Please use a PC Browser to access Register-Tadawul

Is Kinetik Holdings’ (KNTK) King's Landing Project a Turning Point for Margin Growth?

Kinetik Holdings Inc. Class A KNTK | 35.58 35.58 | -0.20% 0.00% Pre |

- Kinetik Holdings Inc. recently announced its third-quarter 2025 earnings, reporting revenues of US$463.97 million and net income of US$15.55 million, both compared to higher figures one year prior, alongside major project milestones.

- While revenue increased, the company's profit fell sharply, highlighting both the benefits and near-term pressures of recent expansions and new commercial agreements.

- We'll explore how Kinetik's King's Landing project coming online may shape the company’s investment outlook and industry positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Kinetik Holdings Investment Narrative Recap

To be a shareholder in Kinetik Holdings today, you need to believe that large-scale midstream investments in the Northern Delaware Basin can drive multiyear earnings expansion, even as short-term profits are pressured by growth costs and commodity price swings. The Q3 results underline that while revenue catalysts like the King's Landing project coming online remain intact, near-term profits and margins have been squeezed, highlighting how capital intensity and ongoing inflation remain the biggest risks; these earnings do not meaningfully change that calculus.

Among recent announcements, the full launch of King's Landing stands out, boosting Kinetik’s market share in Permian gas processing, a factor directly tied to both the company’s potential for future growth and its exposure to regional drilling activity. With increased capacity now online, Kinetik is more leveraged than ever to volume trends in the basin, which reinforces both its biggest catalyst and also the business’s downside if upstream activity slows.

By contrast, investors should be aware that balance sheet flexibility may be at risk if elevated capital expenditures and inflation persist in coming quarters...

Kinetik Holdings' narrative projects $2.8 billion revenue and $167.1 million earnings by 2028. This requires 19.0% yearly revenue growth and a $122.6 million earnings increase from $44.5 million in current earnings.

Uncover how Kinetik Holdings' forecasts yield a $49.92 fair value, a 43% upside to its current price.

Exploring Other Perspectives

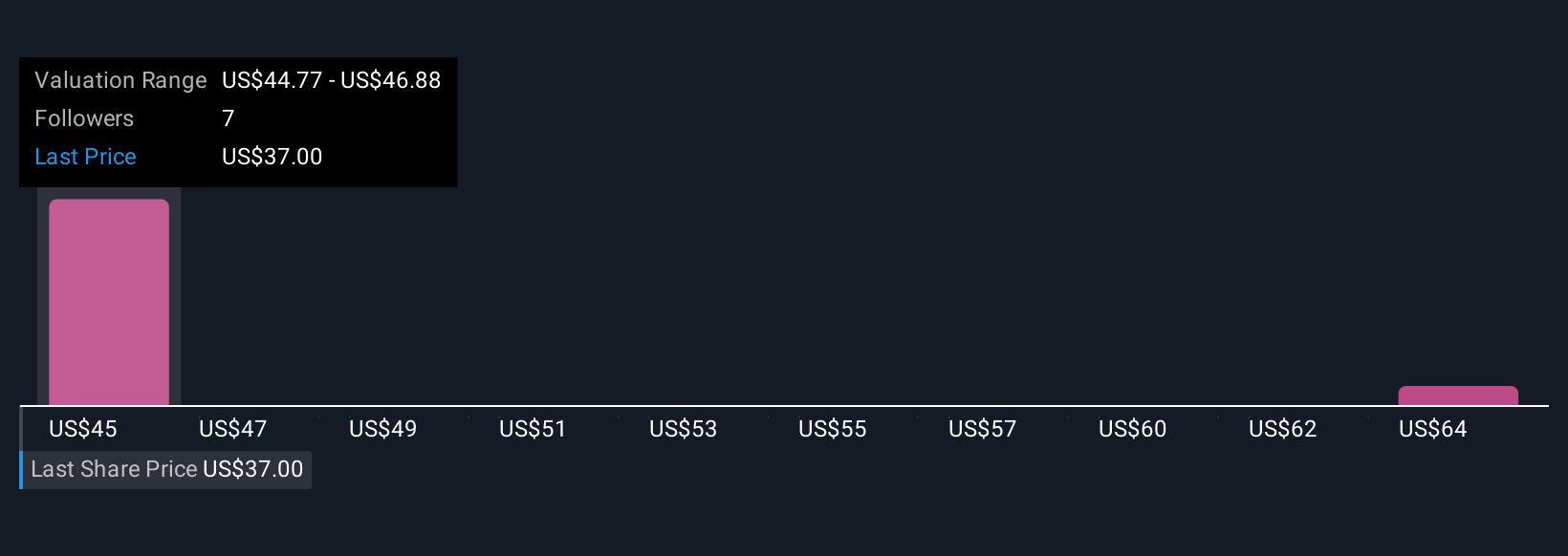

Fair value estimates from three Simply Wall St Community members range from US$49.92 to US$65.85, reflecting a wide spread in growth outlooks. In light of this, remember that Kinetik's concentrated exposure to Permian Basin activity means future results may hinge on basin-wide production trends; explore these varied viewpoints before forming your own view.

Explore 3 other fair value estimates on Kinetik Holdings - why the stock might be worth just $49.92!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

No Opportunity In Kinetik Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.