Please use a PC Browser to access Register-Tadawul

Is It Too Late to Consider Roblox After Its 68.3% Surge and DCF Fair Value Signal?

Roblox RBLX | 94.34 91.97 | -0.02% -2.51% Pre |

- Wondering if Roblox at around $99 a share is still a smart buy after its huge run, or if the easy money has already been made? This article will walk through what the numbers really say about its value.

- The stock has climbed 68.3% year to date and 76.0% over the last year, even after a recent 7.3% pullback over the past month and a 5.7% rebound in just the last week. This signals that investors are still willing to pay up for growth.

- Recent headlines have focused on Roblox expanding beyond gaming into broader social and digital experiences, with partnerships around branded virtual worlds and creator monetization that continue to fuel the growth story. At the same time, regulators and parents are watching the platform more closely, reminding investors that rapid user growth can come with policy and reputational risks.

- Despite all that excitement, Roblox scores just 0/6 on our valuation checks, suggesting it screens as expensive on most traditional metrics. Next we will break down the usual valuation approaches, then finish by exploring a more nuanced way to think about what this business might actually be worth long term.

Roblox scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Roblox Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

For Roblox, the model starts with last twelve months Free Cash Flow of about $1.03 billion and applies a 2 Stage Free Cash Flow to Equity framework. Analyst forecasts cover the next few years, with projected FCF reaching roughly $3.28 billion by 2029. Simply Wall St then extrapolates additional years beyond that to capture a full decade of growth. These future cash flows, all in $, are then discounted to reflect risk and the time value of money.

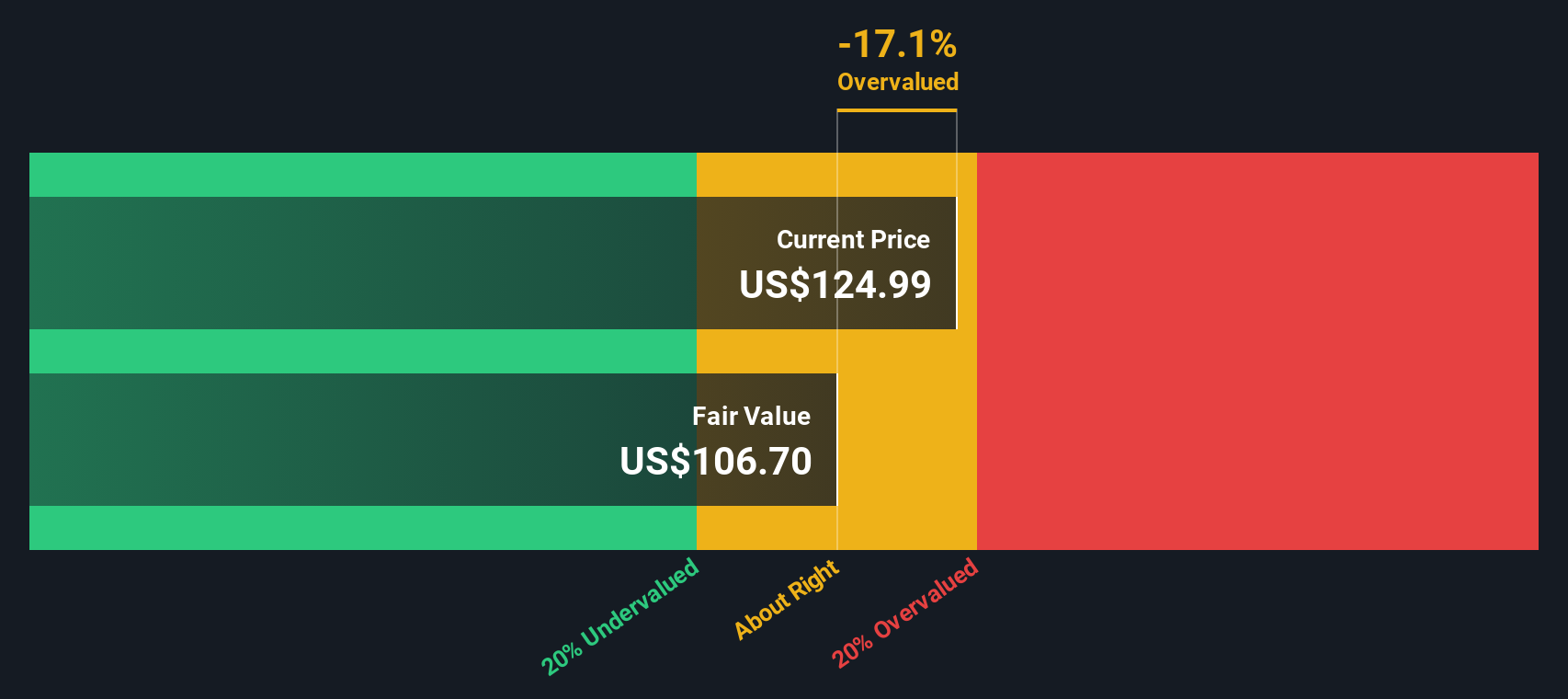

Adding those discounted figures together yields an estimated intrinsic value of about $94.81 per share. With the stock trading around $99, the DCF suggests Roblox is roughly 4.4% overvalued, which is a relatively small gap and well within a normal margin of error for such models.

