Please use a PC Browser to access Register-Tadawul

Is Adobe’s AI Push After Earnings Enough to Defend Its Creative Edge (ADBE)?

Adobe Systems Incorporated ADBE | 356.43 | +1.71% |

- Adobe reported earnings after the bell, drawing significant market attention as investors weighed the company's performance and its approach to generative AI amid rising competition in creative software.

- An interesting insight is the ongoing debate around whether Adobe's current AI initiatives will be enough to sustain its market advantage as competitors advance their own image generation tools.

- We'll take a closer look at how Adobe's AI strategy and recent analyst optimism could influence its long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Adobe Investment Narrative Recap

To be a shareholder in Adobe, you must believe in its ability to lead creative software through AI-driven innovation and retain pricing power despite fierce competition. The latest earnings report drew attention to these very strengths, but also highlighted the immediate challenge: whether Adobe's generative AI advancements can keep its creative suite indispensable as rivals move quickly. At this point, the news hasn't materially shifted the balance between AI as a catalyst and competition as the most pressing risk.

One particularly relevant announcement alongside earnings is the rapid integration of generative AI tools throughout Adobe's Creative Cloud, following a quarter with recurring AI revenue at US$3.5 billion. This move directly relates to investor expectations for new growth, as analysts have generally expressed optimism that these AI innovations will expand the user base and drive recurring revenue.

However, investors should also be aware that, if AI tools from competitors gain traction faster than expected, Adobe's competitive advantage may...

Adobe's outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This implies 9.0% annual revenue growth and a $1.8 billion increase in earnings from the current $6.9 billion.

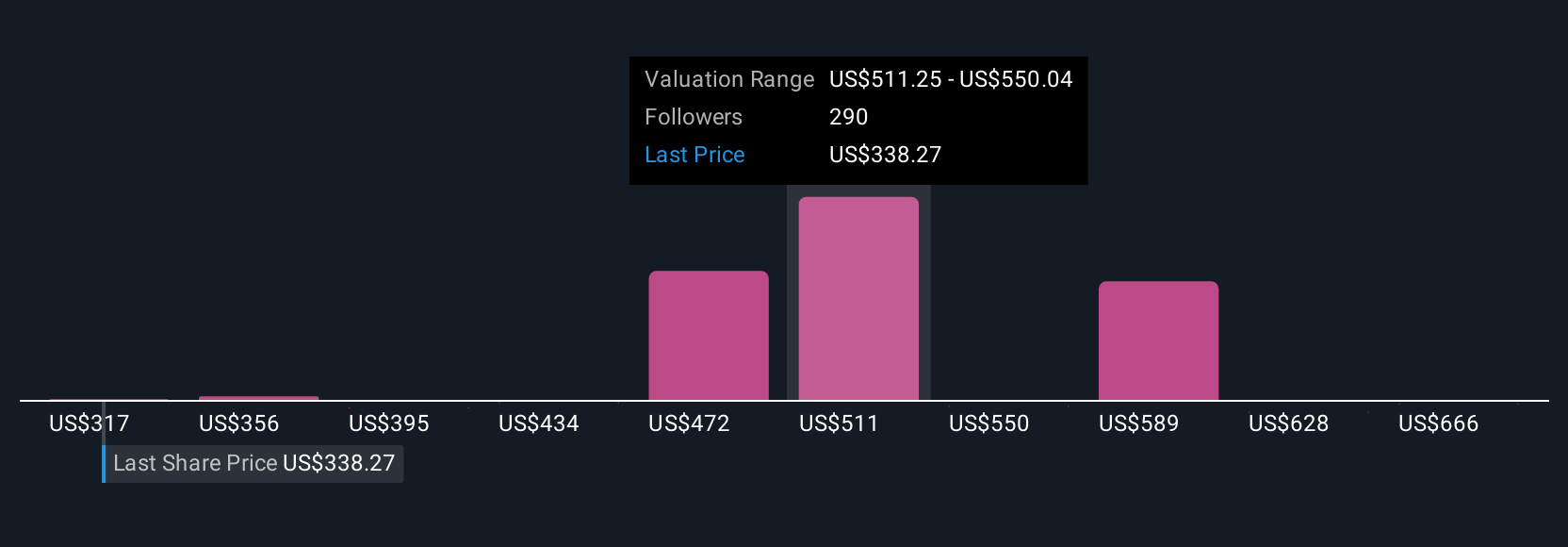

Uncover how Adobe's forecasts yield a $480.60 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Compared with consensus, the most pessimistic analysts were forecasting Adobe’s annual revenue to reach around US$27 billion with contracting margins. If you are focused on the risk that Firefly app initiatives might fall short in growing subscriptions, it’s worth noting that views on Adobe’s future can vary widely. Consider both optimistic and cautious perspectives when weighing whether recent news could meaningfully change these outlooks.

Explore 70 other fair value estimates on Adobe - why the stock might be worth over 2x more than the current price!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.