Please use a PC Browser to access Register-Tadawul

IRADIMED Record Revenue Streak Supports 3870 Pump Rollout And Dividend Growth

IRadimed Corp. IRMD | 103.56 | +2.68% |

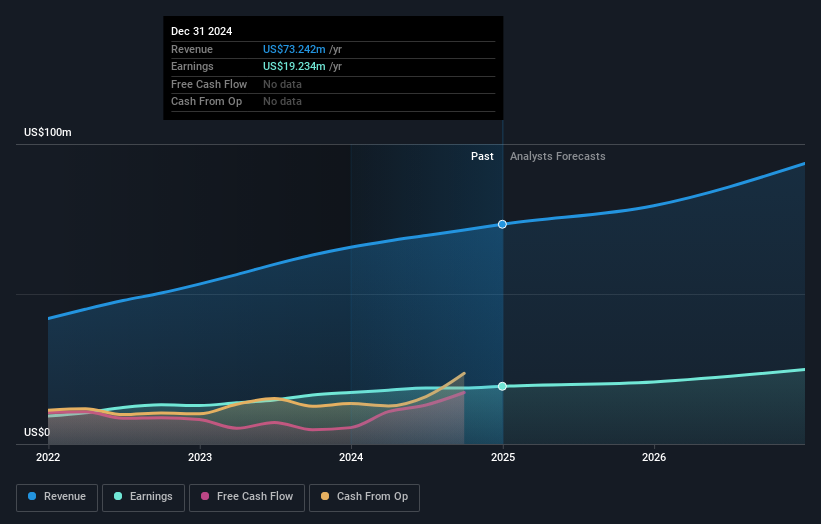

- IRADIMED (NasdaqGM:IRMD) reported its 18th consecutive quarter of record revenue.

- The company announced the full rollout of its next generation 3870 MRI compatible IV infusion pump.

- IRADIMED also increased its quarterly dividend alongside the product launch.

IRADIMED enters this news cycle with clear momentum, reflected in a current share price of $103.08 and a 1 year return of 89.0%. Over 3 years the stock is up 181.9%, and over 5 years it is up 368.7%. This puts recent developments in the context of a strong longer term track record for shareholders.

The launch of the 3870 pump, combined with expectations for broader use in Europe and Japan, gives the business a wider runway in MRI compatible infusion systems. Management’s decision to raise the quarterly dividend, alongside another record revenue quarter, indicates they view the product rollout and replacement opportunity as potentially meaningful drivers for the company’s next phase.

Stay updated on the most important news stories for IRADIMED by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IRADIMED.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$103.08 vs a US$120.00 analyst target, the share price sits about 14% below that view.

- ❌ Simply Wall St Valuation: The stock is trading about 210.3% above the estimated fair value, which flags a rich valuation.

- ✅ Recent Momentum: A 30 day return of roughly 3.9% suggests the stock has been holding positive short term momentum into this news.

There is only one way to know the right time to buy, sell or hold IRADIMED: head to Simply Wall St's company report for the latest analysis of IRADIMED's Fair Value.

Key Considerations

- 📊 Eighteen consecutive record revenue quarters, the 3870 pump rollout, and a higher dividend strengthen the business case around MRI compatible devices and shareholder returns.

- 📊 Keep an eye on how revenue, earnings per share and margins trend as the 3870 gains traction in Europe and Japan, and whether the P/E of 58.3x drifts closer to the medical equipment industry average of 30.8x.

- ⚠️ Simply Wall St flags one minor risk related to significant insider selling over the past 3 months, which some investors may want to weigh against the strong operating performance.

Dig Deeper

For the full picture including more risks and rewards, check out the complete IRADIMED analysis. Alternatively, you can visit the community page for IRADIMED to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.