Please use a PC Browser to access Register-Tadawul

Is Grindr's (GRND) CFO Transition and Revenue Outlook Shifting Its Investment Narrative?

Grindr Inc. Common Stock GRND | 10.76 10.76 | +2.38% 0.00% Post |

- On July 31, 2025, Grindr announced the planned transition of CFO Vanna Krantz, reaffirmed its full-year 2025 earnings guidance for at least 26% revenue growth, and disclosed that a shareholder proposal regarding a human rights policy was not approved at its recent annual meeting.

- The reaffirmed revenue outlook signals ongoing user momentum and business confidence, while the CFO's departure introduces new questions about future financial leadership at the company.

- We'll examine how Grindr's reaffirmed revenue growth outlook and CFO succession could reshape its investment narrative moving forward.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Grindr Investment Narrative Recap

Grindr’s investment story hinges on the belief that the company can capture sustained growth by deepening engagement within its core LGBTQ+ male audience while expanding into broader markets and regions. The reaffirmed 2025 revenue guidance suggests feature-led user momentum remains the near-term catalyst, and the CFO transition, while notable, is unlikely to materially alter Grindr’s immediate growth drivers; however, leadership turnover does introduce uncertainty around financial management if the new hire does not maintain the current trajectory.

Among recent announcements, the reaffirmed full-year guidance of at least 26% revenue growth stands out because it reflects continued business confidence, even as Grindr undergoes key leadership changes and faces competitive risks. This update keeps attention squarely on user engagement and product innovation as central levers for both revenue expansion and margin improvement in the coming quarters.

Yet, for all the focus on growth, investors should not lose sight of the risk that Grindr remains highly dependent on a concentrated user base…

Grindr's outlook anticipates $657.6 million in revenue and $165.3 million in earnings by 2028. This scenario requires a 21.9% annual revenue growth rate and a $259.9 million increase in earnings from the current level of -$94.6 million.

Uncover how Grindr's forecasts yield a $26.25 fair value, a 48% upside to its current price.

Exploring Other Perspectives

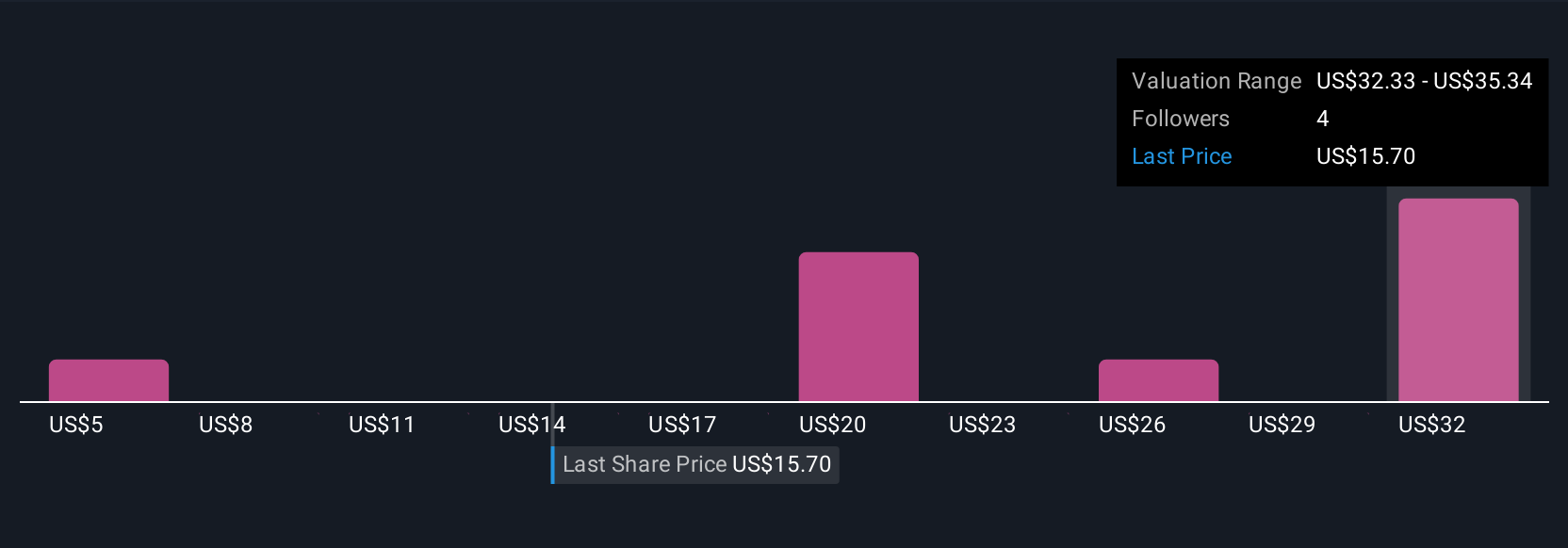

Fair value estimates from four Simply Wall St Community members for Grindr range from US$5.24 to US$33.57. While opinions vary widely, the ongoing risk of high dependence on its core demographic could shape the company’s earnings potential and overall trajectory, explore several viewpoints to understand these implications.

Explore 4 other fair value estimates on Grindr - why the stock might be worth less than half the current price!

Build Your Own Grindr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Grindr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grindr's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.