Please use a PC Browser to access Register-Tadawul

Is Bitcoin Still 'Digital Gold'? The October Crash Tells A Different Story

Last Friday delivered a hard lesson for cryptocurrency investors.

The crypto market wiped out $19.3 billion in a single day, marking the largest liquidation event in crypto history. And for anyone who’s been treating Bitcoin as a safe haven or modern alternative to gold, this crash should be a serious wake-up call.

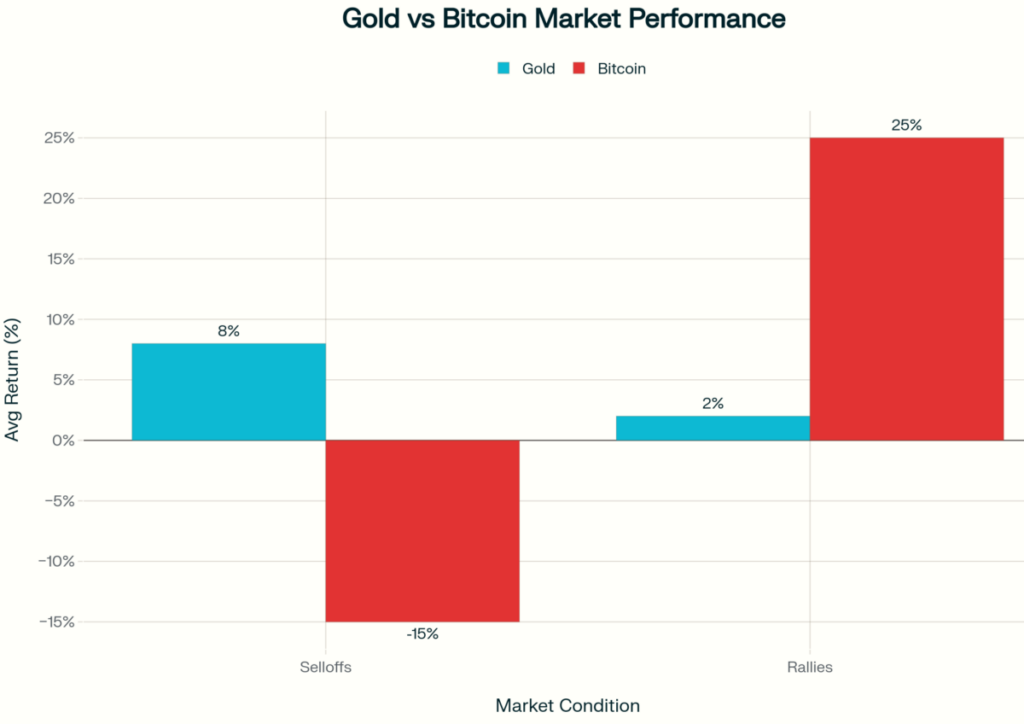

When President Trump announced sweeping tariffs on Chinese imports, we saw something fascinating play out in real-time. Bitcoin crashed 15% from its recent high near $126,000. Meanwhile, gold (which had just broken through $4,000 per ounce) held steady and actually attracted safe-haven flows.

That split-screen moment tells you everything you need to know about how these assets really behave when markets get choppy.

The “Digital Gold” Story Doesn’t Hold Up Anymore

For years, Bitcoin supporters positioned it as “digital gold”, as a modern safe haven that could protect your wealth during times of uncertainty.

But the reality has become impossible to ignore.

Bitcoin’s correlation with the NASDAQ 100 reached 0.87 in 2024. That means Bitcoin now moves almost in lockstep with tech stocks. When the market rallies, Bitcoin rallies. When tech names pull back, Bitcoin gets hit even harder.

This wasn’t always the case. Before 2021, Bitcoin actually showed very little correlation with traditional markets, which supported its reputation as an alternative asset. But as institutions piled in through ETFs and corporate treasury purchases, Bitcoin’s behavior fundamentally changed.

Today, institutional investors hold over 40% of the global Bitcoin supply. And that concentration has tied Bitcoin’s fate directly to broader market sentiment.

