Please use a PC Browser to access Register-Tadawul

Is Bio-Rad (BIO) Using Biodesix Collaboration to Deepen Its Precision Oncology Ambitions?

Bio-Rad Laboratories, Inc. Class A BIO | 308.13 | -1.86% |

- Biodesix, Inc. recently announced an expanded partnership with Bio-Rad Laboratories to develop and seek regulatory approval for new in vitro diagnostic assays based on Bio-Rad's Droplet Digital PCR technology, with the first focus on a test for detecting ESR1 mutations relevant to advanced breast cancer.

- This collaboration may position Bio-Rad to strengthen its footprint in high-value molecular diagnostics, offering potential new revenue streams and increased relevance in precision oncology testing.

- We'll explore how the extended Biodesix collaboration for advanced cancer diagnostics influences Bio-Rad Laboratories' investment narrative and outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bio-Rad Laboratories Investment Narrative Recap

For shareholders, Bio-Rad Laboratories represents a belief in the company's role as a technology leader in life sciences and molecular diagnostics, a sector often driven by innovation in areas such as digital PCR. The expanded collaboration with Biodesix could accelerate Bio-Rad's relevance in precision oncology, though the most immediate catalyst remains the recovery of core instrument demand, while persistent softness in research markets remains the central short-term risk. The impact of this partnership isn’t likely to materially shift these top priorities just yet.

The upcoming Q3 2025 earnings release on October 29 is the most relevant near-term event for investors, providing an update on whether underlying demand trends in Bio-Rad’s core segments have turned a corner or if margin pressures will continue to weigh on performance. As the Biodesix news focuses attention on Bio-Rad’s innovation pipeline, the earnings report will clarify whether this momentum is reflected in recent sales and profitability developments.

However, against these promising trends, investors should also be aware of ongoing margin compression from...

Bio-Rad Laboratories' outlook sees revenues reaching $2.7 billion and earnings coming in at $232.0 million by 2028. This reflects an annual revenue growth rate of 2.3%, but a decrease in earnings of $87.2 million from the current $319.2 million.

Uncover how Bio-Rad Laboratories' forecasts yield a $310.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

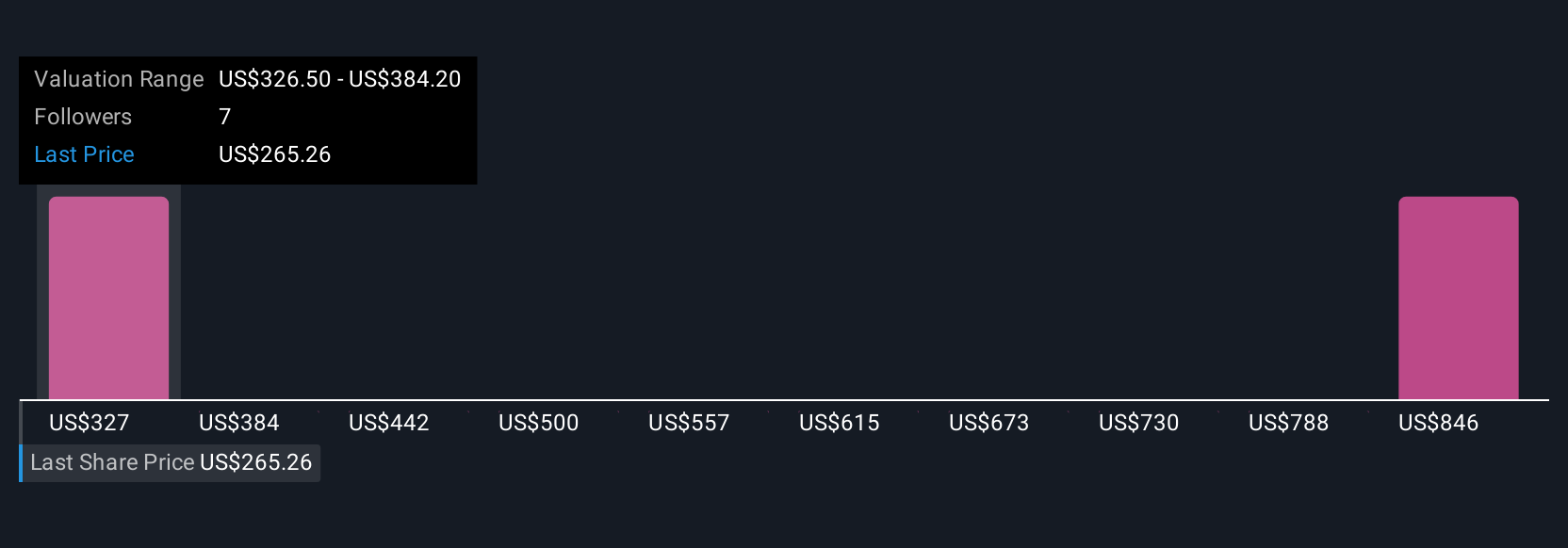

Two Simply Wall St Community members estimate Bio-Rad’s fair value between US$310 and US$880, showing broad disagreement on potential upside. In light of ongoing margin pressure, you can see how expectations for recovery and innovation can lead to very different views on what Bio-Rad might be worth.

Explore 2 other fair value estimates on Bio-Rad Laboratories - why the stock might be worth over 2x more than the current price!

Build Your Own Bio-Rad Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bio-Rad Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Rad Laboratories' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.