Please use a PC Browser to access Register-Tadawul

Is It Time To Reassess Kellanova After Its Snacks Focus Spin Off?

Kellogg Company K | 83.44 | Delist |

- Wondering if Kellanova is still a snack aisle staple for your portfolio, or if most of the easy gains are already baked in? Let us unpack what the numbers are really saying about its value.

- The stock has inched up 0.4% over the last week and 0.1% over the past month, adding to a 2.9% gain year to date and a solid 6.4% over the last year, with longer term returns of 33.3% over three years and 71.5% over five years.

- Recent attention has focused on Kellanova’s post spin off repositioning as a focused snacks and emerging markets cereals business, as well as its efforts to streamline operations and sharpen its brand portfolio. Those moves have nudged sentiment, with investors weighing whether a more focused Kellanova can command a higher long term valuation multiple.

- On our checks, Kellanova scores a 2/6 valuation score, suggesting it screens as undervalued on only a couple of metrics, so it is not an obvious bargain at first glance. Next, we will walk through the main valuation approaches investors are using today, and then finish with a more holistic way to decide what the stock is really worth.

Kellanova scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kellanova Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects Kellanova’s future cash flows and then discounts them back to today, aiming to estimate what the business is worth in dollars based on the cash it can generate over time.

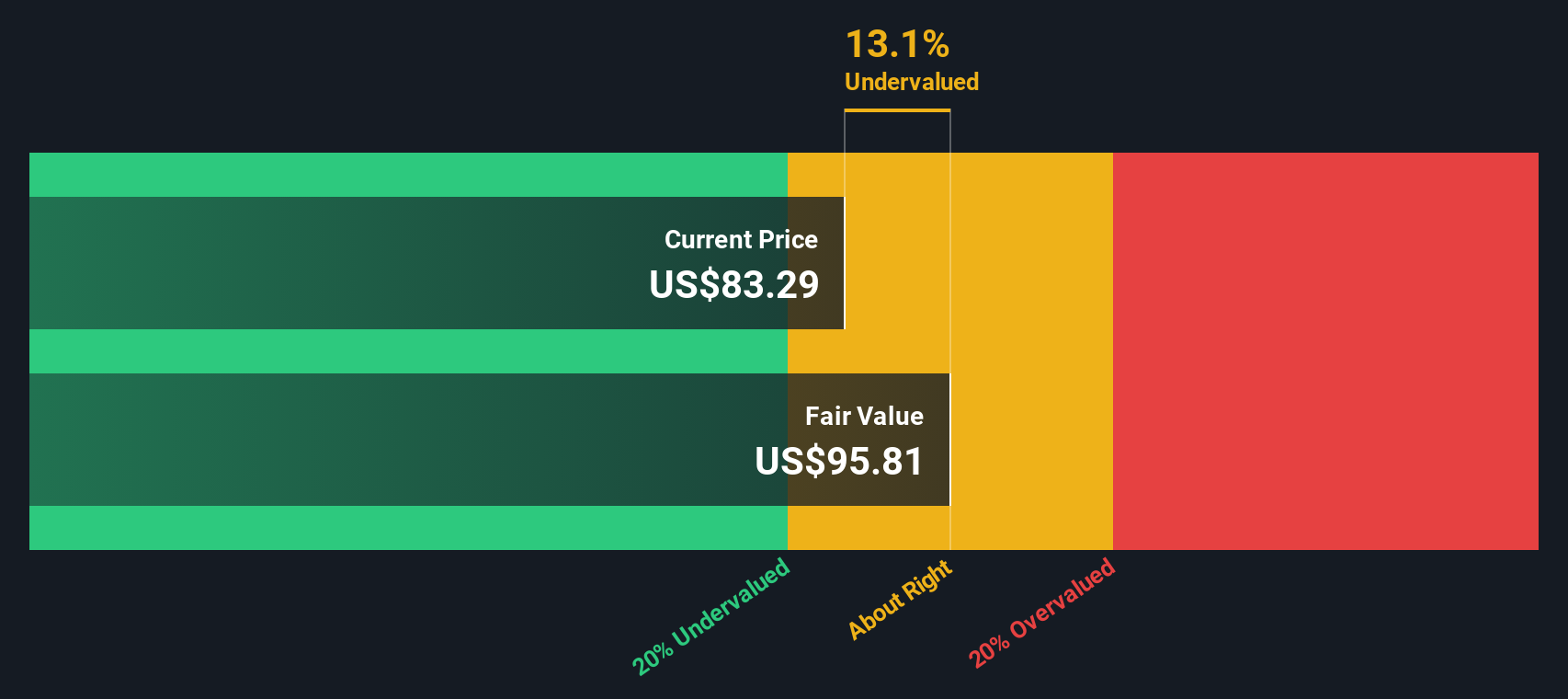

Kellanova’s latest twelve month Free Cash Flow sits at about $594.5 million. Analysts expect this to rise steadily, with Simply Wall St extrapolating those expectations so that by 2035 free cash flow could reach roughly $1.75 billion. The 2 Stage Free Cash Flow to Equity model assumes a period of faster growth followed by a more mature phase, and then discounts each of those yearly cash flows back to today’s value.

