Please use a PC Browser to access Register-Tadawul

Is Kohl’s (KSS) Capital Return Approach Aligned With the Meme Stock Surge Momentum?

Kohl's Corporation KSS | 22.74 | +2.52% |

- Kohl’s Corporation’s Board of Directors recently declared a regular quarterly dividend of US$0.125 per share, payable on September 24, 2025, to shareholders of record as of September 10, 2025.

- An influx of retail investor activity and speculative trading amid a broader meme stock rally, rather than company fundamentals, appears to have driven recent excitement around Kohl’s.

- We’ll explore how retail trader momentum and surging meme stock interest may influence Kohl’s longer-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Kohl's Investment Narrative Recap

Staying invested in Kohl’s means believing in its ability to reinvigorate revenue and reconnect with core customers amid digital channel struggles and recent management changes. While the newly declared US$0.125 per share dividend rewards shareholders, the most important catalyst, restoring sales growth, is unlikely to be directly affected by this announcement. The biggest risk continues to be prolonged sales declines, which threaten Kohl’s ability to sustain margins and turn earnings around; the latest dividend news does little to materially change this near-term concern.

Among recent company updates, the appointment of a new Chief Digital Officer stands out as highly relevant. This is particularly meaningful given sharp declines in digital sales and the need for fresh leadership to address online performance, an area central to any potential rebound as digital engagement drives future catalysts.

On the other hand, sustained underperformance in digital could lead to new challenges that investors should be aware of if...

Kohl's narrative projects $14.0 billion revenue and $234.5 million earnings by 2028. This requires a 4.4% annual revenue decline and a $113.5 million earnings increase from the current $121.0 million earnings.

Uncover how Kohl's forecasts yield a $9.33 fair value, a 33% downside to its current price.

Exploring Other Perspectives

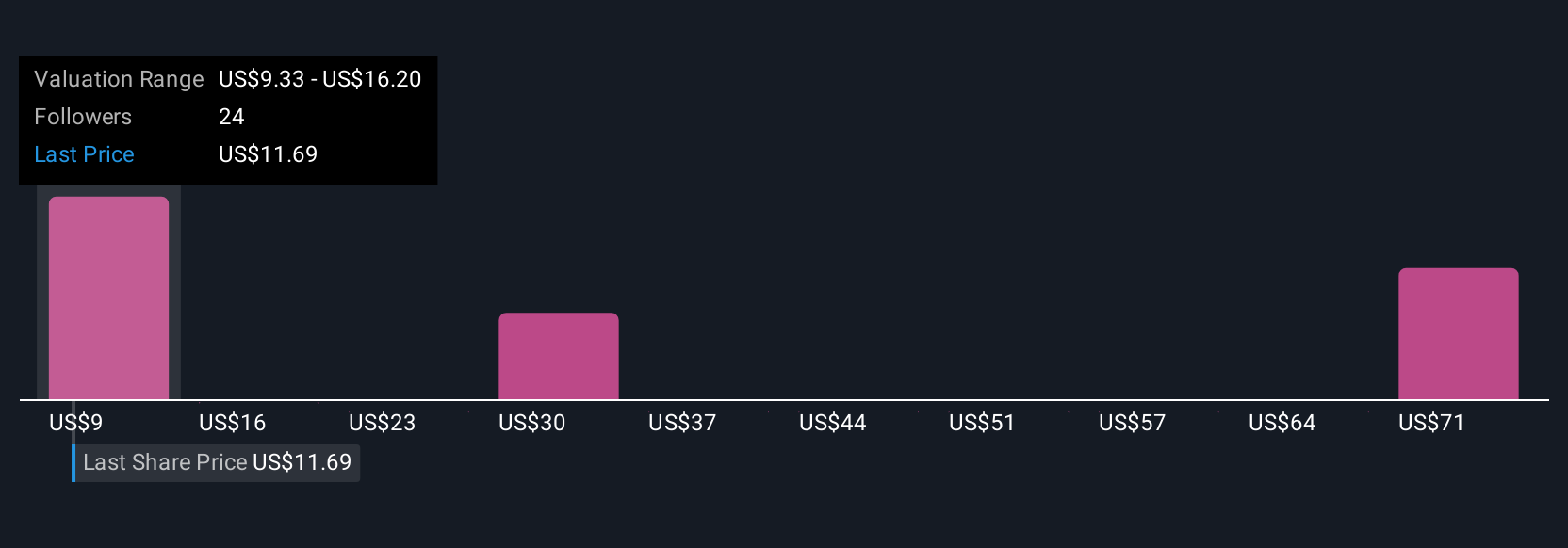

Simply Wall St Community members offered five distinct fair value estimates for Kohl’s, ranging from just US$9.33 to as high as US$72.36. With such wide-ranging views, especially as the company battles ongoing sales declines, be sure to consider multiple perspectives on future prospects.

Explore 5 other fair value estimates on Kohl's - why the stock might be worth over 5x more than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.