Please use a PC Browser to access Register-Tadawul

Is It Too Late To Reassess Old Dominion Freight Line (ODFL) After Recent Share Price Strength?

Old Dominion Freight Line, Inc. ODFL | 201.39 | +3.19% |

- If you are wondering whether Old Dominion Freight Line is priced attractively right now, you are not alone. The stock’s current level is raising plenty of value questions.

- The share price sits at US$196.11, with returns of 3.3% over the past week, 13.3% over the past month, 23.2% year to date, 11.2% over 3 years, 91.1% over 5 years and a 4.0% decline over the past year.

- Recent coverage of Old Dominion has focused on its role as a major less than truckload carrier in the US and how that positions the business within freight demand trends. This backdrop, including ongoing attention on freight volumes and pricing, helps frame how investors are reacting to the stock’s recent moves.

- On our checks, Old Dominion Freight Line scores just 1 out of 6 for potential undervaluation. We will look at what standard valuation methods say, then finish by pointing you to a more comprehensive way to think about what the stock might be worth.

Old Dominion Freight Line scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

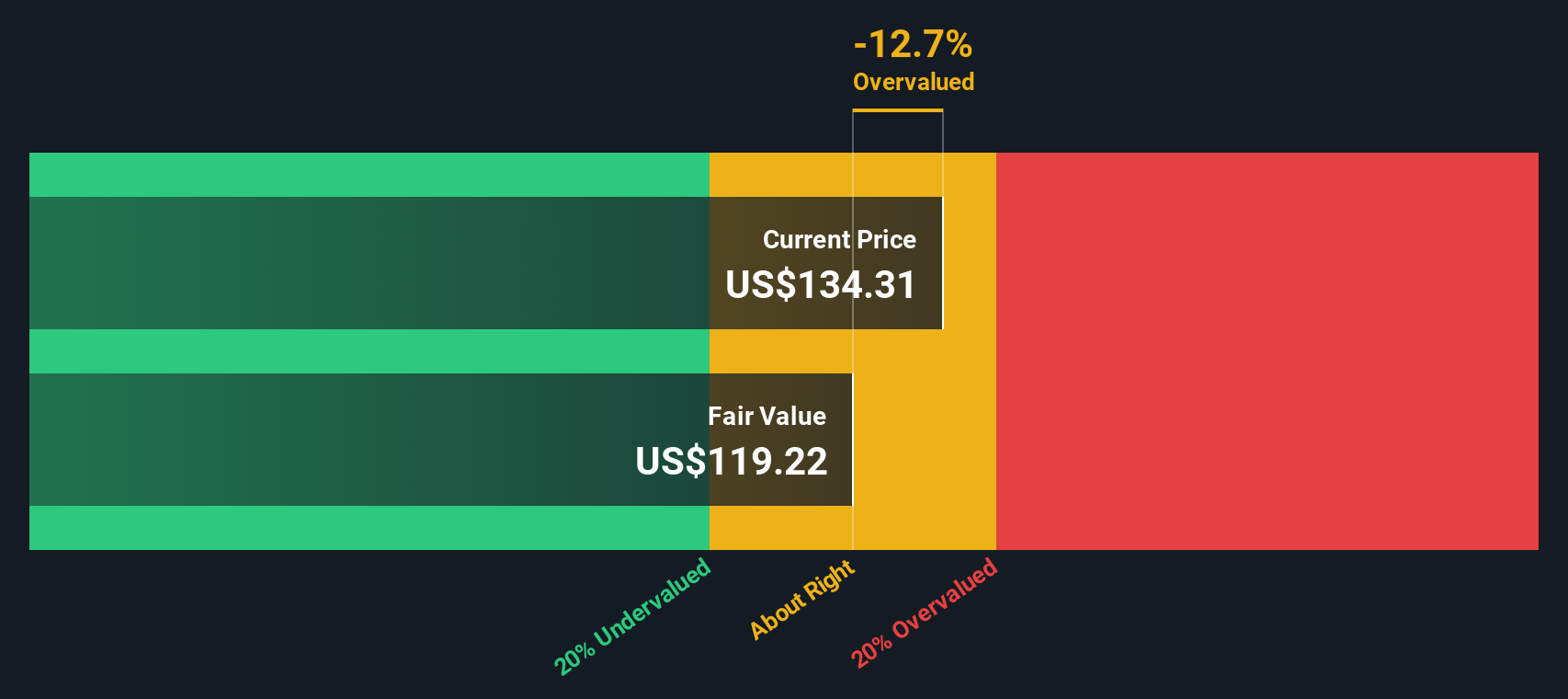

Approach 1: Old Dominion Freight Line Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows and discounts them back to today’s value using a required return, giving a single estimate of what the business might be worth per share.

For Old Dominion Freight Line, the latest twelve month Free Cash Flow is reported at about $757.2 million. Using a 2 Stage Free Cash Flow to Equity model with cash flow projections, analysts and extrapolated estimates point to Free Cash Flow of $1,197 million by 2029. Simply Wall St then extends those forecasts further using its own assumptions to build a full long term cash flow path.

