Please use a PC Browser to access Register-Tadawul

Is Grainger's (GWW) Revised Earnings Outlook Reshaping the Long-Term Investment Case?

W.W. Grainger, Inc. GWW | 1197.65 | +1.23% |

- W.W. Grainger, Inc. recently reported its second quarter 2025 results, announcing US$4.55 billion in sales, US$482 million in net income, ongoing share repurchases totaling 1.32 million shares, and a quarterly cash dividend affirmation of US$2.26 per share.

- While the company raised its full-year revenue guidance, it revised its earnings per share outlook slightly downward, reflecting nuanced business conditions amid continued buybacks and dividend stability.

- With the company's revised earnings guidance and capital return strategies in mind, we'll explore how these developments influence Grainger's long-term investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

W.W. Grainger Investment Narrative Recap

To be a Grainger shareholder is to believe in the company’s established position as a leading MRO distributor benefiting from long-term infrastructure demand and supply chain digitalization trends. The recent Q2 results, with higher sales and ongoing buybacks, but slightly reduced earnings guidance, do not materially alter short-term catalysts, such as the company's capture of infrastructure-related demand, nor do they fundamentally change key risks like margin pressures from inflation or cost pass-through challenges.

Among the recent announcements, Grainger’s reaffirmed US$2.26 per share quarterly dividend stands out in the context of business resilience. This steady dividend, alongside robust cash flow and share repurchases, aligns with the company’s focus on rewarding shareholders, even as margin pressures and earnings volatility remain near-term considerations.

Yet, in contrast, investors should stay attentive to persistent cost inflation and gross margin pressure, which could have an outsized impact if supply chain complexity...

W.W. Grainger's outlook anticipates $21.3 billion in revenue and $2.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.7% and an increase in earnings of $0.4 billion from the current $1.9 billion.

Uncover how W.W. Grainger's forecasts yield a $1047 fair value, a 10% upside to its current price.

Exploring Other Perspectives

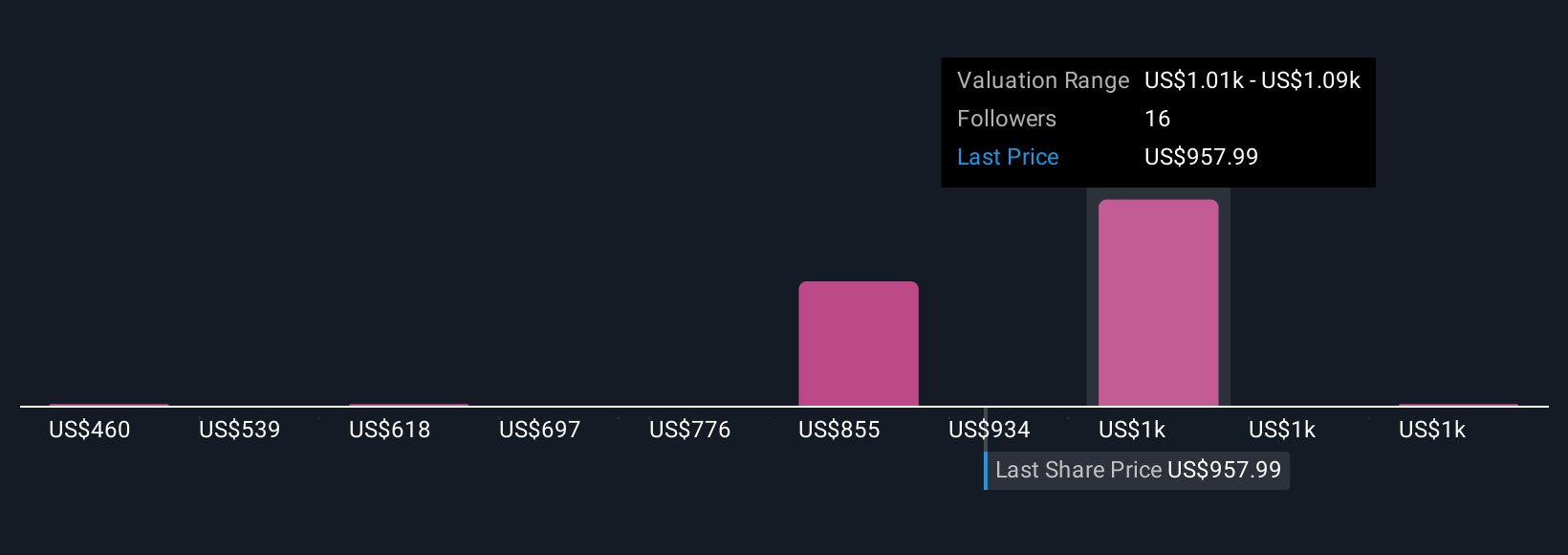

Simply Wall St Community members offered five fair value estimates for Grainger, ranging from US$460 to US$1,250 per share. While opinions differ widely, the recurring risk of margin compression due to inflation and pricing pressures remains a key concern that could influence results ahead.

Explore 5 other fair value estimates on W.W. Grainger - why the stock might be worth as much as 32% more than the current price!

Build Your Own W.W. Grainger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W.W. Grainger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W.W. Grainger's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.