Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Photronics (PLAB) After Its 53% One Year Rally?

Photronics, Inc. PLAB | 38.00 | +2.01% |

- If you are wondering whether Photronics is still reasonably priced after its strong run, this article walks through what the current share price might be implying about value.

- Photronics shares last closed at US$35.28, with a 7 day return of a 2.5% decline, a 30 day return of 4.7%, a year to date return of 5.6%, a 1 year return of 53.0%, a 3 year return of 82.9% and a 5 year return of 193.0%.

- These moves sit against a backdrop of ongoing interest in semiconductor related names and continued attention on suppliers that support chip manufacturing capacity. Recent coverage has focused on how companies in this area fit into longer term chip production and technology investment themes, which helps frame how investors may be thinking about risks and opportunities for Photronics.

- On our checks, Photronics scores 3 out of 6 on valuation, based on this valuation score. Next we look at how different valuation methods line up, and then finish with a way of looking at value that can give you a deeper read than any single metric.

Approach 1: Photronics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today using a required rate of return. It aims to translate future cash earnings into a single value per share in today’s money.

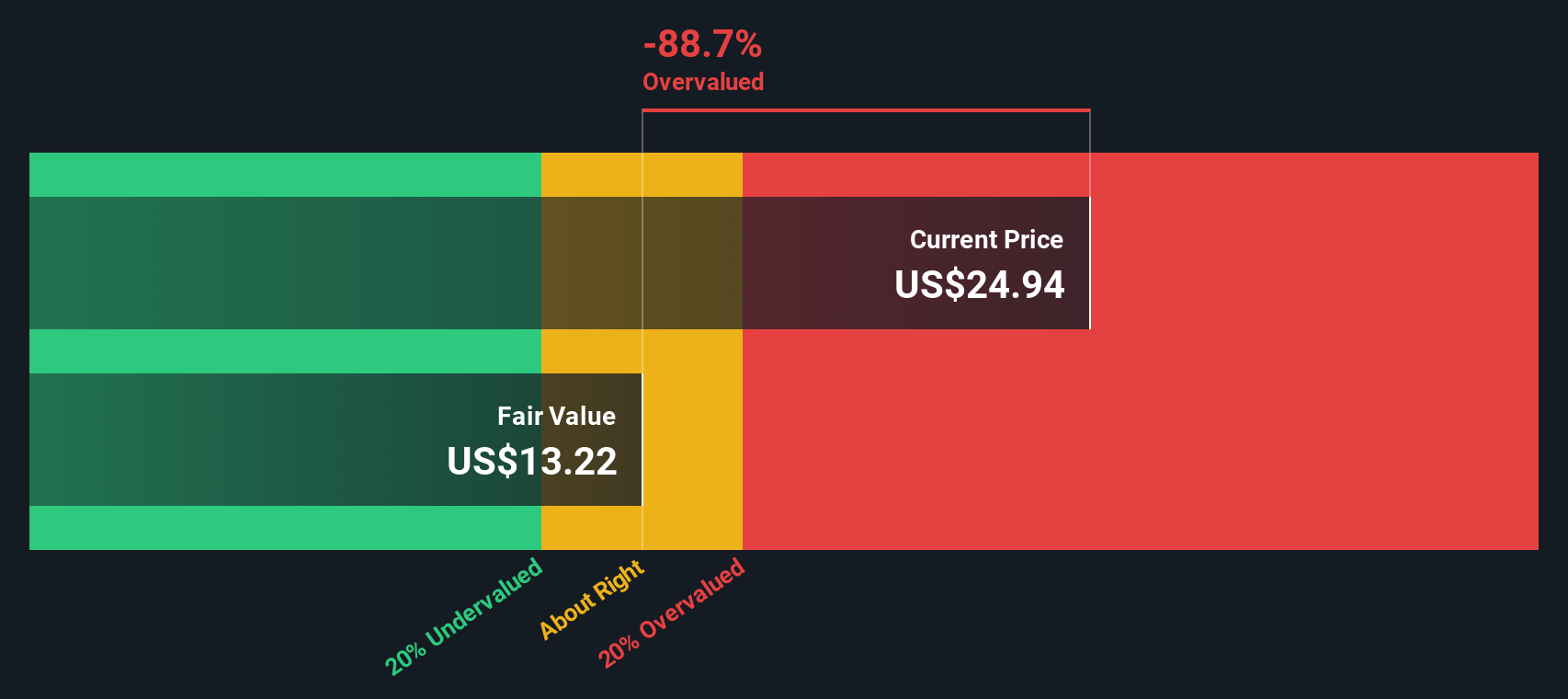

For Photronics, the model used is a 2 stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month free cash flow is US$101.1 million. Simply Wall St then uses analyst inputs where available and extends them, so the projections from 2026 through 2035 blend analyst expectations for the near term with extrapolated figures further out. By 2035, the model is using an estimated free cash flow of about US$105.2 million, all expressed in US$ and kept below the billion mark.

When these cash flows are discounted back and divided across the share count, the model produces an estimated intrinsic value of about US$19.06 per share. Against the recent share price of US$35.28, the DCF output indicates that the stock is about 85.1% overvalued on this method alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Photronics may be overvalued by 85.1%. Discover 868 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Photronics Price vs Earnings

For a profitable company like Photronics, the P/E ratio is a useful cross check because it ties what you are paying directly to the earnings the business is generating today. It is a quick way to see how the market is weighing the company’s current profitability against what it might earn in the future and the risks along the way.

Higher growth expectations and lower perceived risk usually line up with a higher P/E ratio, while slower expected growth or higher risk usually sit with a lower P/E. Photronics is trading on a P/E of 15.28x, compared with the Semiconductor industry average of 43.55x and a peer group average of 57.57x. Simply Wall St’s Fair Ratio for Photronics is 23.34x, which is its view of what a “normal” P/E could look like once you factor in the company’s earnings profile, margins, industry, size and risk characteristics.

The Fair Ratio is more tailored than a straight peer or industry comparison because it tries to line up what you pay with company specific drivers rather than broad sector averages. With Photronics at 15.28x versus a Fair Ratio of 23.34x, this framework points to the shares trading below that tailored reference point.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Photronics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way for you to write the story behind your numbers, including your view of fair value and your expectations for Photronics’ future revenue, earnings and margins.

A Narrative connects three things: the story you believe about a company, the financial forecast that flows from that story, and the fair value that those forecasts imply, so you can see clearly how your view translates into a number.

You can build and compare Narratives on Simply Wall St’s Community page, where millions of investors share their views, and the platform helps you see how each Narrative’s fair value lines up against the current share price to decide whether the stock looks expensive or inexpensive on your assumptions.

Narratives are kept fresh because they update automatically when new information arrives, such as earnings releases or major news, and you can quickly see how that might shift your fair value for Photronics.

For example, one investor might use a Narrative that points to a much higher fair value for Photronics based on more optimistic revenue and margin assumptions, while another might set a lower fair value using more cautious estimates and a higher discount rate.

Do you think there's more to the story for Photronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.