Please use a PC Browser to access Register-Tadawul

Is Globus Medical’s (GMED) Raised 2025 Guidance Changing the Investment Case for Investors?

Globus Medical Inc Class A GMED | 90.59 | -0.36% |

- Globus Medical recently increased its full-year 2025 guidance for both revenue and adjusted earnings after reporting third-quarter results that exceeded analyst expectations.

- This guidance raise, driven by stronger operational performance, comes as broader market sentiment was also helped by comments from a Federal Reserve official about potential interest rate cuts.

- We'll explore how Globus Medical's decision to raise guidance after quarterly outperformance may affect its investment outlook and future expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Globus Medical Investment Narrative Recap

To be a Globus Medical shareholder, you need to believe in the company's ability to capture long-term growth from the rising demand for spine and orthopedic solutions, driven by aging demographics and ongoing innovation in robotics and minimally invasive technologies. The recent raised guidance reflects strong operational execution and positive near-term momentum, but ongoing integration challenges from major acquisitions and persistent international pressures remain the biggest risks. The upward guidance shift is likely the most important near-term catalyst, while management's ability to deliver on synergy goals and boost margins will be closely monitored.

Among recent announcements, the November increase to full-year 2025 revenue and earnings guidance stands out as most relevant. This update, paired with strong Q3 earnings that beat expectations, may further raise expectations for operational execution. However, longer-term investor enthusiasm will hinge on whether Globus Medical can sustain this performance as it works through integration of acquired businesses and navigates challenges in international growth.

By contrast, even with stronger results, investors should also be mindful of ongoing integration risks and possible disruption from the NuVasive and Nevro acquisitions...

Globus Medical's narrative projects $3.4 billion in revenue and $538.8 million in earnings by 2028. This requires 9.0% yearly revenue growth and a $182.2 million earnings increase from $356.6 million today.

Uncover how Globus Medical's forecasts yield a $88.80 fair value, a 3% upside to its current price.

Exploring Other Perspectives

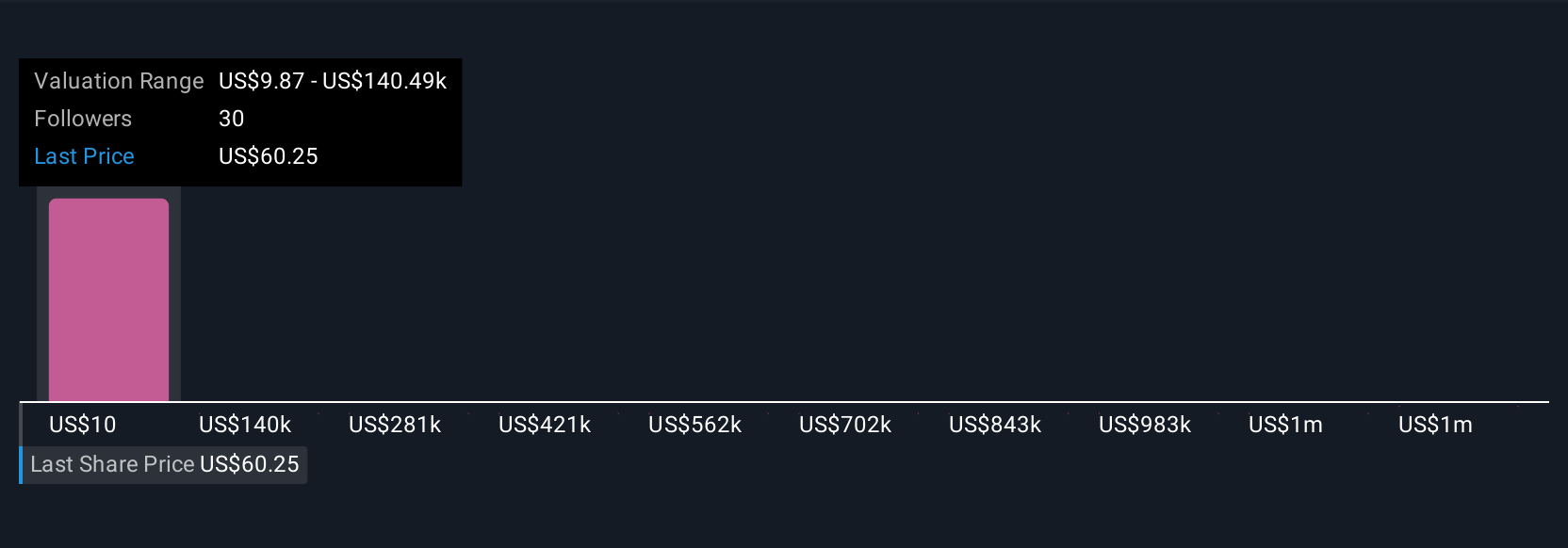

Five members of the Simply Wall St Community assigned fair values for Globus Medical ranging from US$17.31 to US$91.20 per share. Alongside these wide estimates, recent operational momentum from upgraded guidance could reshape how you assess potential and risk in the current market.

Explore 5 other fair value estimates on Globus Medical - why the stock might be worth less than half the current price!

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.