So when the Fed adjusts interest rates or economic data disappoints, Bitcoin increasingly reacts like a high-growth tech stock rather than a defensive asset. That’s a problem if you’re counting on it to protect your portfolio during a downturn.

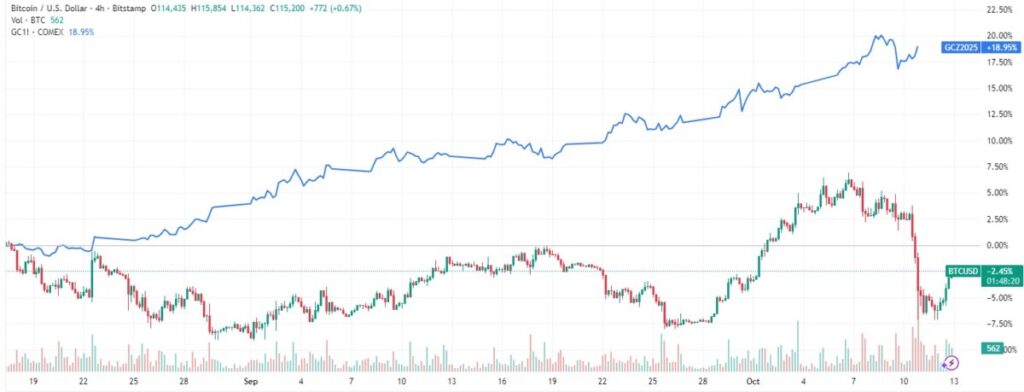

Chart showing BTC and Gold (blue line) performance during the last 30 days

What Gold Still Does Right

Gold’s performance during last Friday’s chaos reinforces why it’s been trusted for centuries.

Central banks have been accumulating record amounts of gold throughout 2024 and 2025, and the metal has gained 53% year-to-date. During periods of geopolitical tension, currency concerns, or market volatility, gold consistently does what it’s supposed to do: it rises when investors seek safety.

Research from BlackRock shows that traditional portfolios typically allocate 5-10% to gold as a diversifier and volatility hedge. That’s because gold maintains near-zero long-term correlation with equities and actually shows slight negative correlation with the U.S. dollar.

In other words, gold provides genuine diversification benefits. It zigs when your stocks zag.

How gold and Bitcoin perform during different market conditions

The Problem with Institutionalization

Here’s the irony that Bitcoin enthusiasts don’t want to talk about.

Bitcoin ETFs have made crypto accessible to mainstream investors, which sounds great. But this institutionalization has fundamentally changed Bitcoin’s characteristics in ways that actually hurt its usefulness as a portfolio diversifier.

Registered investment advisors and wealth managers now hold roughly 50% of Bitcoin ETF assets. That means Bitcoin’s price action increasingly reflects institutional positioning in tech stocks and other risk assets.

Studies confirm that as Bitcoin ETFs gained adoption, the cryptocurrency’s sensitivity to macroeconomic factors intensified. Inflation expectations, interest rates, liquidity measures, all the same triggers that move your stock portfolio now move Bitcoin too.

This substantially reduces Bitcoin’s effectiveness as a true diversifier.

What This Means for Your Money

The key question for investors isn’t whether Bitcoin is “good” or “bad.” You need to think about what role it should actually play in your portfolio.

Portfolio experts now suggest treating Bitcoin more like a position in high-growth tech stocks than a safe-haven alternative. And that changes everything about how you should size it.

