Please use a PC Browser to access Register-Tadawul

Is ASGN's Agentforce AI Integration Shaping the Salesforce (CRM) Investment Story?

Salesforce.com, inc. CRM | 264.20 263.00 | +1.22% -0.45% Post |

- In November 2025, ASGN Incorporated announced a multi-year partnership with Salesforce to integrate the Agentforce AI platform into its digital engineering practice, aiming to accelerate innovation and deploy automated solutions for enterprise and government clients.

- This collaboration highlights the growing enterprise demand for AI-driven automation and underscores Salesforce's expanding influence within the digital transformation landscape.

- We'll explore how the adoption of Agentforce by ASGN could impact Salesforce's investment narrative, especially through enhanced enterprise adoption of its AI capabilities.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Salesforce Investment Narrative Recap

To be a Salesforce shareholder today, one needs to believe that its continued investments in AI-driven automation and expanding enterprise partnerships will position the company to capture rising digital transformation demand. While the recent ASGN partnership confirms Salesforce’s growing presence in enterprise AI, it does not fundamentally change the most important immediate catalyst: the upcoming Q3 FY26 earnings, nor does it materially affect the primary risks around competitive pressures from hyperscalers; these remain central to the current investment debate.

The recently announced expansion of Salesforce’s collaboration with Google, integrating Google Workspace with Agentforce, is particularly relevant to how the company is scaling its AI suite into broader workflows. This underscores the near-term catalyst of accelerating cross-cloud adoption and customer stickiness but does not eliminate competitive or pricing risks as enterprises seek to consolidate vendors and optimize software spend.

However, investors should also be aware of the margin and revenue growth headwinds that could emerge if increased competition from technology giants starts to...

Salesforce's outlook anticipates $51.9 billion in revenue and $10.3 billion in earnings by 2028. This projection relies on a 9.6% annual revenue growth rate and a $3.6 billion increase in earnings from the current $6.7 billion.

Uncover how Salesforce's forecasts yield a $330.59 fair value, a 42% upside to its current price.

Exploring Other Perspectives

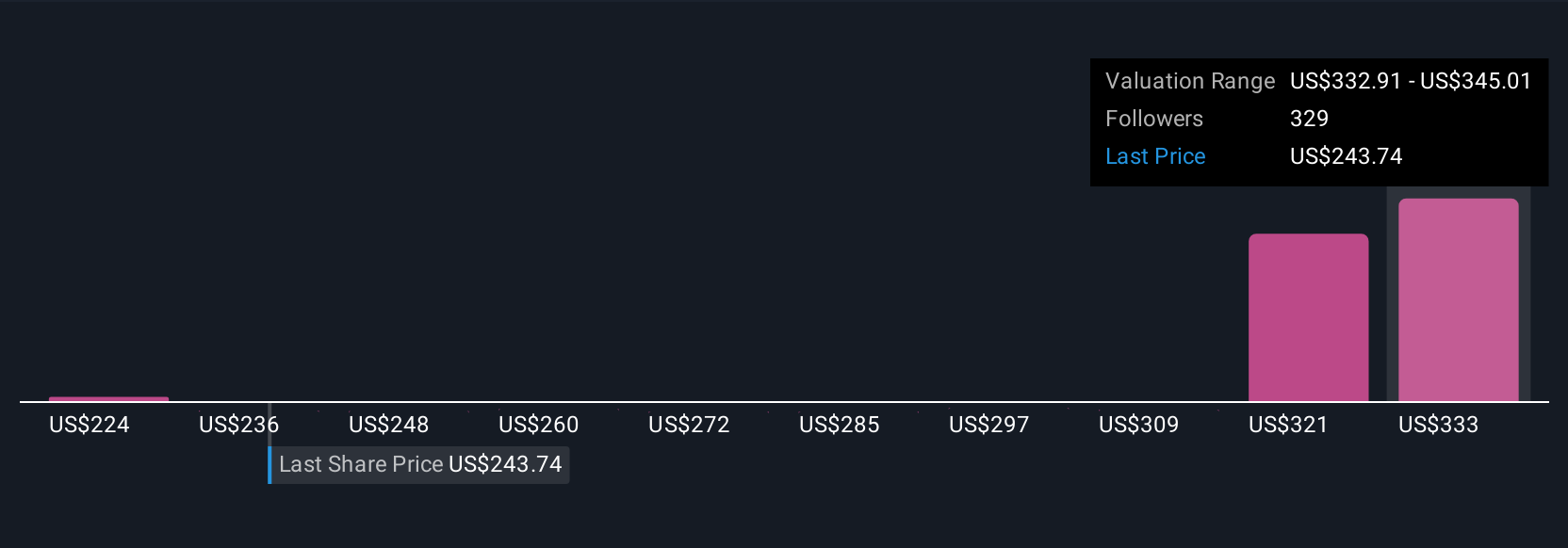

Across 42 private investor fair value estimates, Salesforce’s potential ranges from US$223.99 to US$373.09 per share, reflecting wide differences within the Simply Wall St Community. Many highlight the importance of enterprise AI partnerships, but caution remains as competition may influence revenue growth in ways you should consider when comparing these viewpoints.

Explore 42 other fair value estimates on Salesforce - why the stock might be worth just $223.99!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.