Please use a PC Browser to access Register-Tadawul

iRhythm Reorganization Raises Questions On Valuation And Shareholder Position

iRhythm Holdings, Inc. IRTC | 150.96 | -4.98% |

- iRhythm Technologies, Inc. has voluntarily deregistered its Common Stock.

- The company has completed a holding company reorganization.

- iRhythm Holdings, Inc. now serves as the new public entity for shareholders.

- The changes affect the stock associated with NasdaqGS:IRTC and the prior operating company.

iRhythm focuses on cardiac monitoring solutions, so any change in its corporate structure tends to attract attention from investors who follow medical technology names. The move to a holding company format, with iRhythm Holdings, Inc. now out front, can influence how investors think about legal risk, capital allocation, and future corporate actions.

For you as a shareholder or potential investor, the key question is what this reorganization means for voting rights, reporting, and how NasdaqGS:IRTC trades over time. The rest of this article looks at what has changed, what appears to be largely administrative, and which areas might warrant a closer read of company filings.

Stay updated on the most important news stories for iRhythm Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on iRhythm Holdings.

Quick Assessment

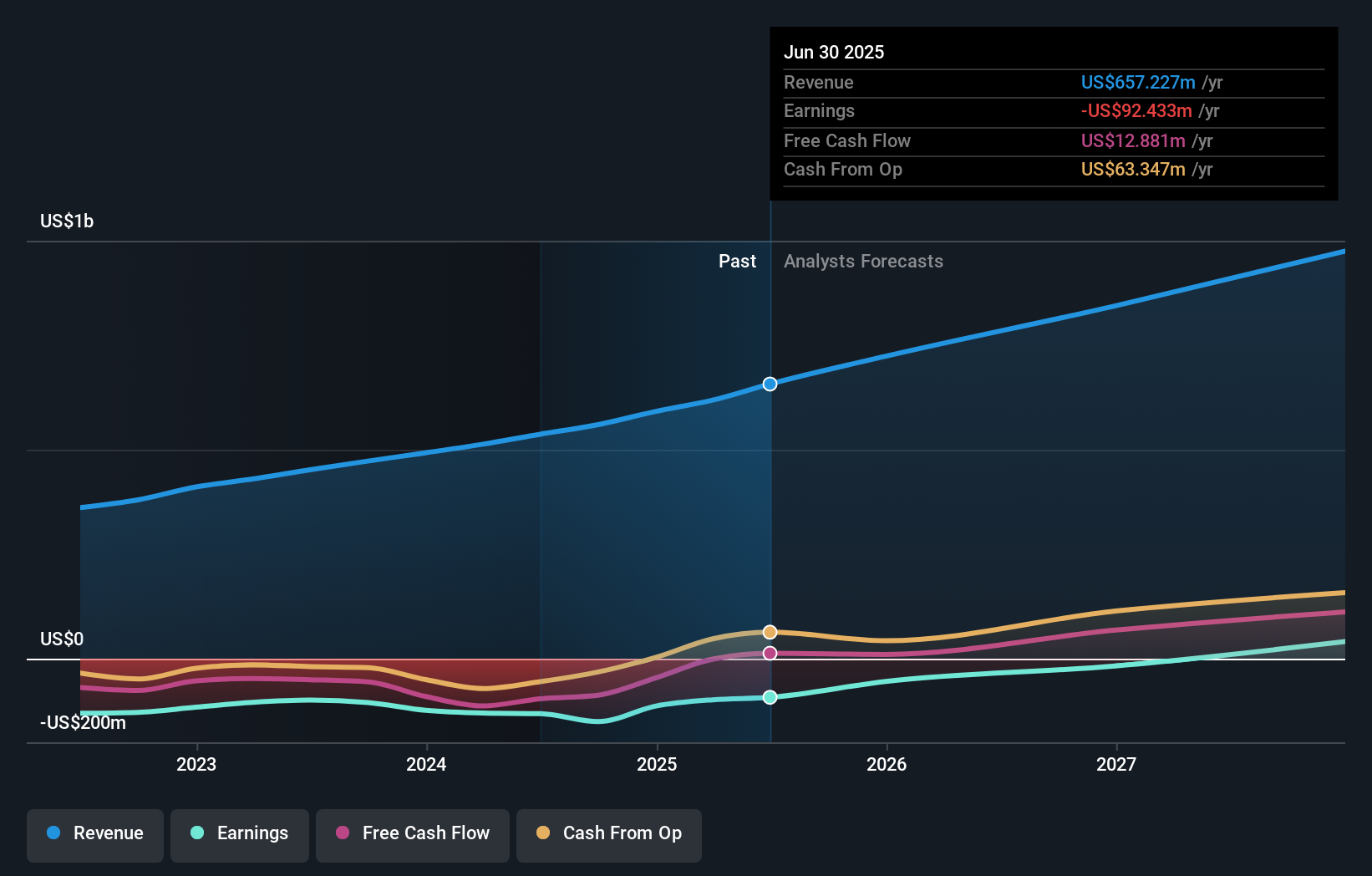

- ✅ Price vs Analyst Target: At US$152.22, iRhythm Holdings trades about 31% below the US$221.27 analyst price target range midpoint.

- ❌ Simply Wall St Valuation: Shares are described as trading 93% above estimated fair value, which flags valuation as stretched on this model.

- ❌ Recent Momentum: The 30 day return of about 9.9% decline suggests the stock has recently been under pressure.

There is only one way to know the right time to buy, sell or hold iRhythm Holdings. Head to Simply Wall St's company report for the latest analysis of iRhythm Holdings's Fair Value.

Key Considerations

- 📊 The holding company reorganization means you will want to confirm how your existing NasdaqGS:IRTC position now maps to iRhythm Holdings and whether any rights or obligations changed.

- 📊 Keep an eye on how the market prices the new holding company relative to the analyst target of US$221.27 and the modelled fair value gap, especially after the recent 9.9% 30 day pullback.

- ⚠️ One highlighted risk is recent insider selling. Together with an overvalued label, this may warrant closer attention to future filings and trading updates.

Dig Deeper

For the full picture including more risks and rewards, check out the complete iRhythm Holdings analysis. Alternatively, you can visit the community page for iRhythm Holdings to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.