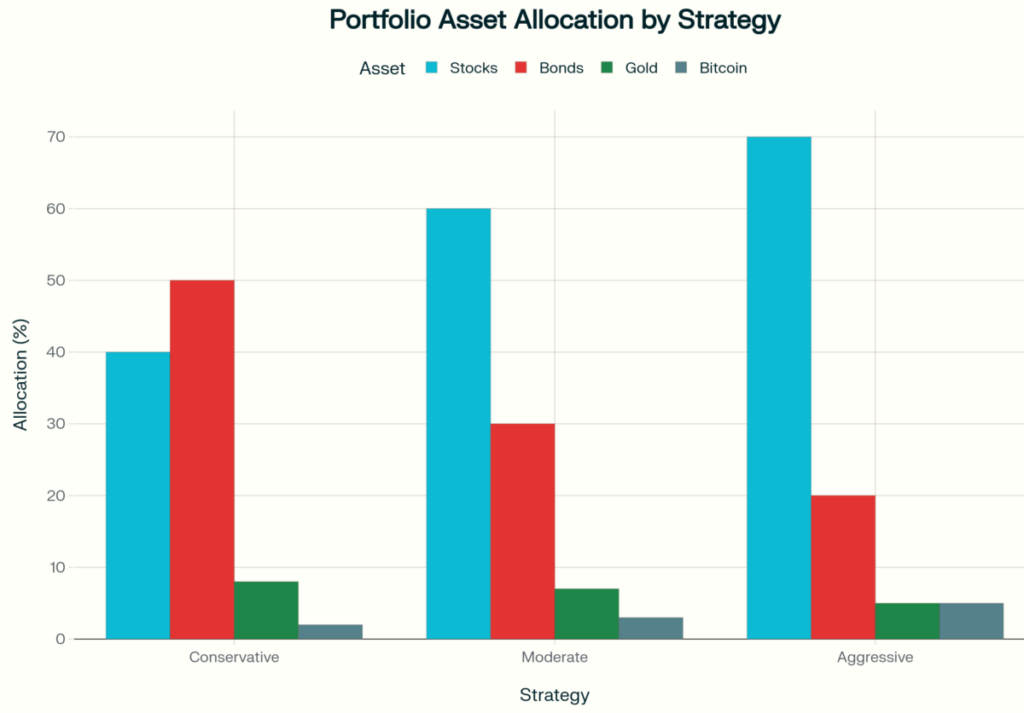

BlackRock recommends that investors comfortable with Bitcoin’s volatility consider allocations of 1-2% maximum. That’s roughly equivalent to the portfolio risk of holding a single Magnificent Seven tech stock. More aggressive investors might push to 5%, but that allocation should come from your growth bucket, not your defensive allocation.

Going beyond these ranges substantially increases your overall portfolio volatility. And last Friday’s crash showed exactly why that matters.

Many traders were using 10x, 20x, or even 50x leverage on their Bitcoin positions. When the market rolled over, those positions got liquidated catastrophically. For long-term investors trying to build wealth, this kind of speculative behavior is the opposite of prudent portfolio construction.

A More Disciplined Approach

Despite Bitcoin’s challenges as a safe haven, it can still offer portfolio benefits when sized appropriately.

Research from Galaxy Digital shows that portfolios with 1-5% Bitcoin allocations historically achieved improved risk-adjusted returns compared to traditional 60/40 stock-bond portfolios. The key is understanding that Bitcoin contributes growth potential and some diversification, but not stability.

Some advisors recommend what they call a “barbell” approach. You maintain a larger, stable gold allocation for genuine crisis protection while holding a smaller Bitcoin position for its asymmetric upside potential. This framework acknowledges both assets’ strengths without expecting Bitcoin to behave like gold.

Sample portfolio allocations for different investor risk profiles

Reading the Writings on the Walls

Last Friday’s crash revealed that Bitcoin has evolved, whether supporters like it or not.

As institutional ownership grows and ETFs integrate crypto deeper into mainstream finance, Bitcoin’s correlation with traditional markets will likely persist or even strengthen. This doesn’t make Bitcoin worthless, but it does require investors to recalibrate their expectations.

Bitcoin may offer long-term value as a technological innovation or alternative monetary system. But its day-to-day behavior increasingly resembles a volatile tech stock, not a defensive haven.

For investors building portfolios designed to weather different market conditions, the lesson is clear.

Build your portfolio foundation with proven diversifiers like bonds and gold. Then consider Bitcoin as a small, speculative allocation only if your risk tolerance and time horizon allow for that kind of volatility.

Last Friday showed us that when markets get rough, gold still plays defense while Bitcoin joins the selloff. That’s not a criticism of Bitcoin, but it’s just the reality that should inform smarter portfolio decisions.

The key is not to assume Bitcoin will protect you during the next crisis, but to position yourself flexibly with the right mix of assets that each serve their specific purpose in your overall strategy.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.