Please use a PC Browser to access Register-Tadawul

Is Ashland’s Q1 Results, Buybacks And New Partnership Altering The Investment Case For Ashland (ASH)?

Ashland Inc. ASH | 64.80 | +2.50% |

- Ashland Inc. recently reported first-quarter 2026 results, with sales of US$386 million versus US$405 million a year earlier and a net loss of US$12 million compared with US$165 million, while also completing a US$480.07 million share repurchase program begun in June 2023.

- In parallel, Univar Solutions B.V. announced an exclusive EMEA food and beverage distribution partnership for Ashland’s cellulose ethers, and Ashland issued full-year 2026 sales guidance of US$1.84 billion to US$1.91 billion, underscoring its focus on innovation-driven product lines.

- Against this backdrop, we’ll explore how Ashland’s sharpened 2026 sales outlook shapes its investment narrative for long-term-oriented investors.

Uncover the next big thing with 24 elite penny stocks that balance risk and reward.

What Is Ashland's Investment Narrative?

To be comfortable holding Ashland today, you need to believe in its shift toward higher-value specialty ingredients while accepting that profitability is still a work in progress. The latest quarter showed modestly lower sales but a much smaller loss, which, together with the reaffirmed dividend and completion of a US$480.07 million buyback, points to a management team signaling confidence in the business and its capital return priorities. The new EMEA food and beverage distribution deal with Univar fits neatly into Ashland’s message about “innovation-driven and globalized” product lines, but its financial impact is likely to be incremental near term rather than a major catalyst. The more immediate swing factors remain execution on the 2026 sales guidance, the path back to sustainable profits and whether margins can improve in a still-challenging demand backdrop.

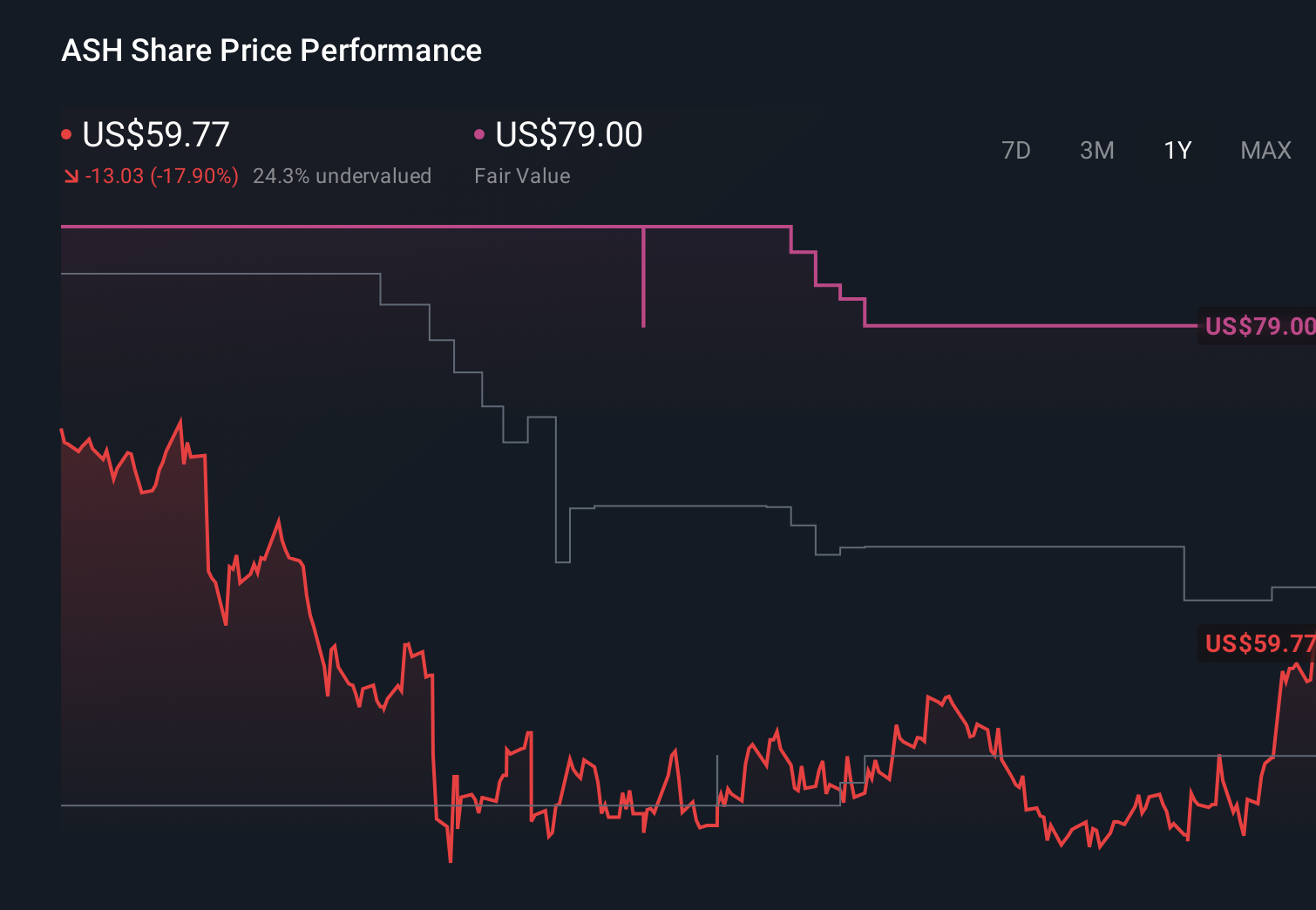

However, one operational and earnings risk in particular deserves closer attention from investors. Ashland's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Ashland - why the stock might be worth just $63.20!

Build Your Own Ashland Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ashland research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ashland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ashland's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.