Please use a PC Browser to access Register-Tadawul

Is LendingClub Still a Good Value After Recent Fintech Partnership News?

LendingClub Corp LC | 19.21 19.21 | +0.42% 0.00% Pre |

- Ever wondered if LendingClub’s latest run-up means the stock is still a good deal, or if the ship has already sailed on value? Let’s take a closer look at what’s really happening beneath the surface before making that call.

- The stock has had quite the ride, climbing 15.5% over the past year and racking up a huge 151.3% gain over five years, even with a slight 5% pullback over the last week.

- Some of the excitement and volatility stems from recent headlines about fintech partnerships and changes in the broader credit market, which investors are watching closely. These moves are fueling speculation on both LendingClub’s future growth and how the company manages risk moving forward.

- On our valuation checks, LendingClub earns a score of 4 out of 6, hinting at solid value in several key areas. We’ll break down what different valuation methods say about LendingClub shortly and reveal a fresh perspective to consider at the end of this article.

Approach 1: LendingClub Excess Returns Analysis

The Excess Returns valuation model estimates the value of a company by examining how much it earns above the minimum required return on its equity. Essentially, this approach evaluates the company's ability to generate profit in excess of investors' expectations. This method highlights LendingClub’s efficiency and profitability by focusing on the difference between the company’s return on equity and its cost of equity capital.

For LendingClub, analysts project a stable Book Value of $14.66 per share, while the current Book Value is $12.68 per share. Stable Earnings Per Share (EPS) are estimated at $1.78, backed by a weighted average Return on Equity of 12.12%. The Cost of Equity is calculated at $1.15 per share, resulting in an Excess Return of $0.63 per share. These figures suggest LendingClub efficiently turns shareholder capital into profits above its cost of capital, indicating a healthy investment outlook.

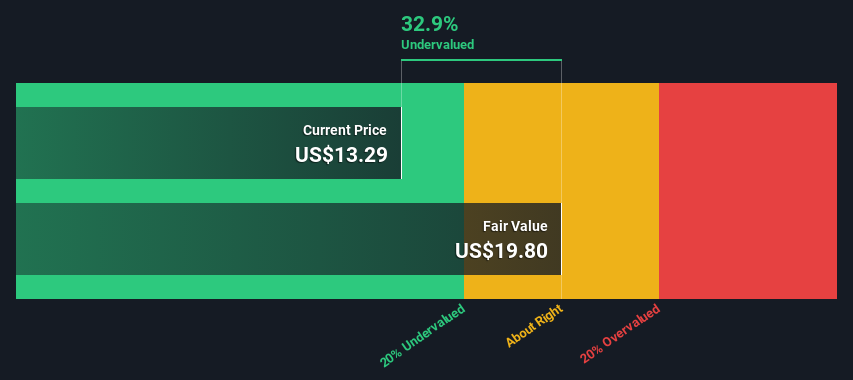

Based on these projections, the Excess Returns model estimates LendingClub’s intrinsic value is 39.4% higher than the current share price, implying the stock is significantly undervalued right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests LendingClub is undervalued by 39.4%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: LendingClub Price vs Earnings

The price-to-earnings (PE) ratio is the go-to valuation metric for profitable companies because it directly connects share price to the company's ability to generate earnings. For investors, this metric makes it easier to compare profitability across companies of different sizes or business models. Typically, higher growth prospects or lower risks command a higher "normal" PE ratio, while slower growth or greater uncertainty would warrant a lower one.

