Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider SiteOne (SITE) After Recent Share Price Gains?

SiteOne Landscape Supply, Inc. SITE | 161.02 | +8.23% |

- If you are wondering whether SiteOne Landscape Supply is fairly priced at around US$150 a share, you are not alone. This article is here to unpack what that tag might really mean for you.

- The stock has recently recorded returns of 4.5% over 7 days, 16.3% over 30 days, 20.0% year to date and 12.7% over 1 year, with a much flatter 2.1% over 3 years and an 8.3% decline over 5 years.

- Recent market attention on SiteOne has been driven mainly by ongoing interest in building products and services companies and how they might respond to shifts in construction and outdoor projects over time. This backdrop helps explain why some investors are reassessing what they are willing to pay for the shares today.

- Right now, our valuation framework gives SiteOne a score of 0 out of 6 on under-valuation checks. Next we will look at how different valuation approaches line up for this stock and then finish with a more complete way of thinking about its value.

SiteOne Landscape Supply scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SiteOne Landscape Supply Discounted Cash Flow (DCF) Analysis

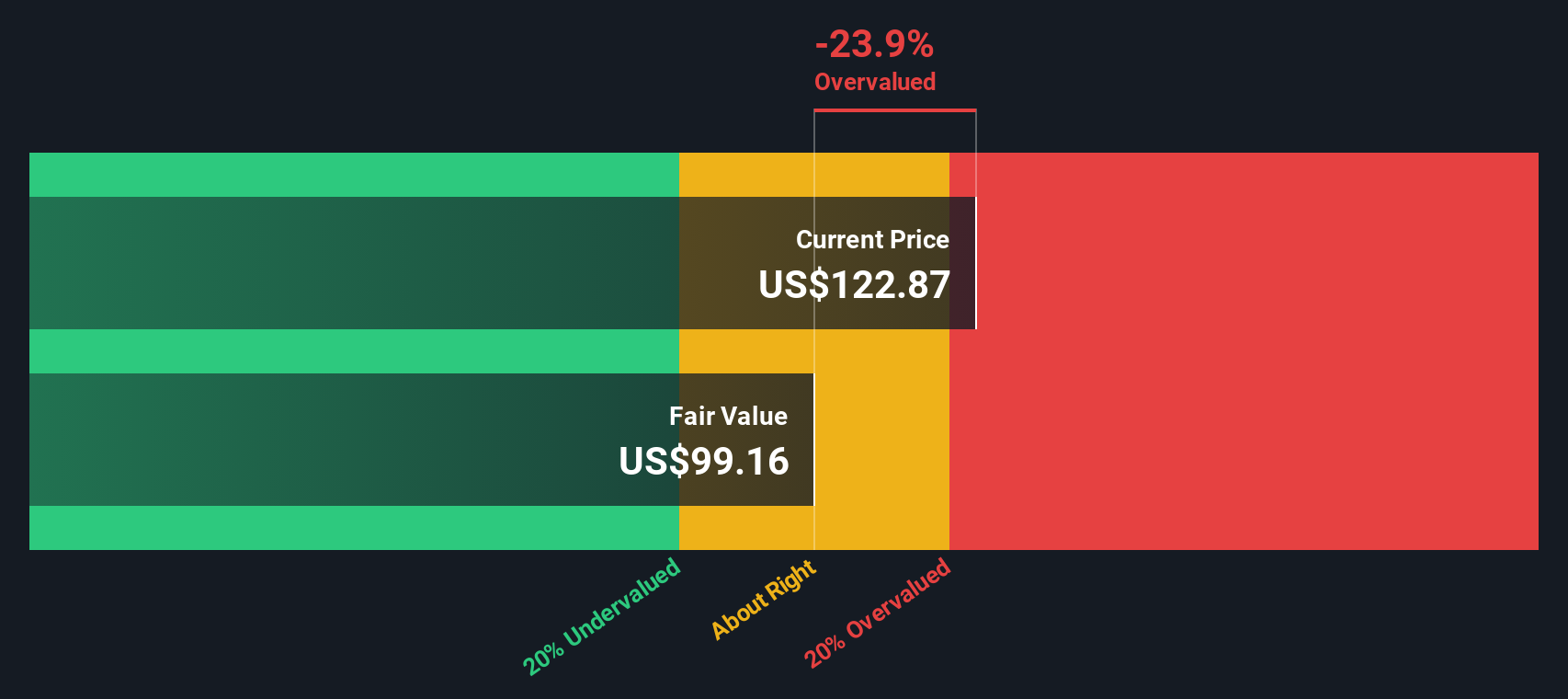

A Discounted Cash Flow, or DCF, model looks at the cash SiteOne Landscape Supply is expected to generate in the future and then discounts those cash flows back to what they might be worth in today’s dollars.

SiteOne’s latest twelve month free cash flow is about $209.2 million. Using a 2 Stage Free Cash Flow to Equity model, analysts have supplied estimates out to 2027, with Simply Wall St extending these to a 10 year path. Within that set of projections, free cash flow for 2026 is $228.9 million and for 2027 it is $256.7 million, with later years extrapolated rather than directly forecast by analysts.