When those projected cash flows are discounted back, the DCF model arrives at an estimated intrinsic value of $112.29 per share, compared with the current share price of $196.11. On this basis, the stock screens as 74.6% overvalued relative to this particular DCF framework.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Old Dominion Freight Line may be overvalued by 74.6%. Discover 52 high quality undervalued stocks or create your own screener to find better value opportunities.

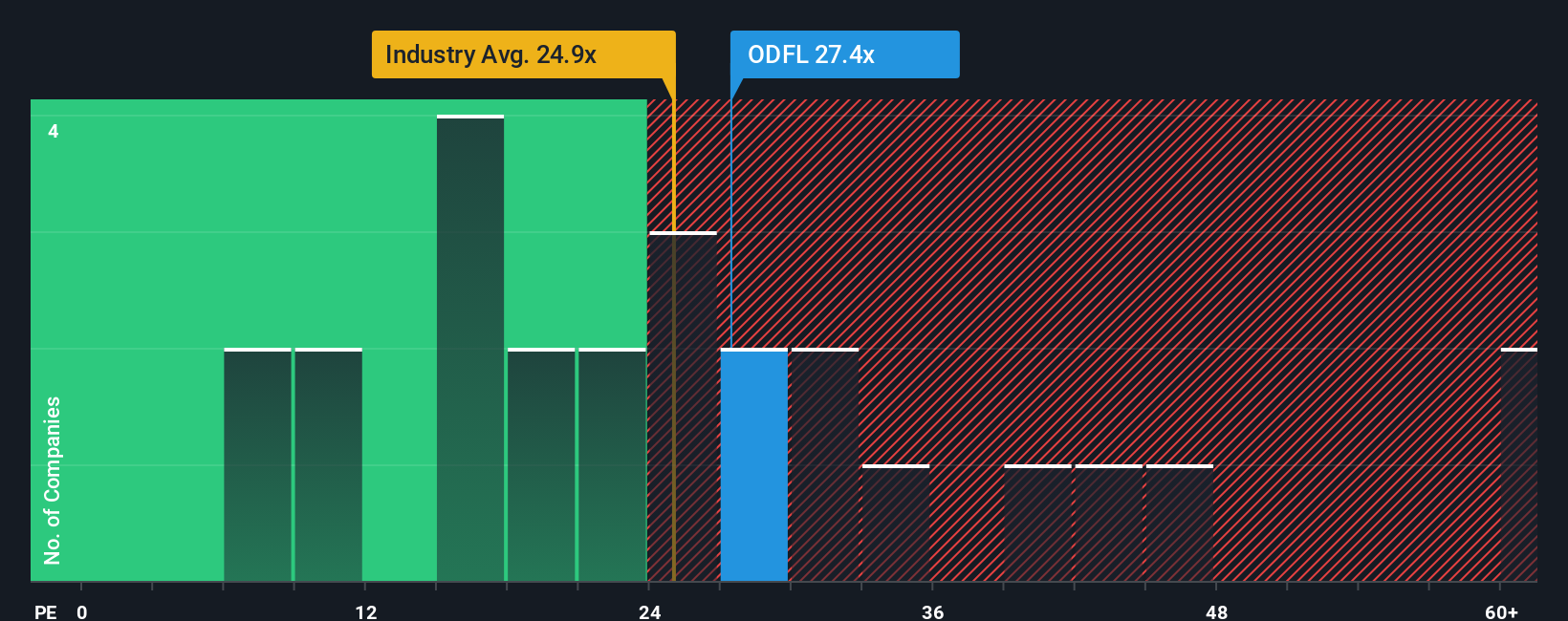

Approach 2: Old Dominion Freight Line Price vs Earnings

P/E is a common way to look at valuation for profitable companies because it links what you pay for each share to the earnings that business is currently generating. The level of a “normal” or “fair” P/E usually reflects how the market views a company’s growth outlook, the stability of its earnings and the risks around its business model.

Old Dominion Freight Line is trading on a P/E of 40.1x. That is close to the broader Transportation industry average of about 39.2x, but below the peer group average of 74.2x. Simply comparing P/E ratios like this only gets you part of the way, because it does not fully account for differences in growth, profitability, size or risk between companies.

To address that, Simply Wall St uses a proprietary “Fair Ratio” for each stock. This is an estimate of what the P/E might be, given factors such as earnings growth, profit margins, the company’s industry, its market capitalization and key risks. For Old Dominion Freight Line, the Fair Ratio is 20.2x, which is well below the current P/E of 40.1x. This suggests the shares trade above this tailored estimate of fair value.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Old Dominion Freight Line Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St’s Community page you can use Narratives, where you write the story you believe about Old Dominion Freight Line, tie that story to specific forecasts for revenue, earnings and margins, connect those forecasts to a Fair Value, then compare that to today’s price to help inform your decision. The model updates automatically when fresh news or earnings arrive. For example, one investor might lean toward a higher fair value around US$189 per share based on stronger growth and margins, while another might anchor closer to US$123 per share based on softer freight trends and a lower assumed P/E. Both views can sit side by side with clear numbers behind each story.

Do you think there's more to the story for Old Dominion Freight Line? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.