Result: ABOUT RIGHT

Roblox is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Roblox Price vs Sales

For a fast growing platform business that is not yet consistently profitable, price to sales is often the cleanest way to compare value, because it focuses on what investors are paying for each dollar of revenue rather than volatile earnings.

In general, higher growth and stronger competitive positioning can justify a richer multiple, while higher risk, cyclicality or regulatory pressure should pull that multiple down. So a normal or fair price to sales range is really a balancing act between upside potential and execution risk.

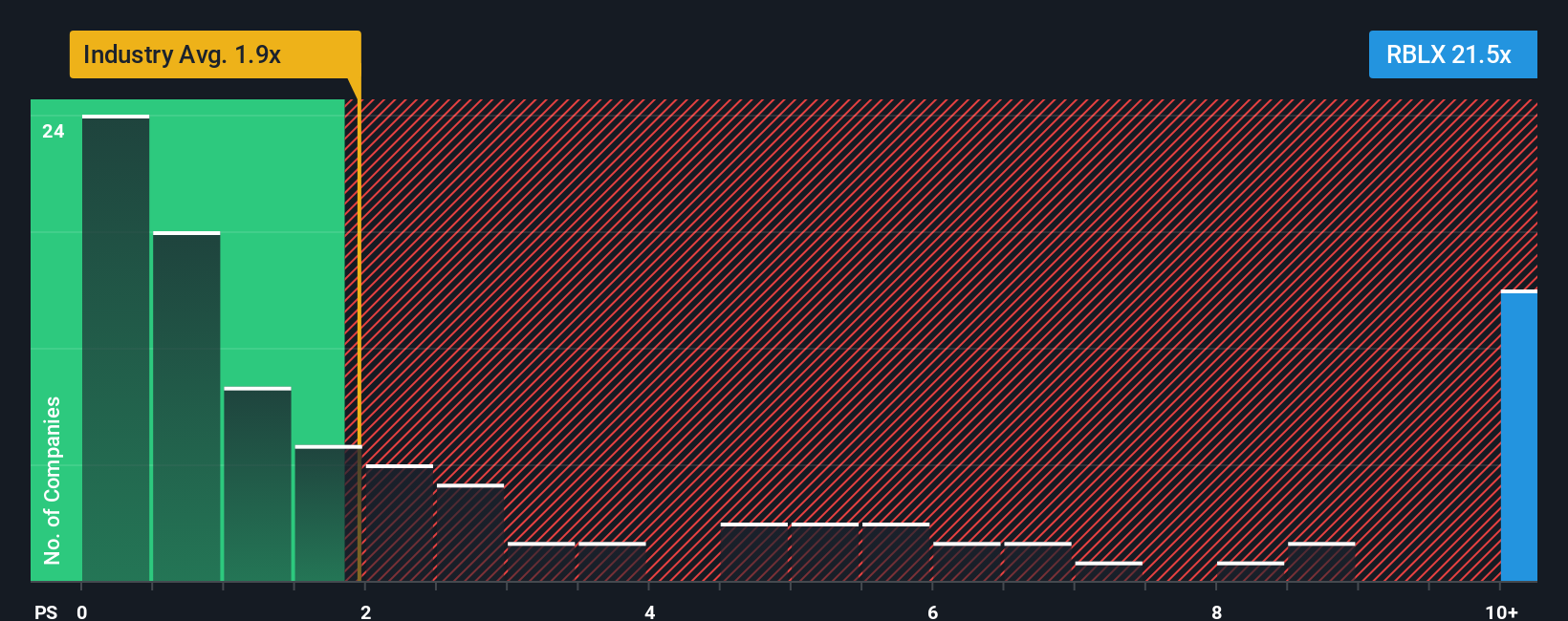

Roblox currently trades on a price to sales multiple of about 15.6x, far above the Entertainment industry average of roughly 1.4x and even well ahead of its peer group at about 4.2x. Simply Wall St’s Fair Ratio framework estimates that, after accounting for Roblox’s growth outlook, margins, market cap, industry and risk profile, a more justified price to sales multiple would be closer to 5.1x. Because this Fair Ratio bakes in those company specific drivers, it provides a more tailored benchmark than a simple comparison against industry or peers.

With the actual multiple at 15.6x versus a Fair Ratio of 5.1x, Roblox screens as meaningfully overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roblox Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way to attach your own story about a company to the numbers you expect it to deliver, by connecting your view of Roblox’s future revenue, earnings and margins to a forecast and then to a personal fair value estimate. On Simply Wall St’s Community page, millions of investors can build or follow Narratives that clearly link a company’s story, such as rapid international expansion or rising safety and regulatory costs, to the financial outcomes they think are most likely. Each Narrative then compares its Fair Value to the live share price, providing an accessible, dynamic view of whether that story suggests Roblox is a buy, hold, or sell. It also automatically updates as fresh news or earnings data comes in. For example, one Roblox Narrative might assume the optimistic $175 fair value based on advertising and older users driving very strong growth. Another might lean toward a cautious $62 fair value that incorporates heavier costs, stiffer competition, and slower monetization.

Do you think there's more to the story for Roblox? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.