Please use a PC Browser to access Register-Tadawul

IRADIMED Dividend Hike Follows Record Revenue And New MRI Pump Rollout

IRadimed Corp. IRMD | 103.56 | +2.68% |

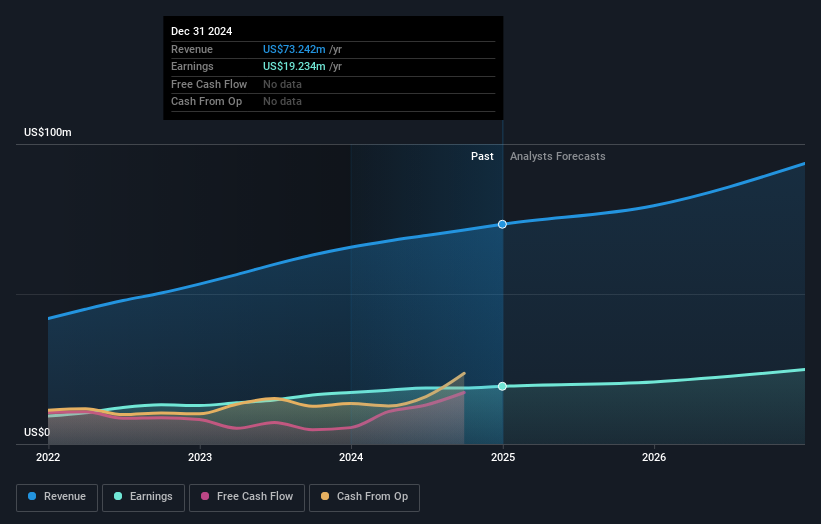

- IRADIMED (NasdaqGM:IRMD) has reported its 18th consecutive quarter of record revenue.

- The company is seeing strong adoption of its existing MRI-compatible devices alongside shipments of its new 3870 infusion pump.

- IRADIMED has raised its regular quarterly dividend, citing confidence supported by future product launches and domestic replacement demand.

At a share price of $99.81, IRADIMED comes into this news with a 1-year return of 83.6% and a 3-year return of 177.7%. The stock has moved 4.0% over the past week and 4.5% year to date, while the 30-day return of 1.7% shows some recent consolidation after a strong multi-year run.

For investors, this mix of record revenue, a new MRI-compatible infusion pump shipping to customers, and a higher dividend indicates a company that is actively investing in its product line while returning more cash to shareholders. The upcoming product rollouts and domestic replacement opportunities highlighted by management are areas to monitor when assessing how durable this performance may be over time.

Stay updated on the most important news stories for IRADIMED by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IRADIMED.

The dividend increase to US$0.20 per share comes on the back of what the company describes as its 18th straight quarter of record revenue and double digit growth in both sales and earnings. With full year 2025 net income of US$22.48m on sales of US$83.81m, and 2026 guidance pointing to revenue of US$91.0m to US$96.0m and GAAP diluted EPS of US$1.90 to US$2.05, the higher payout signals management’s comfort with current cash generation and near term visibility. Investors will likely pay close attention to how the 3870 MRI compatible infusion pump rollout and the identified domestic replacement opportunity of about 6,400 older pump channels support cash flows that can fund both growth investments and dividends. At the same time, recent heavy insider selling over the past 6 months invites some caution and may lead income focused investors to cross check whether the higher dividend aligns with insider behavior and long term capital allocation priorities.

How This Fits Into The IRADIMED Narrative

- The stronger dividend sits alongside expectations that the new 3870 pump and higher pricing can support recurring revenue from replacement cycles and consumables, which is a key part of the existing narrative.

- Heavy reliance on a relatively narrow MRI compatible pump and monitor portfolio still features as a risk, and the dividend increase does not remove concerns about product concentration or future competitive pressure from peers like Becton Dickinson, Baxter International, or ICU Medical.

- The higher regular dividend and the prior special dividend show a willingness to return cash that is not fully captured in the earlier narrative focus on growth and margins, and may influence how investors think about capital allocation over time.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for IRADIMED to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Analysts have flagged 1 risk for IRADIMED, including significant insider selling over the past 3 months, which some investors may see as a mixed signal alongside the higher dividend.

- ⚠️ Dependence on a narrow set of MRI compatible devices means any disruption in product adoption, supply chain, or regulatory timelines could affect the cash flows that support ongoing dividend payments.

- 🎁 Earnings grew by 16.9% over the past year, which gives the company more room to fund dividends while still investing in its next generation pump and international expansion.

- 🎁 Earnings are forecast to grow 10.6% per year, which, if achieved, could help support both a regular dividend and potential future increases without stretching the balance between shareholder returns and reinvestment.

What To Watch Going Forward

From here, it is worth tracking how quickly the 3870 pump moves from initial shipments to broad commercial adoption, and whether the identified 6,400 channel domestic replacement pool starts to show up clearly in quarterly revenue and earnings. Investors may also want to monitor the payout in relation to GAAP EPS, especially against the 2026 guidance range, to judge how conservative or aggressive the dividend policy looks over time. Finally, insider trading activity and updates on European and Japanese approvals could provide useful context for how durable the current dividend level may be if growth outside the United States progresses more slowly than expected.

To ensure you're always in the loop on how the latest news impacts the investment narrative for IRADIMED, head to the community page for IRADIMED to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.