Please use a PC Browser to access Register-Tadawul

Is Barclays’ Downgrade and Board Departure Shifting the Investment Case for Patterson-UTI Energy (PTEN)?

Patterson-UTI Energy, Inc. PTEN | 6.21 6.21 | -2.20% 0.00% Pre |

- Barclays recently downgraded Patterson-UTI Energy’s rating and lowered its future outlook after the company reported softer drilling activity and a board member departed for a role at the U.S. Department of the Interior.

- This series of analyst downgrades highlights shifting confidence in Patterson-UTI’s near-term prospects amidst changing conditions in the energy services sector.

- We’ll now examine how reduced drilling activity and analyst downgrades impact Patterson-UTI Energy’s investment narrative and future expectations.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Patterson-UTI Energy Investment Narrative Recap

For Patterson-UTI Energy, shareholders must believe in an eventual rebound in U.S. drilling and completions activity and the company's ability to secure premium pricing for technologically advanced rigs. The recent analyst downgrades, along with continued softness in drilling rig averages, may delay but do not substantially alter the significance of these catalysts; the most immediate risk remains if drilling activity fails to recover at the pace management and the market expect.

Among recent company updates, the announcement of a continued quarterly dividend of US$0.08 per share stands out. Despite unprofitability, maintaining the dividend could indicate management's commitment to shareholder returns, but it also raises questions given the forecast for ongoing negative earnings, particularly as prolonged industry softness remains the primary headwind to near-term cash flow and business momentum.

However, investors should also keep in mind the risk of ongoing capital expenditure needs if Patterson-UTI's newer fleets lose pricing power faster than expected...

Patterson-UTI Energy's narrative projects $4.8 billion revenue and $337.4 million earnings by 2028. This requires a 1.3% yearly revenue decline and a $1.44 billion increase in earnings from current earnings of -$1.1 billion.

Uncover how Patterson-UTI Energy's forecasts yield a $7.29 fair value, a 28% upside to its current price.

Exploring Other Perspectives

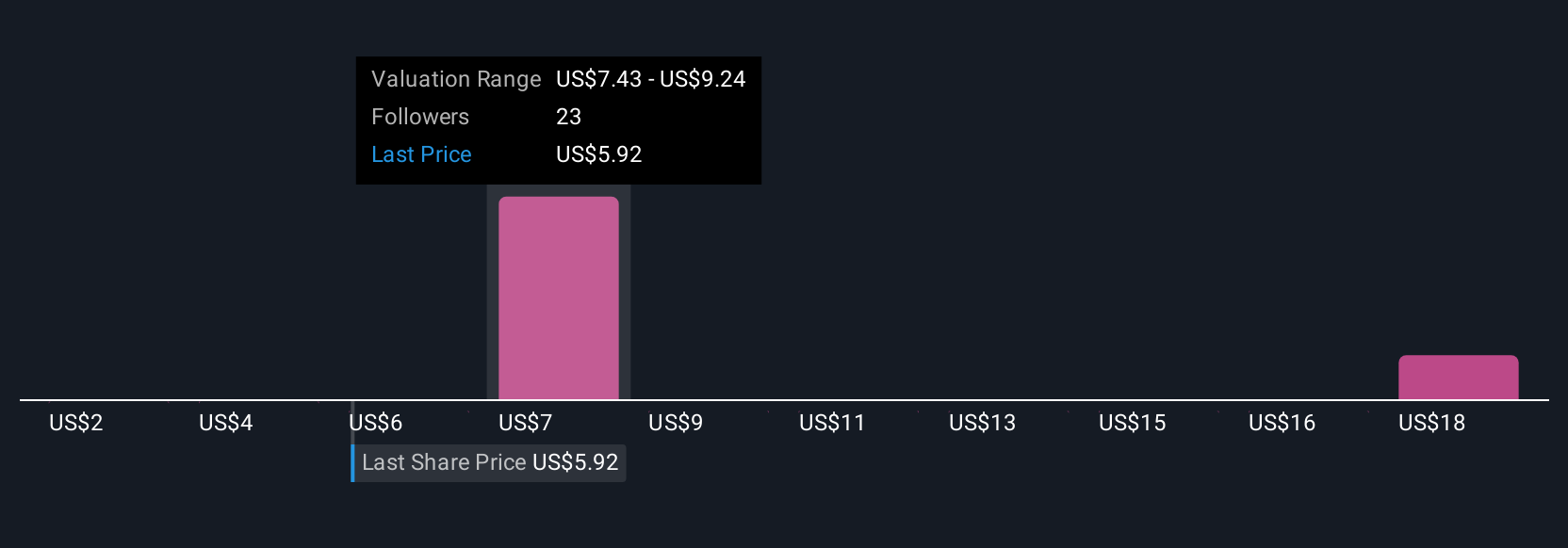

Four Simply Wall St Community fair value estimates for Patterson-UTI range from US$2 to nearly US$19, capturing very different outlooks. With multiple analysts and community members weighing in, watch for how ongoing softness in drilling activity influences future opinions and performance expectations.

Explore 4 other fair value estimates on Patterson-UTI Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.