Please use a PC Browser to access Register-Tadawul

Is EMCOR Group’s (EME) EPS Surge and Buyback Strategy Quietly Redefining Its Long-Term Narrative?

EMCOR Group, Inc. EME | 812.79 | +1.15% |

- Earlier this week, EMCOR Group highlighted strong underlying performance, with robust recent revenue expansion and rapid earnings per share growth supported by active share repurchases.

- These trends suggest EMCOR is gaining share and using its balance sheet proactively, helping to shape how investors assess its long-term potential.

- With EMCOR’s earnings per share growth amplified by buybacks, we’ll now examine how this development reshapes the company’s broader investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

EMCOR Group Investment Narrative Recap

To own EMCOR Group, you need to believe its network of electrical and mechanical services can keep converting project demand into consistent revenue and disciplined capital returns. The recent share price move and mixed valuation signals from analysts do not materially change the near term picture, where the key catalyst remains continued earnings per share expansion, and the biggest risk is project volatility in cyclical industrial and oil and gas exposed end markets.

The most relevant recent development here is EMCOR’s accelerated earnings per share growth, lifted by share repurchases on top of solid revenue gains. That combination has sharpened attention on how efficiently EMCOR turns its construction and services backlog into profit, while amplifying the impact of any swings in large, project based sectors such as high tech manufacturing and semiconductors, where contract timing can quickly influence reported results and investor sentiment.

Yet alongside the strong earnings per share momentum, investors should be aware of the risk that large, project based contracts can suddenly...

EMCOR Group's narrative projects $20.6 billion revenue and $1.4 billion earnings by 2028.

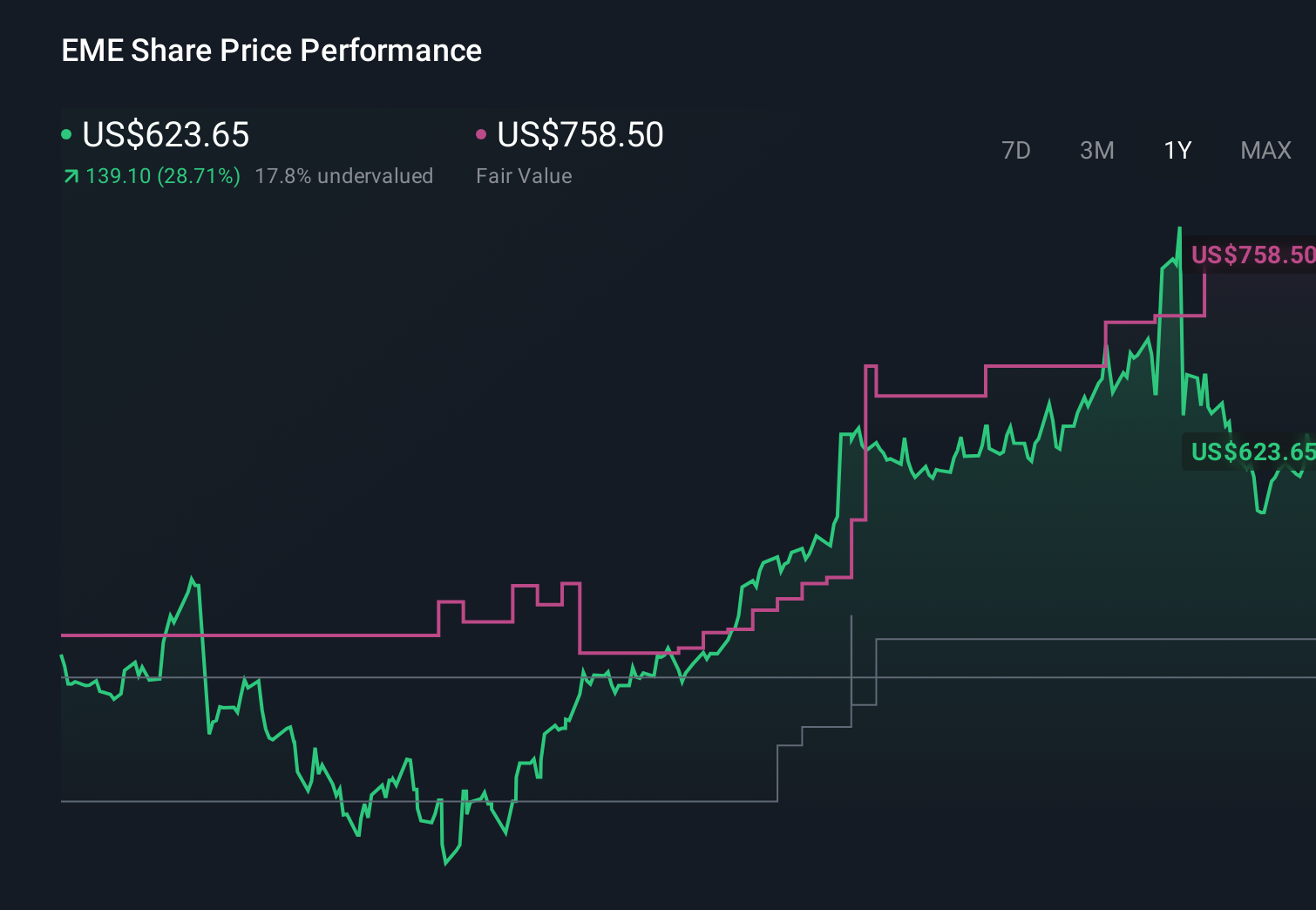

Uncover how EMCOR Group's forecasts yield a $758.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$468 to US$908 per share, showing very wide opinion dispersion. When you set this against concerns about volatile project awards in key sectors, it underlines why many market participants are weighing both upside potential and contract concentration risk before forming a view.

Explore 8 other fair value estimates on EMCOR Group - why the stock might be worth 33% less than the current price!

Build Your Own EMCOR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.