Please use a PC Browser to access Register-Tadawul

Is Conestoga’s Endorsement of Higher Occupancy Rates Shifting the Investment Case for Bright Horizons (BFAM)?

Bright Horizons Family Solutions, Inc. BFAM | 104.64 | +0.48% |

- Earlier this week, Conestoga Capital Advisors underscored Bright Horizons Family Solutions' operational momentum, citing increased occupancy rates and strong Q1 2025 revenue and earnings growth driven by the return-to-office trend.

- This institutional endorsement spotlights the company's ability to capture value as workplace norms shift, even as some investors look elsewhere for rapid gains in technology stocks.

- We’ll now explore how recognition of Bright Horizons’ rising occupancy rates due to return-to-office policies shapes its overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bright Horizons Family Solutions Investment Narrative Recap

To be a shareholder in Bright Horizons Family Solutions today, you would need to believe in the company's ability to benefit from ongoing return-to-office trends, specifically, increased occupancy at its child care centers. The recent endorsement by Conestoga Capital Advisors and the positive Q1 2025 results reinforce the short-term catalyst of rising enrollment in key markets, which currently remains the most influential factor, while margin pressure at lower-performing centers remains a significant risk; this news does not materially alter those risks or catalysts.

The most relevant recent announcement is the Q1 2025 earnings release, highlighting year-over-year revenue growth to US$665.53 million and a substantial jump in net income. As indicators of operational momentum, these results support the positive narrative tied to increased workplace attendance, setting the tone for the rest of the year.

However, before assuming steady gains, it’s important for investors to recognize that some centers still lag in occupancy rates and…

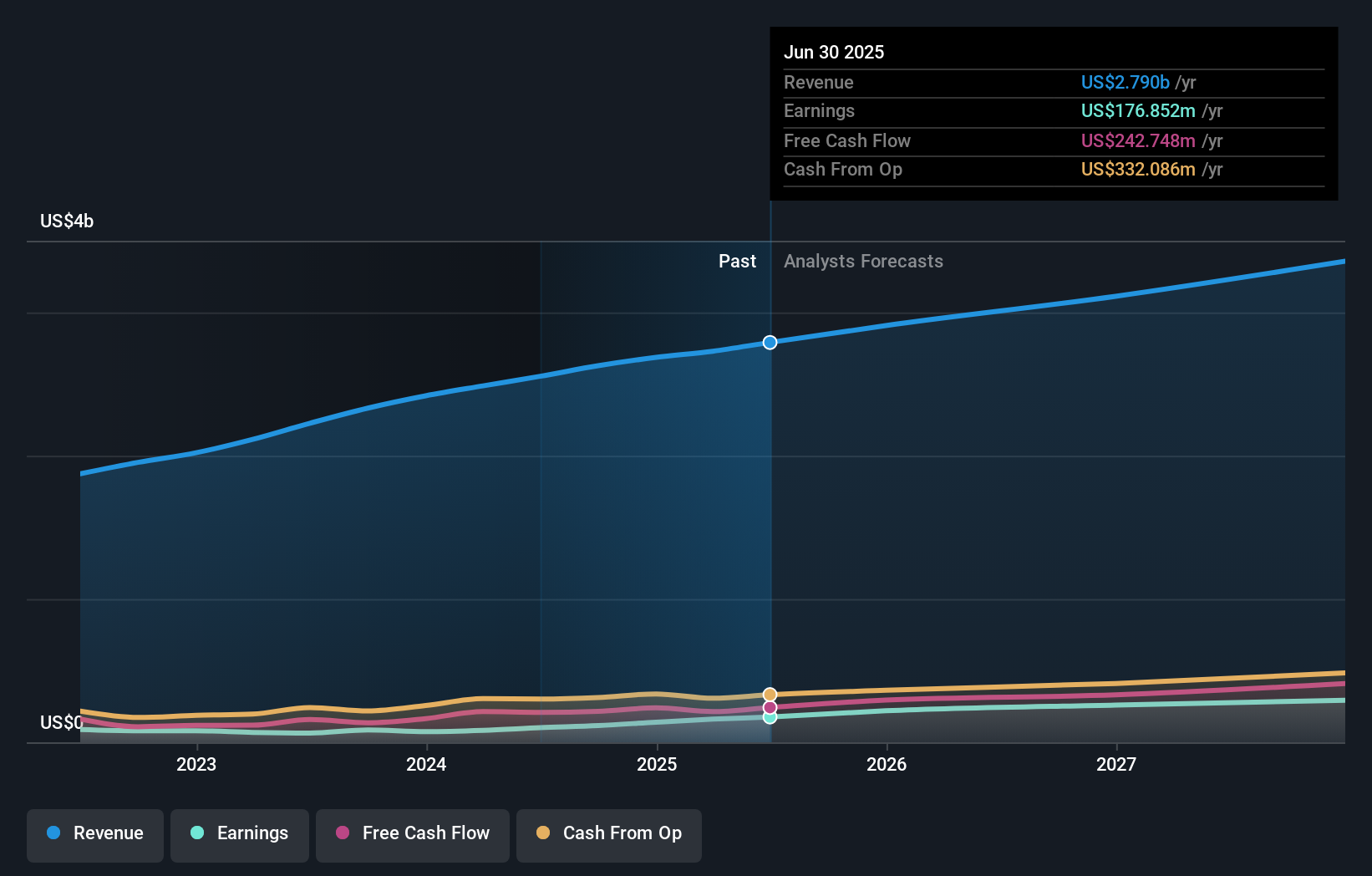

Bright Horizons Family Solutions is forecast to achieve $3.4 billion in revenue and $299.5 million in earnings by 2028. Reaching these levels implies an annual revenue growth rate of 7.2% and a $138.2 million increase in earnings from the current $161.3 million.

Uncover how Bright Horizons Family Solutions' forecasts yield a $138.45 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from just US$5.32 to US$138.45, reflecting wide differences in growth forecasts and risk tolerance. With occupancy-driven revenue growth still viewed as the nearest-term driver, you can compare these opinions to see how other investors weigh the company’s potential versus its challenges.

Explore 4 other fair value estimates on Bright Horizons Family Solutions - why the stock might be worth less than half the current price!

Build Your Own Bright Horizons Family Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bright Horizons Family Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Horizons Family Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.