Please use a PC Browser to access Register-Tadawul

Is ANI Pharmaceuticals (ANIP) Pricing Reflect Long Term Cash Flow Potential?

ANI Pharmaceuticals, Inc. ANIP | 77.77 | -0.42% |

- Investors may be wondering whether ANI Pharmaceuticals is fairly priced at its recent levels, or if the market is overlooking something in the current share price.

- The stock closed at US$81.27, with returns of 2.2% over 7 days, 3.3% over 30 days, 3.6% year to date, 35.9% over 1 year, 81.2% over 3 years and 155.5% over 5 years. These figures may have some investors reassessing both upside potential and risk.

- Recent attention around ANI Pharmaceuticals has focused on its position within the pharmaceuticals and biotech space, along with interest in how its product portfolio and pipeline could affect long term prospects. This context is important when considering why the stock has moved the way it has and what the current price might be factoring in.

- ANI Pharmaceuticals currently has a valuation score of 3 / 6, based on how many checks suggest the shares are undervalued. Next, we will look at how different valuation methods arrive at that view and why there may be an even richer way to think about value by the end of this article.

Approach 1: ANI Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth today by projecting its future cash flows and then discounting those back to a present value.

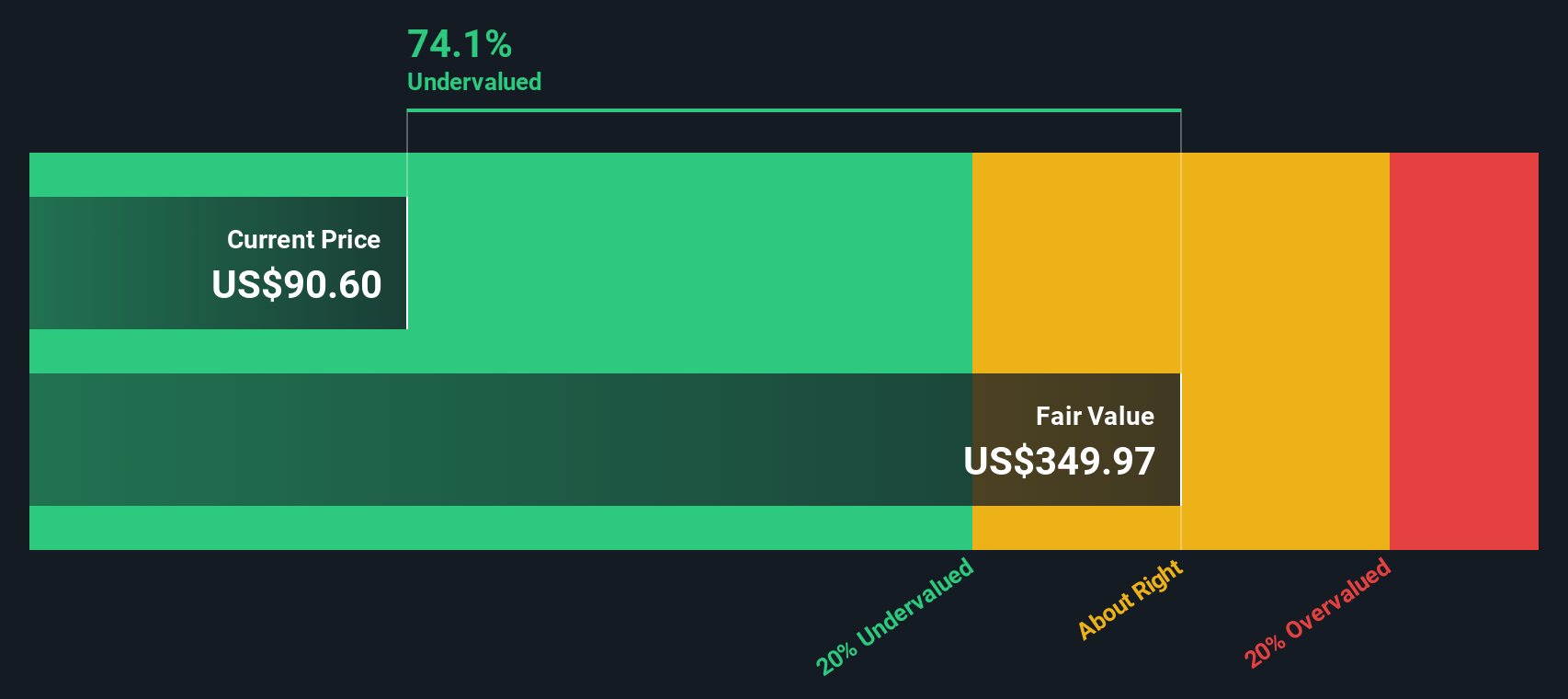

For ANI Pharmaceuticals, the model uses a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is around $138.4 million, and analysts plus modelled estimates project free cash flow out to 2035, with Simply Wall St extrapolating beyond the formal analyst horizon. For example, projected free cash flow in 2035 is $398.3 million, with intermediate yearly projections between 2026 and 2034, all discounted back to reflect the time value of money and risk.

On this basis, the DCF output suggests an estimated intrinsic value of about $369.24 per share. Compared with the recent share price of $81.27, the model implies an intrinsic discount of roughly 78.0%, which indicates that the shares appear undervalued within this specific framework.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ANI Pharmaceuticals is undervalued by 78.0%. Track this in your watchlist or portfolio, or discover 867 more undervalued stocks based on cash flows.