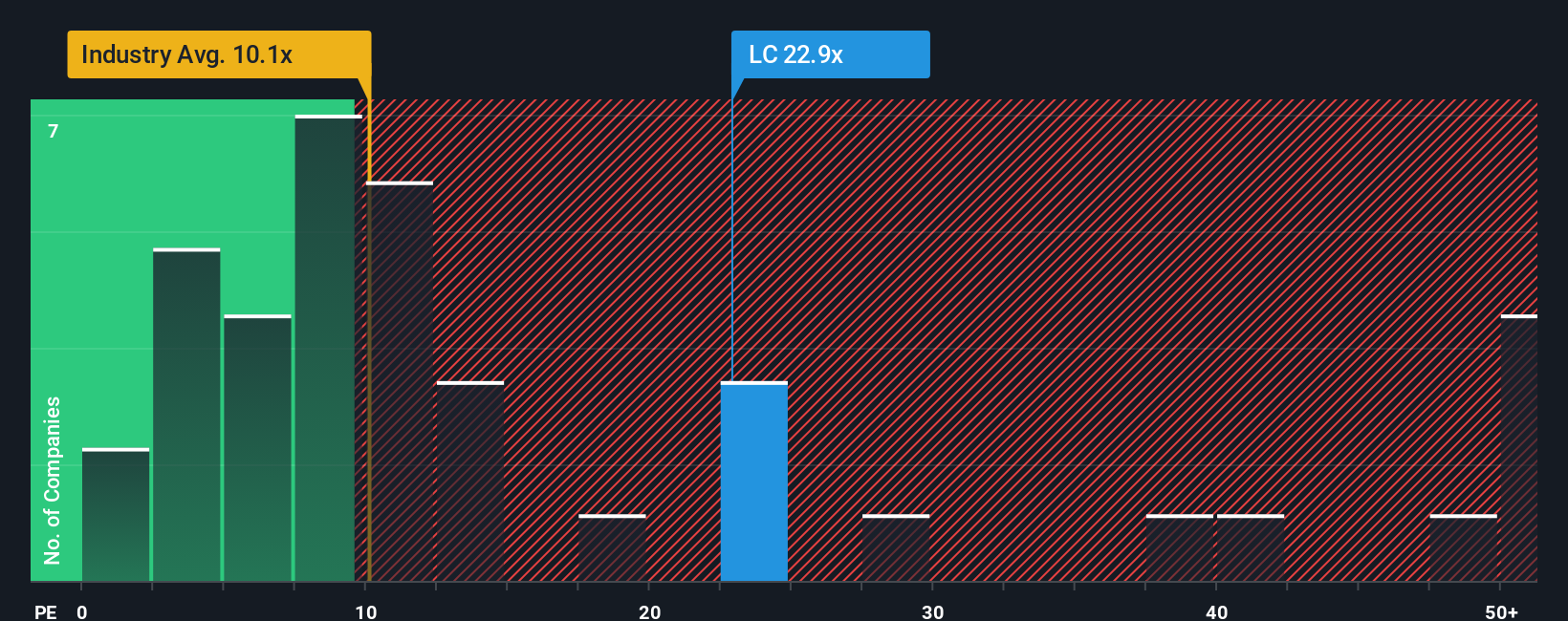

LendingClub currently trades at a PE ratio of 19.1x. This stacks up as noticeably higher than the average in its Consumer Finance industry, which sits at 9.9x, and also above its peer average of 5.0x. At first glance, this might suggest the market expects LendingClub to outpace its rivals in terms of earnings growth, quality, or stability.

Simply Wall St’s proprietary "Fair Ratio" for LendingClub is 22.9x. Unlike basic peer or industry averages, the Fair Ratio factors in a broader set of influences, including expected earnings growth, industry dynamics, profit margins, company size, and risk profile. This makes it a more nuanced and reliable benchmark for what LendingClub's PE should be in practice.

Comparing LendingClub’s current PE of 19.1x against its Fair Ratio of 22.9x suggests the market is offering shares at a meaningful discount relative to what the business fundamentals justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LendingClub Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company, bringing together your perspective on its future prospects alongside your estimates for revenue, earnings, and margins to arrive at what you believe is a fair value.

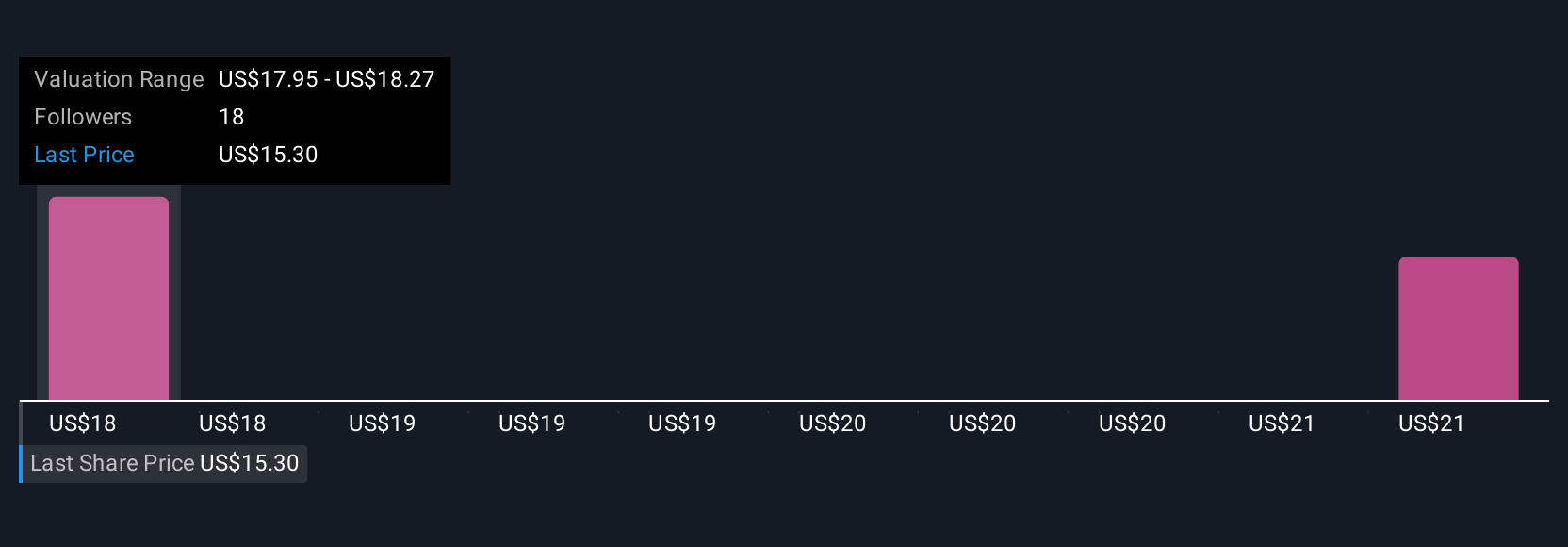

Unlike traditional valuation models that just crunch numbers, Narratives connect the story you believe about a business to a custom financial forecast. This generates a fair value unique to your assumptions. This approach makes investing more intuitive and personal, letting you see not just what a company is worth now, but what it could be worth if your expectations play out.

Narratives are a simple, accessible tool built directly into Simply Wall St’s Community page, ready for any investor to use. Millions of investors interact with Narratives every year to help decide when to buy or sell by comparing their fair value against today’s price and updating automatically as new data or news arrives.

For LendingClub, for example, some investors’ Narratives expect rapid digital product growth and improved margins, resulting in a fair value far above $21. Others see rising competition reducing future profitability, leading to much more cautious estimates closer to $15.50.

Do you think there's more to the story for LendingClub? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.