Please use a PC Browser to access Register-Tadawul

Is Fastenal's Q2 Earnings Growth and Pause on Buybacks Shaping the FAST Investment Case?

Fastenal Company FAST | 42.72 | +1.68% |

- Fastenal recently reported its second quarter 2025 earnings, showing increased sales to US$2,080.3 million and net income rising to US$330.3 million compared to the prior year, along with a board-approved dividend of US$0.22 per share and a completed two-for-one stock split in May.

- One unique insight is that despite the sizable repurchase authorization in place since 2017, the company did not repurchase any shares in the second quarter, instead prioritizing operational growth as seen in their improved earnings.

- We'll now examine how Fastenal's earnings growth and unchanged buyback activity influence the company's investment narrative and outlook.

Fastenal Investment Narrative Recap

To invest in Fastenal, you need to believe the company can sustain growth by leveraging its leadership in supply chain solutions and capitalizing on digital and on-site expansion, while defending margins against rising costs and shifts in customer preferences. The recent earnings beat and solid dividend were positive, but the absence of share buybacks this quarter had no material impact on the main near-term catalyst, adoption of digital and FMI technologies, or the key risk, which remains ongoing cost and margin pressures.

Among recent announcements, Fastenal’s board-approved dividend of US$0.22 per share, adjusted for a two-for-one stock split, stands out. This regular payout supports the investment case for income-focused shareholders, but also draws attention to the challenge of sustaining free cash flows amid higher inventory and persistent cost inflation, both of which can affect dividend reliability over time.

By contrast, investors should be aware that persistent operating margin pressures from cost and competitive factors could...

Fastenal's narrative projects $9.5 billion revenue and $1.5 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.3 billion earnings increase from $1.2 billion today.

Exploring Other Perspectives

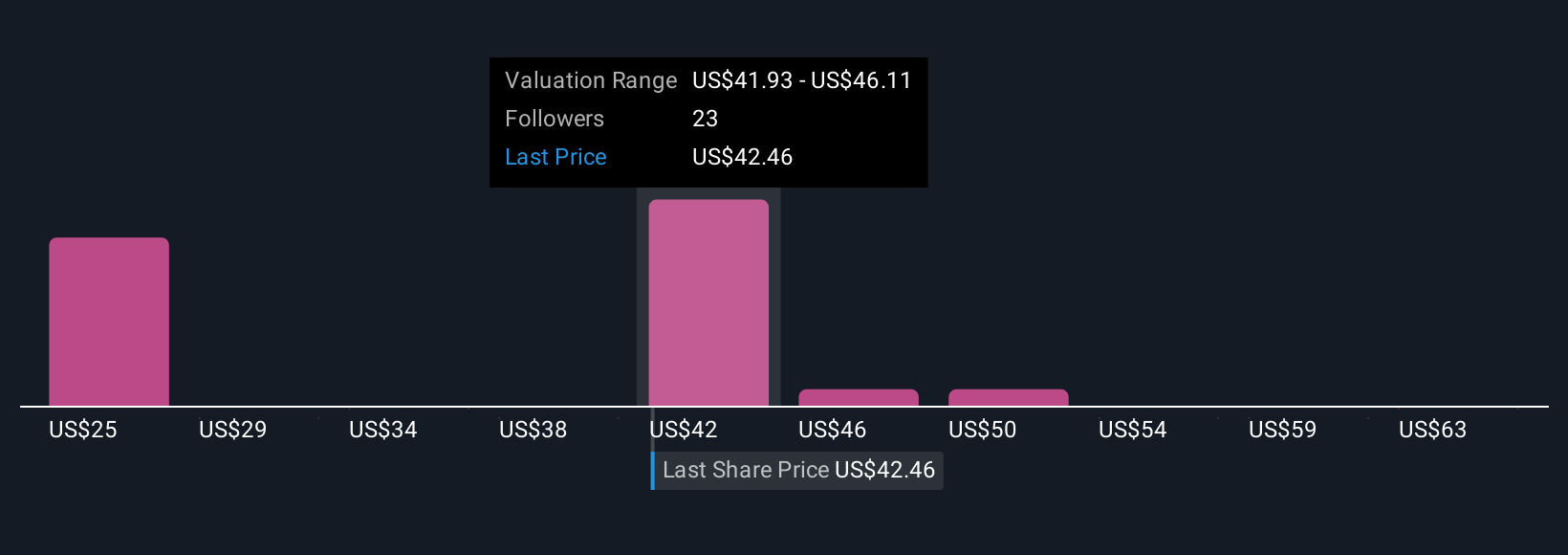

Seven community fair value estimates for Fastenal span a wide US$26.26 to US$70.59 range, signaling opinions can diverge markedly. With margins under pressure, exploring multiple viewpoints is essential when considering the company’s future performance.

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.