Please use a PC Browser to access Register-Tadawul

Is Ace Hardware’s In-Store Buy Now Pay Later Launch a Turning Point for Affirm (AFRM)?

Affirm AFRM | 67.25 | -2.58% |

- On October 1, 2025, Ace Hardware announced a new partnership with Affirm to offer buy now, pay later options at participating in-store locations across its 5,200+ U.S. retailers, enabling customers to utilize flexible payment plans on purchases starting at US$50.

- This collaboration significantly expands Affirm’s footprint in the home improvement sector, reinforcing its position as a payments provider with a broad and growing network of retail partners.

- We'll explore how Affirm’s expanded access to Ace Hardware’s nationwide customer base supports its investment case for merchant adoption and offline growth.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Affirm Holdings Investment Narrative Recap

To be a shareholder in Affirm Holdings, you need to believe that sustained merchant adoption and offline expansion can outweigh pressures from intensifying competition and margin risks. The new Ace Hardware partnership strengthens Affirm’s in-store presence but does not fully address concerns around potential revenue losses tied to the end of a large enterprise merchant integration, which remains a key near-term risk. For now, the deal supports the case for growing merchant relationships while the largest immediate threat is the loss of a high-volume integration just ahead of the holiday season. Recent announcements such as the August 2025 expanded collaboration with Stripe are particularly relevant to the Ace Hardware news, as both target increasing Affirm’s reach across offline, in-store retail settings. These deals are crucial short-term catalysts, improving Affirm's physical checkout availability and reinforcing its efforts to diversify revenue beyond pure e-commerce, which could help offset the impact of merchant churn and broader competition. Yet, investors should be mindful that even with partnerships like these, the risk of a major merchant loss right before the holidays could still...

Affirm Holdings' narrative projects $6.0 billion revenue and $756.6 million earnings by 2028. This requires 22.9% yearly revenue growth and an increase of $704.4 million in earnings from the current $52.2 million.

Uncover how Affirm Holdings' forecasts yield a $95.03 fair value, a 23% upside to its current price.

Exploring Other Perspectives

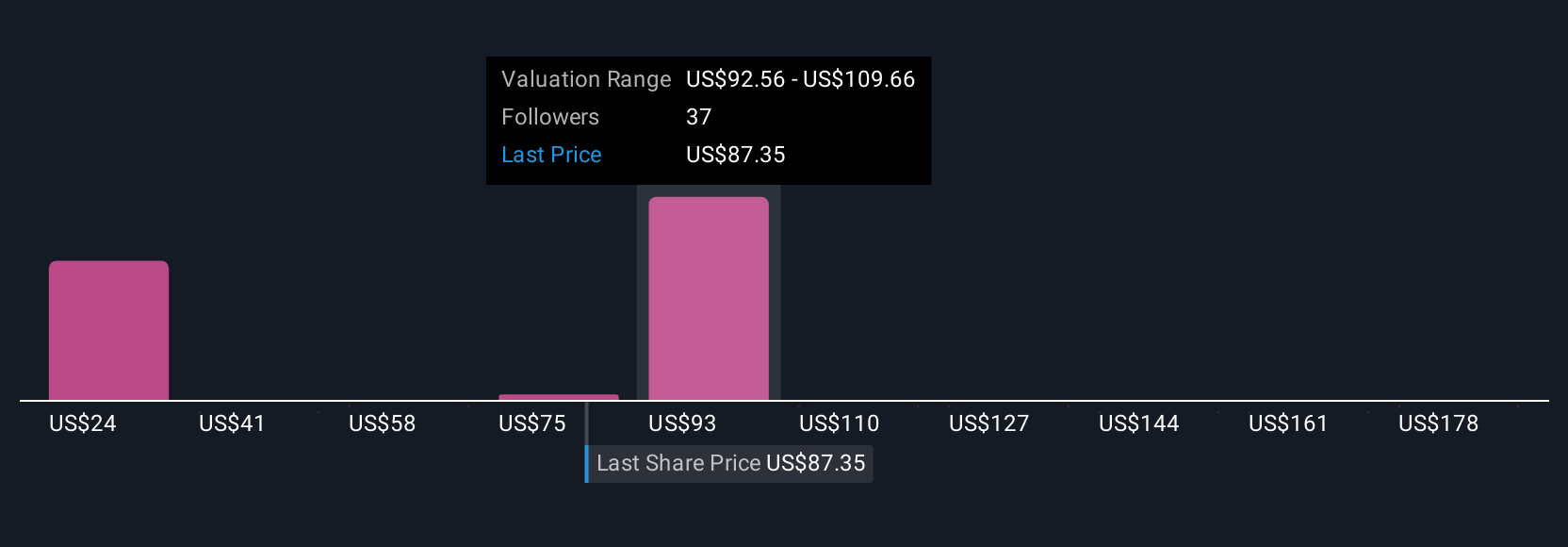

Nineteen private investors in the Simply Wall St Community have fair value estimates for Affirm ranging from US$24.03 to US$195.17. While some see upside tied to merchant network growth, the risk of losing a large enterprise partner continues to shape expectations for Affirm’s momentum, suggesting a wide spectrum of possibilities for the business ahead.

Explore 19 other fair value estimates on Affirm Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.