Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Photronics (PLAB) After Its Strong Multi‑Year Share Price Run?

Photronics, Inc. PLAB | 38.00 | +2.01% |

- If you are wondering whether Photronics at US$37.54 is still reasonably priced after a strong run, you are not alone.

- The stock has returned 4.0% over the past week, 12.6% over the last 30 days, 12.4% year to date, 65.2% over 1 year, and 105.4% over 3 years, with a 5 year return of 182.9%. That naturally raises questions about what is already priced in and how much risk you are taking on at current levels.

- Recent attention on Photronics has focused on its position within the semiconductor industry and how investors are thinking about companies tied to chip demand and manufacturing capacity. That broader interest helps frame the recent share price moves as part of a wider reassessment of where value might lie in the supply chain.

- Our valuation model gives Photronics a score of 3 out of 6, which suggests some checks flag the shares as potentially undervalued while others are more mixed. Next we will look at how different valuation approaches arrive at that view before finishing with a more complete way to think about what the stock might be worth.

Approach 1: Photronics Discounted Cash Flow (DCF) Analysis

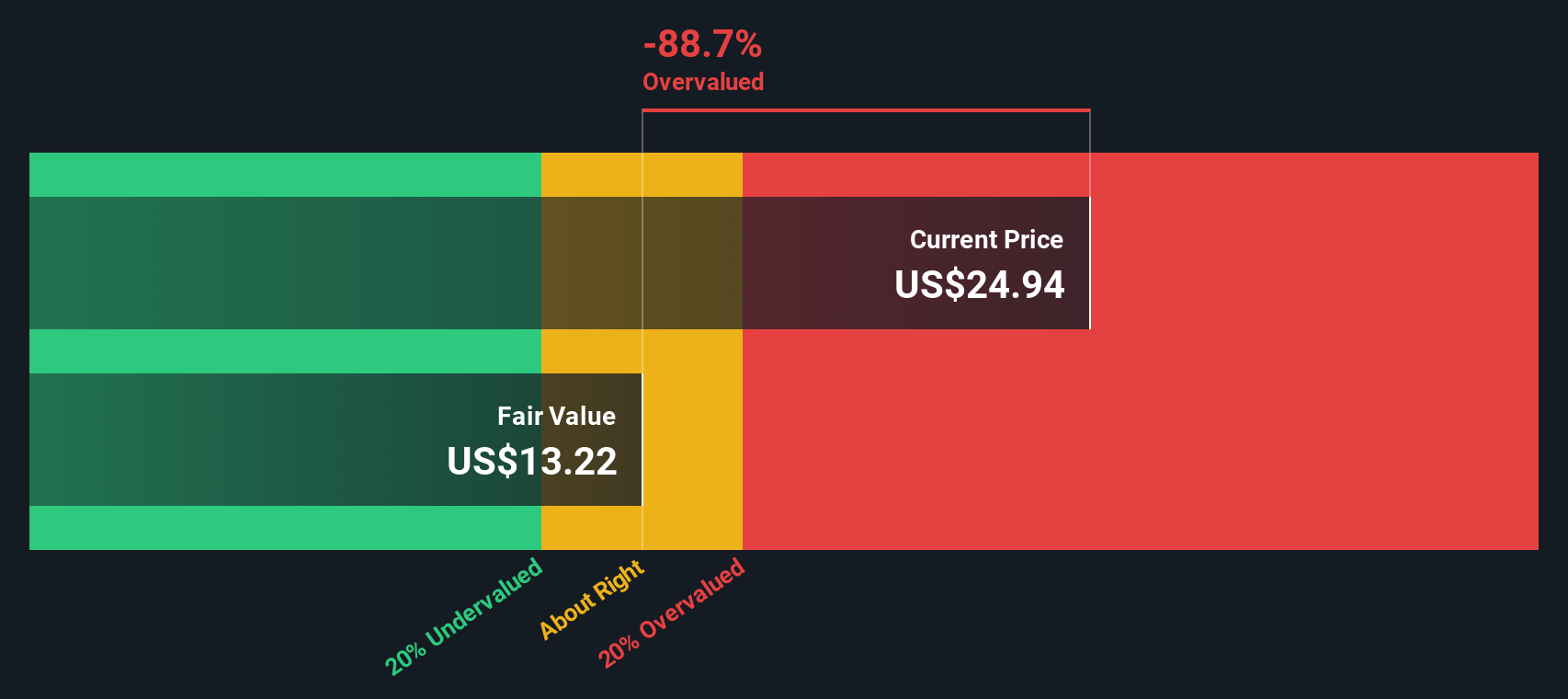

A Discounted Cash Flow model estimates what a company could be worth by projecting its future cash flows and discounting them back to today’s value. For Photronics, the model used is a 2 Stage Free Cash Flow to Equity approach that works off projected free cash flows available to shareholders.

Photronics last twelve month free cash flow is reported at about $101.1 million. Simply Wall St then projects annual free cash flow out to 2035, with figures such as $95.6 million in 2026 and $106.4 million in 2035, and discounts each of these to reflect the time value of money. These projections beyond the usual analyst horizon are extrapolated by Simply Wall St rather than based on explicit analyst estimates.

On this basis, the model arrives at an estimated intrinsic value of $19.73 per share. Compared with the recent share price of US$37.54, the DCF output suggests the stock is 90.3% above this estimate, which points to a stretched valuation on this particular cash flow view.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Photronics may be overvalued by 90.3%. Discover 52 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Photronics Price vs Earnings

For profitable companies, the P/E ratio is a useful way to link what you pay per share to the earnings the business is currently generating. It gives you a quick sense of how many dollars investors are willing to pay today for each dollar of current earnings.

What counts as a “normal” P/E depends a lot on how the market views a company’s growth prospects and risk. Higher expected growth and lower perceived risk usually support a higher P/E, while slower growth or higher uncertainty tend to pull that multiple down.

Photronics is trading on a P/E of 16.26x. That sits below the broader Semiconductor industry average P/E of 44.17x and below the peer group average of 56.67x. Simply Wall St’s Fair Ratio for Photronics is 24.97x, which is its own estimate of what a reasonable P/E might be for this company given factors such as earnings growth, profit margins, industry, market cap and specific risks.

The Fair Ratio aims to be more tailored than simple peer or industry comparisons because it adjusts for those company specific characteristics rather than assuming one size fits all. On this measure, Photronics’ current P/E of 16.26x sits below the Fair Ratio of 24.97x, which points to a discounted valuation on this earnings based approach.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Photronics Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, which are simply your own story about Photronics, linking your view on its future revenue, earnings and margins to a forecast and a fair value, then comparing that fair value to the current price to help you decide what to do.

On Simply Wall St, Narratives live on the Community page and are designed to be easy to use. You can plug in your assumptions, see a fair value output, and then watch that view update automatically when new information such as earnings or news is added.

For example, one investor might build a Photronics Narrative that assumes a fair value of US$42 per share based on certain revenue growth, margin and discount rate assumptions. Another investor might take a more cautious stance with a lower fair value and a different risk view. Comparing both to the current price helps each investor decide whether the stock looks attractive, fairly priced or expensive according to their own story.

Do you think there's more to the story for Photronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.