Please use a PC Browser to access Register-Tadawul

Is Carvana’s (CVNA) Efficiency Push Quietly Rewriting Its Long-Term Profitability Story?

Carvana Co. Class A CVNA | 410.36 409.50 | +0.61% -0.21% Post |

- Carvana recently attracted fresh attention as analysts reaffirmed positive views on the company while investors look ahead to its fourth-quarter and full-year 2025 earnings release, scheduled for February 18, 2026.

- What stands out is how improving earnings momentum and operational efficiency, coupled with recovering used-car market conditions, are reshaping perceptions of Carvana’s business resilience.

- With this backdrop of rising interest around Carvana’s upcoming earnings, we’ll examine how improving profitability trends shape the company’s investment narrative.

AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Carvana's Investment Narrative?

To own Carvana today, you have to believe its recent profitability is sustainable and not just a short-lived rebound in a hot used-car tape. The story now leans heavily on margin discipline, better free cash flow and the ability to keep growing volumes without stretching an already debt-heavy balance sheet. The latest news, including Barclays lifting its target and the stock’s sharp move toward yearly highs, reinforces earnings momentum as the key near-term catalyst ahead of the February 18 results, but it mostly amplifies existing expectations rather than changing them. If anything, stronger analyst enthusiasm and index inclusion magnify execution risk: misses on unit economics, credit performance or guidance could matter more with the shares already pricing in rapid earnings growth and trading on a rich multiple.

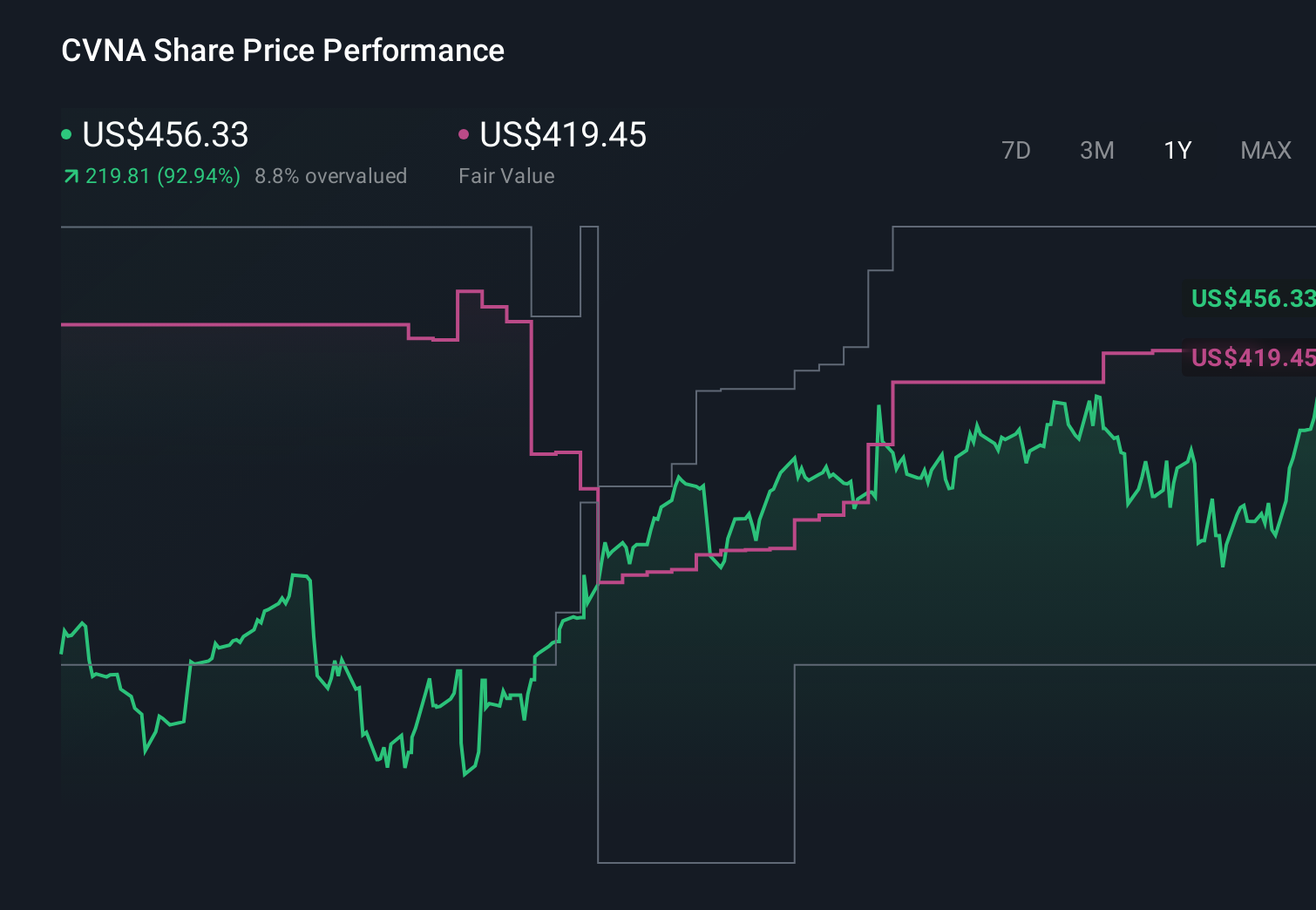

However, the combination of high expectations and significant debt is something investors should be aware of. Carvana's shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore 17 other fair value estimates on Carvana - why the stock might be worth as much as 16% more than the current price!

Build Your Own Carvana Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.