Please use a PC Browser to access Register-Tadawul

Is ACV Auctions (NASDAQ:ACVA) Using Debt In A Risky Way?

ACV Auctions, Inc. Class A ACVA | 7.99 | -1.36% |

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, ACV Auctions Inc. (NASDAQ:ACVA) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does ACV Auctions Carry?

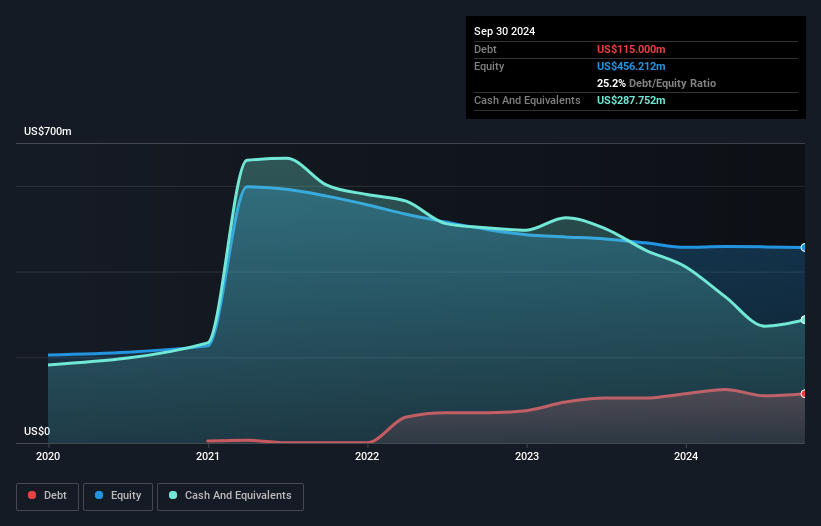

The image below, which you can click on for greater detail, shows that at September 2024 ACV Auctions had debt of US$115.0m, up from US$105.0m in one year. But it also has US$287.8m in cash to offset that, meaning it has US$172.8m net cash.

A Look At ACV Auctions' Liabilities

According to the last reported balance sheet, ACV Auctions had liabilities of US$422.2m due within 12 months, and liabilities of US$155.9m due beyond 12 months. On the other hand, it had cash of US$287.8m and US$334.5m worth of receivables due within a year. So it actually has US$44.1m more liquid assets than total liabilities.

Having regard to ACV Auctions' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$3.62b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, ACV Auctions boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if ACV Auctions can strengthen its balance sheet over time.

Over 12 months, ACV Auctions reported revenue of US$596m, which is a gain of 29%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is ACV Auctions?

Although ACV Auctions had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$8.5m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We think its revenue growth of 29% is a good sign. There's no doubt fast top line growth can cure all manner of ills, for a stock. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting ACV Auctions insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.