Please use a PC Browser to access Register-Tadawul

iRhythm Technologies (IRTC): Analyst Coverage Sparks Fresh Look at Valuation After Sales Expansion and Product Innovations

iRhythm Technologies, Inc. IRTC | 168.83 | -0.16% |

iRhythm Technologies (IRTC) recently attracted attention following new analyst coverage from Freedom Capital Markets, which highlighted the company’s leadership in long-term cardiac monitoring. The report also emphasized iRhythm’s expansion into new sales channels and the introduction of innovative devices.

iRhythm Technologies has enjoyed exceptional momentum this year, with a 103.8% year-to-date share price return and a stellar 1-year total shareholder return of 133.3%. Recent analyst coverage, along with strong revenue growth and successful new product launches, has sparked renewed optimism and helped the stock break out well ahead of its long-term average. This suggests investors are becoming more upbeat about the company’s growth potential.

If you want to see what else is thriving in medtech, it is worth exploring the latest opportunities with our dedicated See the full list for free.

With such strong performance and market enthusiasm, investors might be wondering whether iRhythm Technologies is still trading at an attractive price or if the current valuation already reflects all foreseeable growth.

Most Popular Narrative: 5.6% Undervalued

With iRhythm Technologies trading at $182.27 and the most widely followed narrative assigning a fair value around $193, the gap between price and expectations sparks debate on whether recent gains leave more upside on the table. The forward-looking narrative ties this view directly to the company’s growth runway and evolving market dynamics.

Increasing adoption of early arrhythmia detection by primary care physicians, enabled by EHR integrations and targeted partnerships, is expanding iRhythm's addressable market beyond traditional cardiology channels. This is leading to robust new account openings and sustained volume growth, likely to accelerate top-line revenue.

Want a peek behind the curtain of this valuation? Hint: it packs bold forecasts for iRhythm’s recurring revenue model and margin lift, but that’s just the beginning. Discover what else justifies this rich fair value story and why some believe the potential might surprise even the bulls.

Result: Fair Value of $193 (UNDERVALUED)

However, execution slip-ups or intensified competition from new wearable tech could quickly challenge iRhythm's growth narrative and weaken recent market optimism.

Another View: Looking at Revenue Multiples

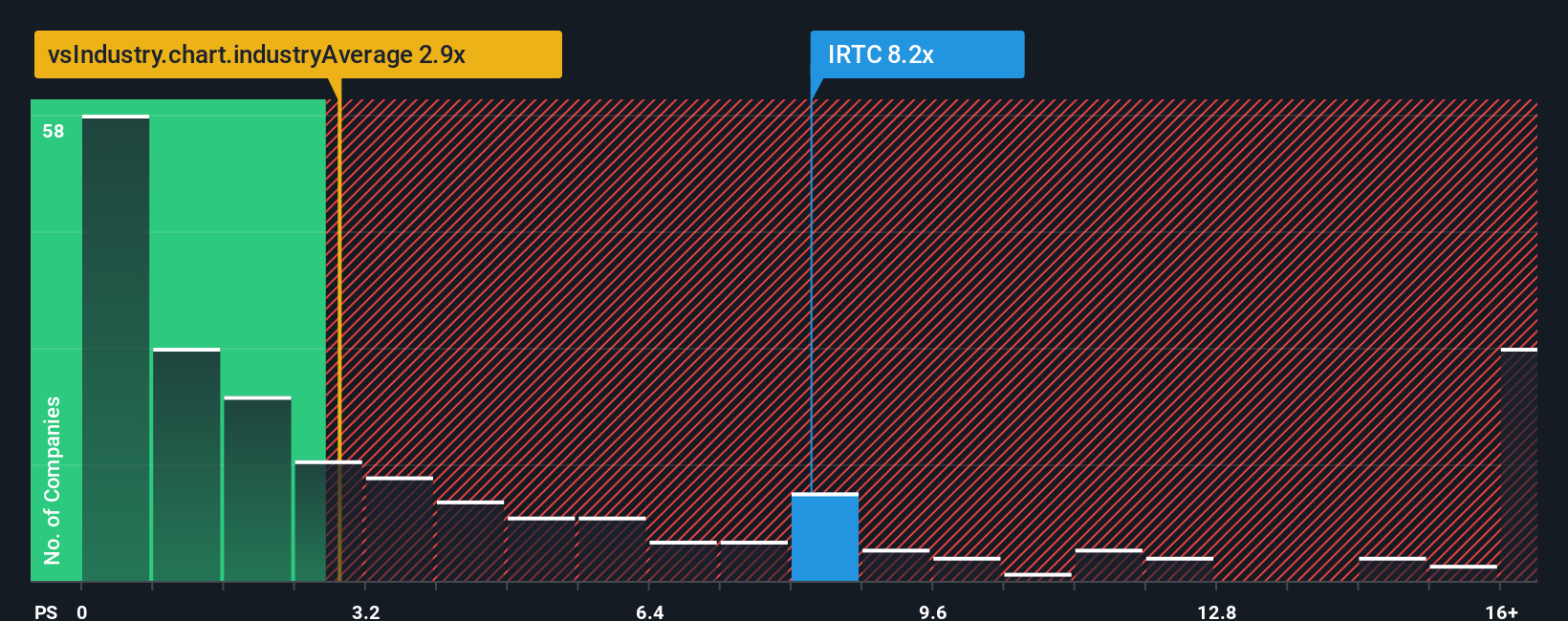

While the most popular narrative points to undervaluation, a different story emerges if we focus on the price-to-sales ratio. iRhythm trades at 8.9 times sales, well above both the industry average of 2.9 and the peer average of 5.3. This premium suggests investors may be paying up for expected growth, but it also amplifies valuation risk if momentum fades or margins disappoint. Could this optimism be overextended, or is it justified by future results?

Build Your Own iRhythm Technologies Narrative

If you would rather form your own conclusion or trust your personal research instincts, you can easily craft a custom narrative in just a few minutes: Do it your way

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one stock? Take control of your portfolio and seize opportunities you might never have considered with these promising investments:

- Tap into the unstoppable momentum in artificial intelligence by checking out these 27 AI penny stocks, which are reshaping entire industries and driving tomorrow's innovations.

- Start collecting cashflow today with these 17 dividend stocks with yields > 3%, offering yields above 3 percent. This can be suitable for those seeking strong income alongside steady growth.

- Cement your edge in the market by reviewing these 867 undervalued stocks based on cash flows, which stand out as rare bargains based on intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.