Approach 2: ANI Pharmaceuticals Price vs Earnings

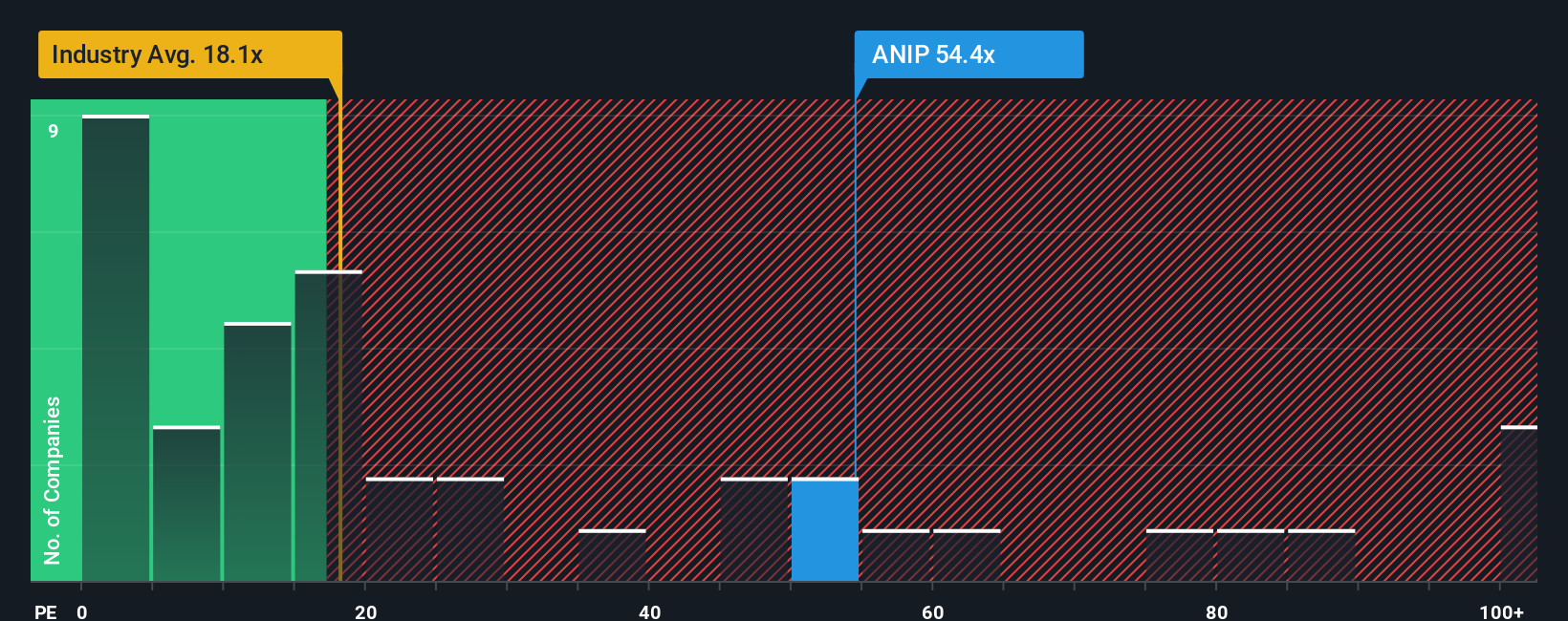

For profitable companies, the P/E ratio is a useful way to see how much investors are paying for each dollar of earnings, which makes it a straightforward cross check against the DCF outcome you saw earlier.

What counts as a "normal" P/E generally reflects how the market views a company’s growth prospects and risk. Higher expected growth and lower perceived risk tend to support a higher P/E, while slower expected growth or higher uncertainty usually align with a lower multiple.

ANI Pharmaceuticals currently trades on a P/E of 49.75x. That is above the Pharmaceuticals industry average of 21.06x and also above the peer average of 18.48x. Simply Wall St’s Fair Ratio for ANI Pharmaceuticals is 21.42x, which is a proprietary estimate of what the P/E might look like given factors such as earnings growth, industry, profit margins, market cap and company specific risks.

This Fair Ratio can be more informative than a simple peer or industry comparison because it adjusts for the company’s own characteristics, rather than assuming all peers deserve similar multiples. Comparing the current 49.75x P/E to the 21.42x Fair Ratio suggests ANI Pharmaceuticals appears overvalued on this metric.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ANI Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool that lets you set out your own story for ANI Pharmaceuticals and connect it directly to your assumptions for fair value, future revenue, earnings and margins.

A Narrative is your view of what the company is doing, how that might influence its finances, and what you think the shares could be worth, all tied together in one place.

On Simply Wall St, Narratives sit inside the Community page and are used by millions of investors as an easy way to turn a company story into a financial forecast and then into a fair value, which you can compare with the current share price to help decide whether you prefer to wait, add or reduce.

Because Narratives update automatically when new information such as news or earnings is added, two investors can look at ANI Pharmaceuticals on the same day and one might build a more cautious Narrative with a lower fair value while another uses higher revenue and margin assumptions to reach a much higher fair value, yet both are working from the same, constantly refreshed data.

Do you think there's more to the story for ANI Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.