Please use a PC Browser to access Register-Tadawul

Is Hanwha’s Stake Increase and Rio Grande FIDs Changing the Investment Case for NextDecade (NEXT)?

NextDecade Corp. NEXT | 5.24 5.24 | +8.71% 0.00% Pre |

- Hanwha Aerospace Co., Ltd. has recently increased its stake in NextDecade Corp by acquiring 591,837 shares, while NextDecade has announced Final Investment Decisions for the US$13.4 billion Trains 4 and 5 of its Rio Grande LNG project and the upcoming resignation of CFO Brent Wahl, effective October 20, 2025.

- This combination of institutional investment and major project milestones signals further commitment to NextDecade’s growth in the liquefied natural gas sector.

- We’ll explore how Hanwha Aerospace’s increased ownership strengthens NextDecade’s LNG growth story and its investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is NextDecade's Investment Narrative?

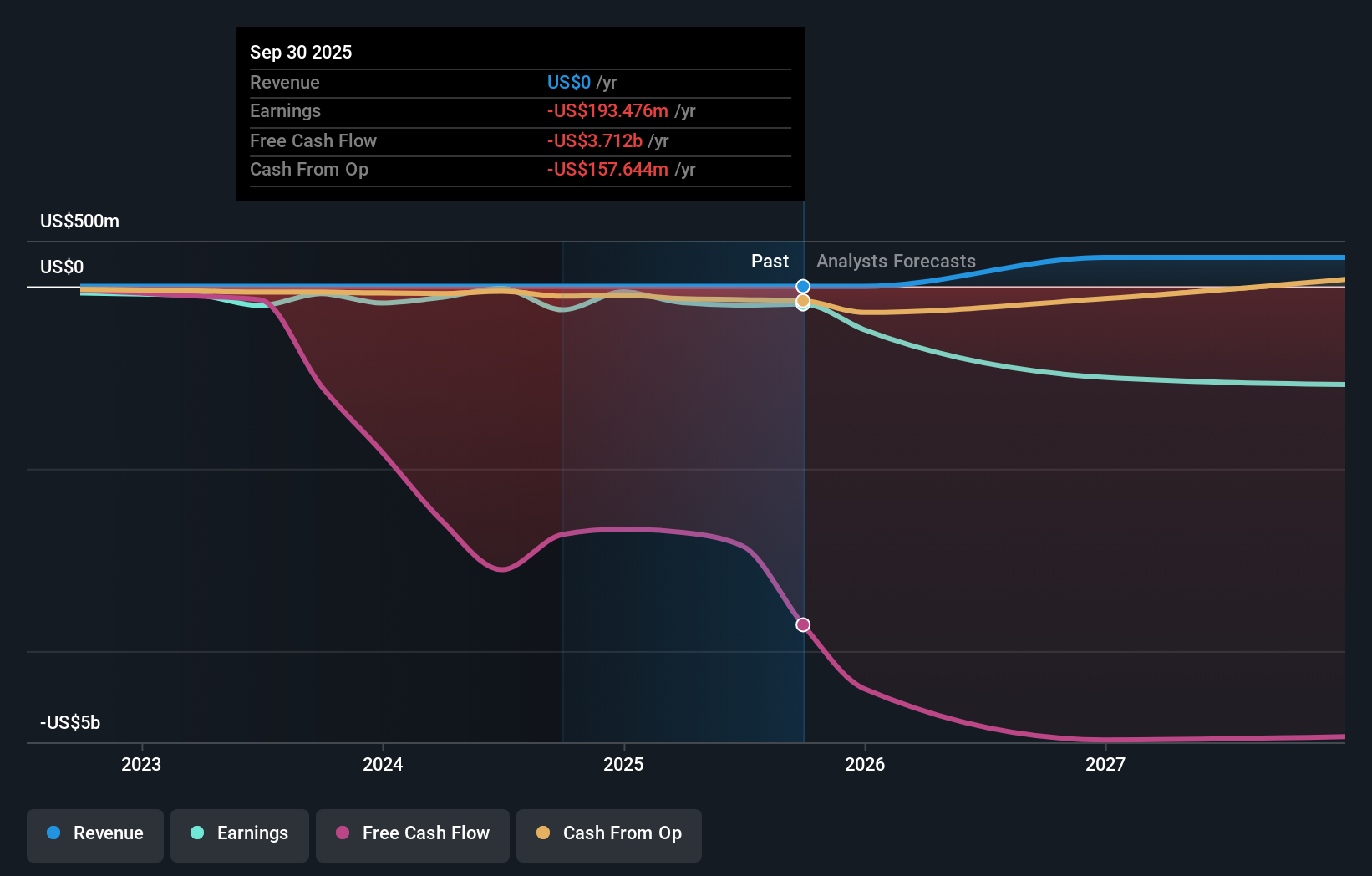

Owning shares in NextDecade means believing that the company can transform ambitious LNG development plans into sustainable value, despite continuing heavy losses and a cash position that remains tight. The recent news of Hanwha Aerospace deepening its stake, alongside NextDecade’s US$13.4 billion commitment to progress Trains 4 and 5 at Rio Grande LNG, addresses a key short-term catalyst: locking in funding and advancing construction. These milestones signal fresh momentum and may decrease concerns about the company’s ability to scale up, though substantial profit generation is still not expected soon. While Hanwha’s renewed backing and recent supply agreements could improve market confidence, challenges remain, such as the unplanned CFO turnover that could unsettle execution or affect financing efforts if not managed smoothly. The impact of these events looks more material for sentiment and funding prospects than for immediate profitability, given current price moves and analyst forecasts. But with so much riding on successful project execution and leadership stability, risks persist that investors should monitor.

NextDecade's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on NextDecade - why the stock might be worth over 3x more than the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextDecade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextDecade's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.