including more risks and rewards, check out the complete IQVIA Holdings analysis. Alternatively, you can visit the community page for IQVIA Holdings to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.