Putting those projections together, the model estimates a fair value of about $101.16 per share. Compared with the current share price, the DCF suggests Kellanova is trading at roughly a 17.5% discount, indicating the stock appears meaningfully undervalued on this cash flow view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kellanova is undervalued by 17.5%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Kellanova Price vs Earnings

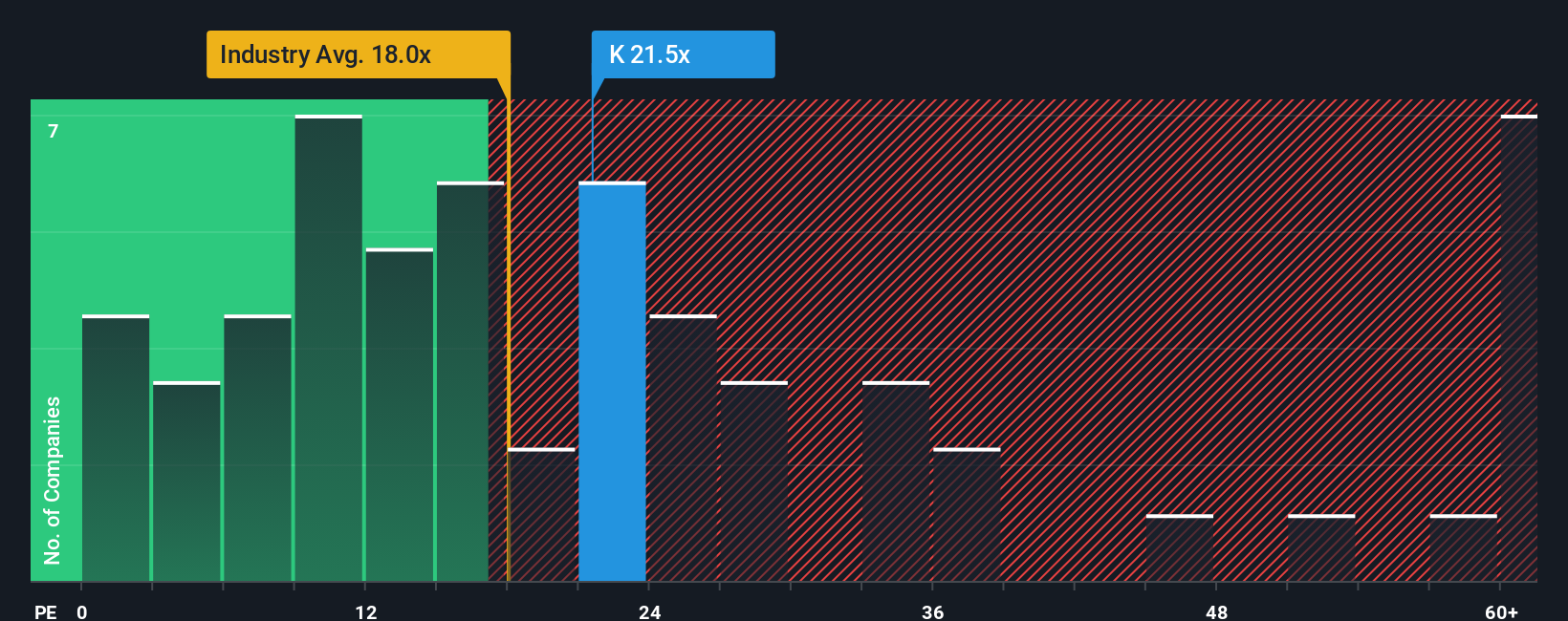

For a profitable, established business like Kellanova, the price to earnings, or PE, ratio is a useful way to gauge what investors are willing to pay for each dollar of current earnings. A higher PE typically reflects stronger growth expectations or lower perceived risk, while a lower PE can signal slower growth, higher risk, or a stock that is out of favor.

Kellanova currently trades on a PE of about 22.7x, which sits above the broader Food industry average of roughly 21.3x but below the peer group average of around 25.1x. To go a step further, Simply Wall St also calculates a Fair Ratio, a proprietary PE estimate that reflects what multiple Kellanova should reasonably trade on given its growth outlook, industry, profit margins, market cap and specific risk profile.

Because the Fair Ratio of 17.0x bakes in these company specific factors, it is a more tailored yardstick than simple industry or peer comparisons. Lining that up against the current 22.7x PE suggests the market is paying a premium to this fundamentals based estimate, implying that Kellanova screens as somewhat overvalued on a pure earnings multiple view.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kellanova Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an approach that lets you connect your view of Kellanova’s business story with the numbers behind its future revenue, earnings and margins.

A Narrative is your own clear, written perspective on how a company will grow, compete and manage risks, tied directly to a simple financial forecast and a resulting fair value estimate so you are not just guessing at a price target.

On Simply Wall St, Narratives are an easy, visual tool within the Community page, used by millions of investors to translate different stories about a company into explicit assumptions and a fair value that can be compared with today’s share price to inform investment decisions.

Because each Narrative is linked to live data, it updates dynamically when new information like earnings releases or major news hits, keeping your fair value estimate aligned with reality.

For example, one Kellanova Narrative might assume steady 2.4% annual revenue growth, modest margin expansion and a fair value near $83, while a more optimistic investor might project faster global snack adoption and a richer future PE, ending up with a meaningfully higher fair value.

Do you think there's more to the story for Kellanova? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.