Please use a PC Browser to access Register-Tadawul

Is Henry Schein (HSIC) Signaling a Strategic Shift Toward Specialty Diagnostics With Its Latest Partnership?

Henry Schein, Inc. HSIC | 76.55 76.55 | +0.41% 0.00% Pre |

- Earlier this month, Biomerica announced a marketing services arrangement with Henry Schein to promote the inFoods IBS diagnostic test across the United States, excluding New York State, utilizing Henry Schein’s expansive network of over 400 medical field sales representatives.

- This collaboration leverages Henry Schein’s 93-year history in healthcare innovation and its nationwide reach to accelerate the adoption of a new, non-drug precision diagnostic for patients with Irritable Bowel Syndrome, following promising recent clinical results published in a top gastroenterology journal.

- We'll examine how marketing an innovative non-pharmaceutical IBS test could influence Henry Schein's approach in specialty diagnostics and future growth areas.

Find companies with promising cash flow potential yet trading below their fair value.

Henry Schein Investment Narrative Recap

To be a Henry Schein shareholder, you need to believe in the company's ability to drive margin expansion from its specialty products and technology offerings, despite ongoing competitive pressures in core distribution segments. The new Biomerica collaboration introduces a promising non-drug diagnostic into Henry Schein’s portfolio but, on its own, is not material enough to immediately shift the most important near-term catalyst, progress in expanding recurring high-margin revenues, or to mitigate key risks related to cost pressures and margin compression.

The upcoming third-quarter earnings release on November 4, 2025, will be particularly relevant, given Henry Schein’s reaffirmed full-year guidance and ongoing focus on cost savings and operational efficiencies. Investors are likely to closely monitor any new details regarding the early impact of recent partnerships or further commentary on gross margin trends, especially as the company works to offset pricing and volume headwinds in its core business.

Yet, against these advances, investors should not lose sight of the ongoing risk that persistent pricing pressures in critical supply categories could undermine...

Henry Schein's narrative projects $14.4 billion in revenue and $614.4 million in earnings by 2028. This requires 4.0% yearly revenue growth and a $225.4 million earnings increase from the current $389.0 million.

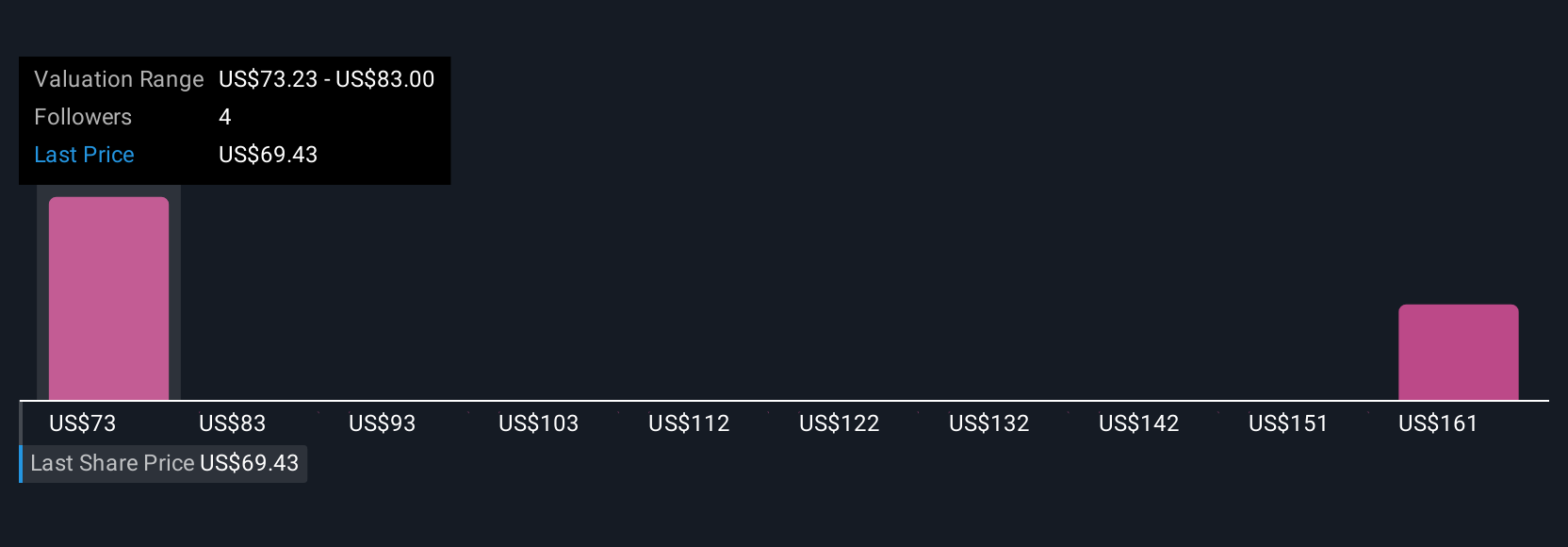

Uncover how Henry Schein's forecasts yield a $73.23 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published fair value estimates for Henry Schein ranging from US$73.23 to US$170.96, based on two independent perspectives. While opinions vary, many remain watchful of persistent competitive pricing pressures that could offset gains in new specialty segments and impact the company’s future performance.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth just $73.23!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.