When all those projected cash flows are discounted back and combined, the model arrives at an estimated intrinsic value of roughly $128.00 per share. Compared with the current share price of around $150, this implies the stock screens as about 17.2% overvalued on this DCF view.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SiteOne Landscape Supply may be overvalued by 17.2%. Discover 53 high quality undervalued stocks or create your own screener to find better value opportunities.

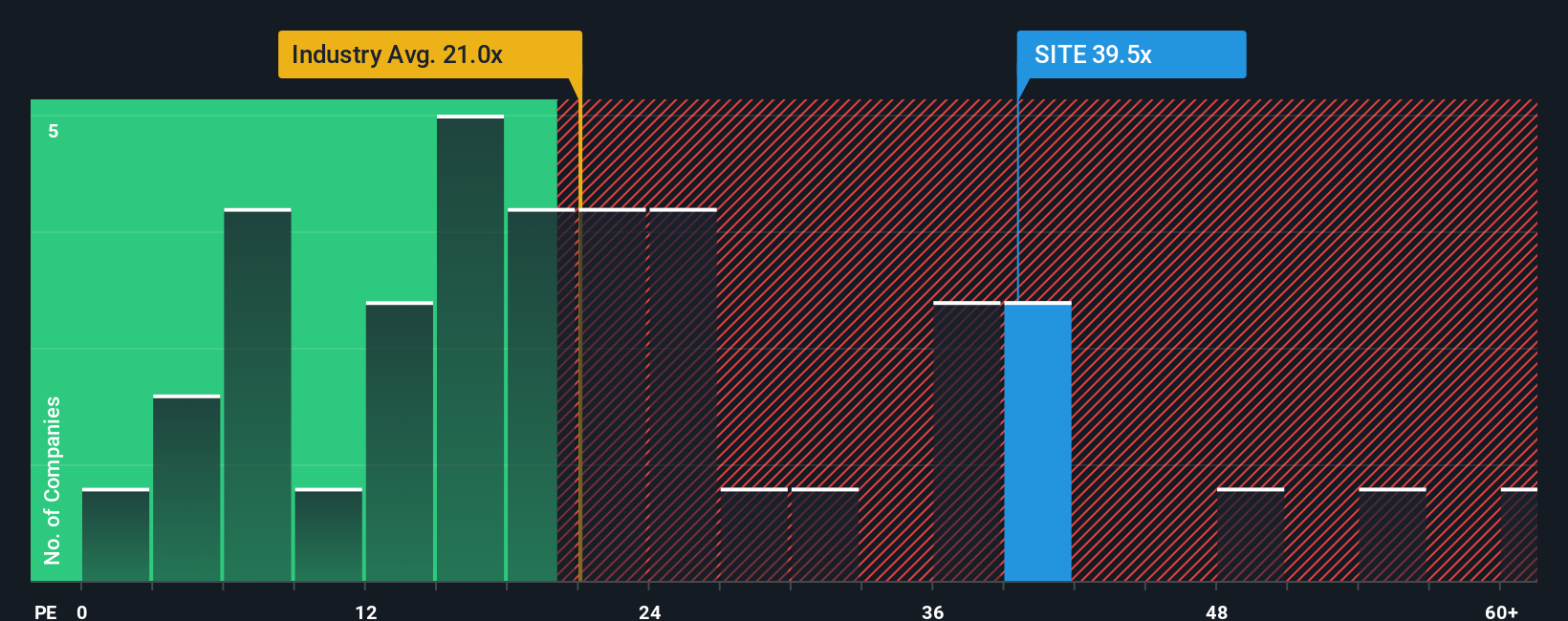

Approach 2: SiteOne Landscape Supply Price vs Earnings

The P/E ratio is a practical way to look at a profitable company like SiteOne because it ties the share price directly to the earnings that support it. Investors usually accept a higher or lower P/E depending on what they expect for future growth and how much risk they see in the business and sector.

SiteOne currently trades on a P/E of 47.75x. That sits above the Trade Distributors industry average P/E of 24.65x and also above the peer group average of 18.95x. On simple comparisons, the shares look expensive relative to both the sector and similar companies.

Simply Wall St’s Fair Ratio for SiteOne is 30.39x. This Fair Ratio is a proprietary estimate of what a more appropriate P/E might be once you factor in elements such as earnings growth, profit margins, industry, market cap and company specific risks. Because it blends these drivers together, it can often give a more tailored view than broad industry or peer averages, which do not adjust for SiteOne’s own profile. With the current P/E of 47.75x sitting above the Fair Ratio of 30.39x, the shares screen as expensive on this earnings based measure.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your SiteOne Landscape Supply Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which connect the story you believe about a company to the numbers you use for its fair value, revenue, earnings and margins.

A Narrative on Simply Wall St is your own storyline for a company that links what you think is happening in the business to a financial forecast and then to a fair value estimate that you can compare directly with today’s share price.

These Narratives sit inside the Community page on Simply Wall St, where millions of investors share views, and the fair values update automatically when new information such as earnings releases or important news is added to the platform.

Narratives can also support your decision making, because you can see at a glance how your SiteOne fair value compares with the current price. You can also compare different viewpoints. For example, one investor might see a much higher fair value than another investor who applies more cautious assumptions about future revenue or margins.

Do you think there's more to the story for SiteOne Landscape Supply? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.